last week bitcoin Most of the crypto money market, especially the crypto money market, faced a selling pressure. The rate hikes expected to be continued by the FED created macroeconomic problems and as a result, created tension in the markets. Despite these developments, a remarkable detail has emerged on the Ethereum side.

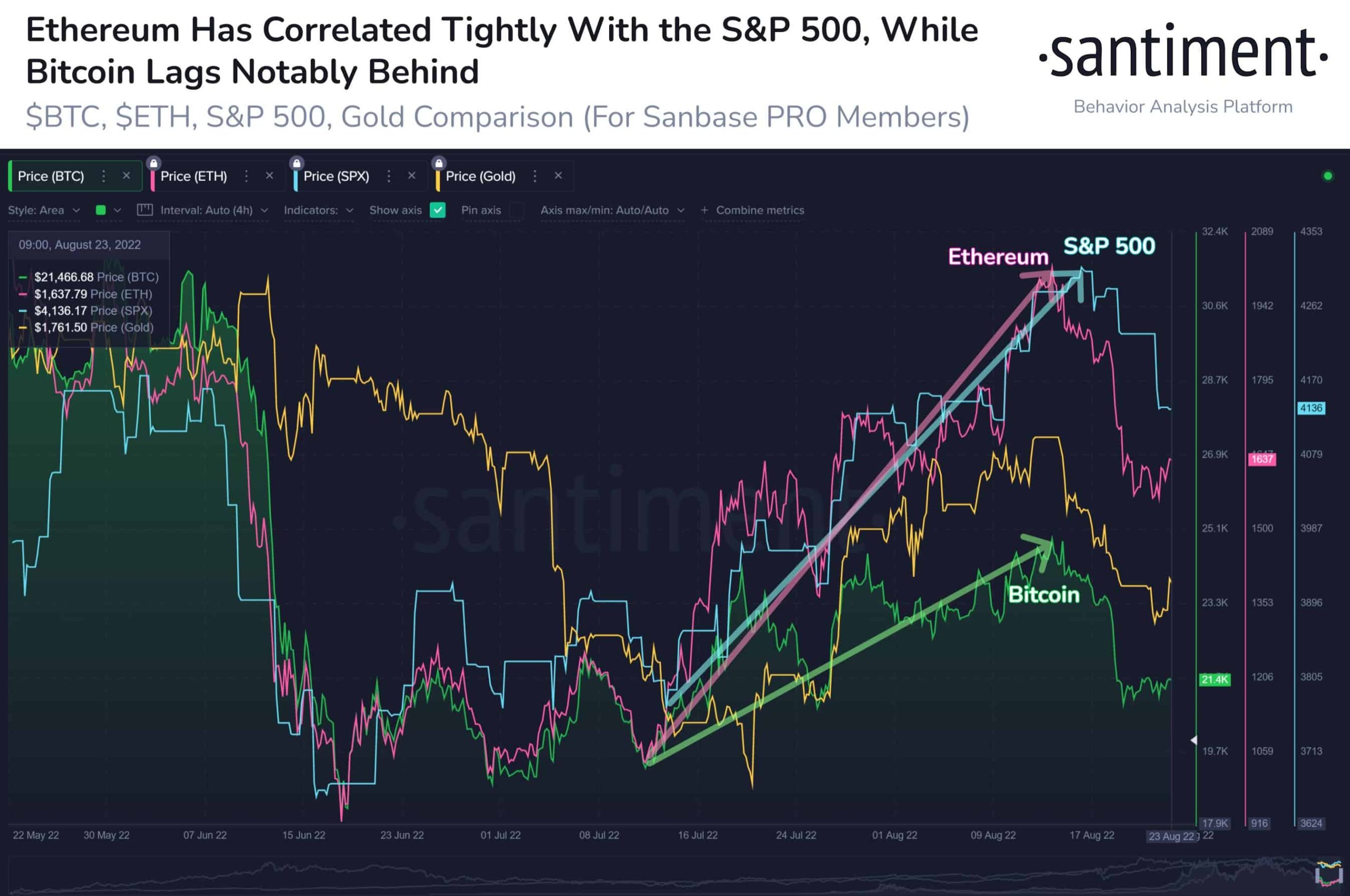

Known to have a strong correlation with the S&P 500, Bitcoin is now the second largest cryptocurrency in the world. EthereumIt seems to be losing to (ETH). On-chain data provider Santiment notes that as the ETH price rallied ahead of the long-awaited Merge upgrade, it shows a greater correlation with the blue-chip US stock index. Santiment stated the following on the subject:

“Both #Ethereum and #SP500 returned to their respective May price levels in mid-August. But #Bitcoin is still lagging behind.”

With the recent surge in Ethereum price, the total number of ETH staked with the Ethereum 2.0 Beacon Chain has now reached a normal level.

The crypto community will be released next month. Ethereum Merge focused on upgrading. As reported by Koinfians.com, two Ethereum clients, Go Ethereum and Nethermind, detected bugs in Mainnet Merge updates. However, the Ethereum developers seem to be in control and it seems unlikely that they will create any further delays in the Merge upgrade.

Investors Interested in Altcoins, Especially Ethereum

According to on-chain data provider Santiment, traders are losing interest in Bitcoin and therefore focus altcoinshifts to.

“Bitcoin started falling after briefly surging above $25,000 on August 14. As traders turn their attention to #Ethereum and #altcoins, $BTC transactions are mostly at a loss. That’s the lowest take-profit rate we’ve seen on record.”

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.