The crash of cryptocurrency exchange FTX last week shook the market. The traces of the collapse continue to be seen in the crypto money market. In addition to bankruptcy, FTX also comes to the fore with hacking news. The person or people who hacked FTX continue to move the funds on the exchange. One cryptocurrency in particular has been the subject of hackers’ accumulation. Here are the details…

FTX hacker focuses on Ethereum

cryptocoin.com As we reported, FTX filed for bankruptcy last Friday. On the day of filing for bankruptcy, on-chain researchers found that funds in FTX were moving. Then, the exchange officials stated that the platform was hacked and that users should not enter the exchange’s website or download the application. Since then, the hacker continues to transfer funds to multiple wallets.

The FTX hacker, who stole $ 600 million in assets from the bora, seems to be selling the other assets he stole and turning them into Ethereum (ETH). Many point to the possibility that this could be a cause for concern for Ethereum investors. Because if the hacker sells the Ethereums in his hands, the coin may be under selling pressure. Cryptocurrency analyst Dylan LeClair used the following statements:

The FTX hacker, who disposed of all other assets for Ethereum, is currently one of the largest ETH holders in the world, with 228,523 ETH ($284.8 million) in his wallet. Everyone should follow very closely what happens next…

Hacker’s wallet consists of 95 percent ETH, 5 percent PAXG

The address of the FTX hacker converted all other assets like PAXG, DAI to Ethereum after many transactions. As of now, the majority, or even 95 percent, of assets are in Ethereum. A very small percentage, 5% is at PAXG. As it is known, PAXG is a gold-pegged stablecoin. PAXG froze PAXG accounts in line with the order from the authorities. On chain data provider Santiment used the following statements:

This FTX hacker address received funding from over 100 different addresses, with a total of 100,614 ETH from the largest address 0x9008d19f58aabd9ed0d60971565aa8510560ab41.

ETH in the hands of whales is falling

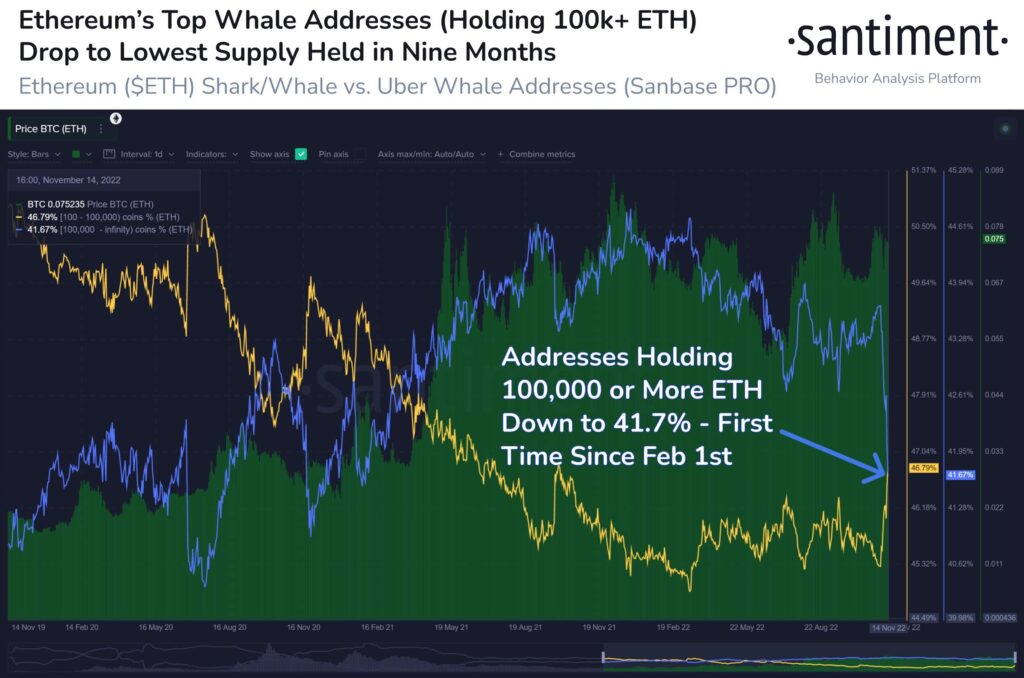

Another cautious signal for Ethereum investors is that ETH whale holdings are on the decline. Supply among the largest whale addresses slumped to a nine-month low. On chain data provider Santiment used the following statements:

Ethereum’s 100,000+ ETH addresses have drastically reduced their aggregate holdings since Nov. This blue line, most likely related to the FTX hacker address, is somewhat related to the price. But this can be abnormal under unique circumstances.

As the FTX crisis unfolded, Ethereum (ETH) corrected more than 25 percent last week. Along with other cryptocurrencies, it has already faced a major blow. According to investors in the market, if the coin suffers another big drop, it is possible for ETH to drop to $ 1,000. At the time of writing, the leading altcoin is valued at $1,248.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.