Famous cryptocurrency analyst Ali Martinez, XRP could see lower prices as it faces rejection at a key resistance level. in your opinion.

Martinez tells his 36,200 followers on X that XRP failed to close above the midpoint of an ascending parallel channel on the three-day chart.

According to the crypto trader, this rejection indicates that XRP may correct towards the formation’s diagonal support.

XRP is moving inside an ascending parallel channel! After facing rejection at the middle line of the channel, XRP could see a pullback towards the lower boundary, around $0.55.

NEWS CONTINUES BELOW

While ascending parallel channels are typically bullish patterns over the long term, price action within the channel changes from bearish to bullish and vice versa, with the upper bound acting as resistance and the lower bound acting as support.

XRP is trading at $0.611 at the time of writing this news. In addition, it is still below the midline of the channel.

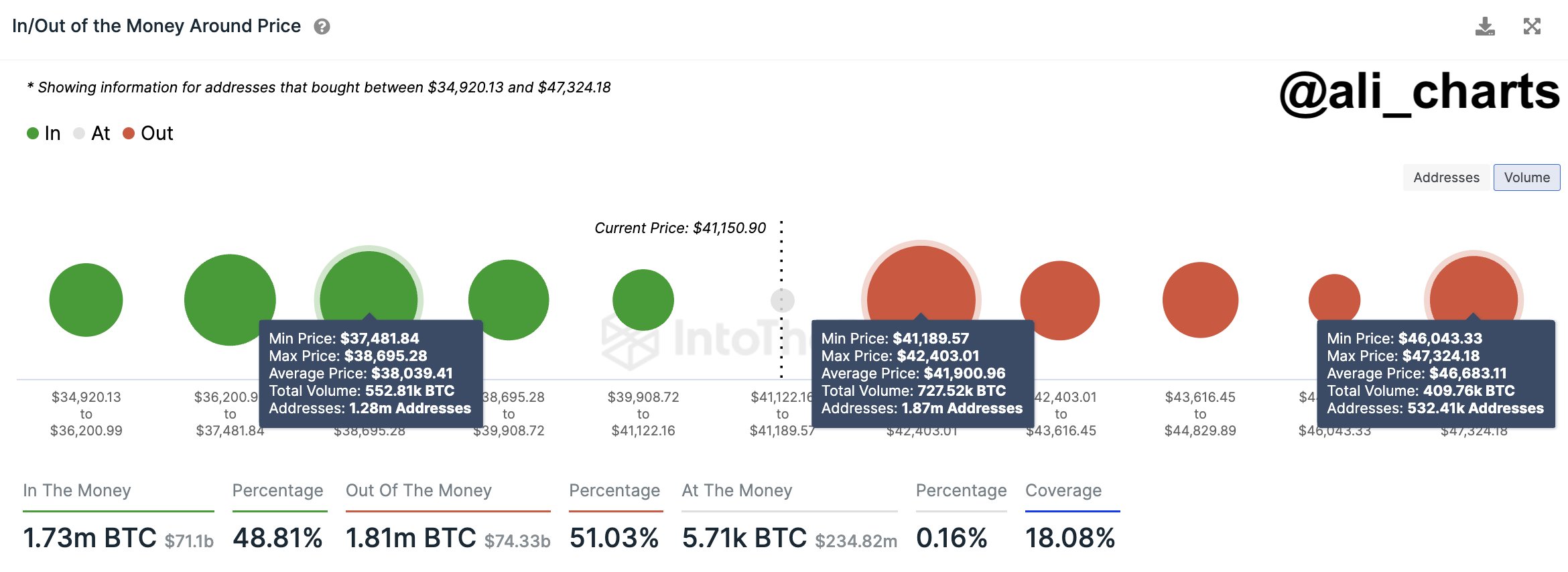

BitcoinTurning to (BTC), Martinez says the flagship crypto asset is close to moving into territory where it could face even more downward pressure, based on data from blockchain analysis platform IntoTheBlock.

According to Trader, 1.87 million addresses accumulated 730,000 BTC between $41,200 and $42,400. A break below these levels could trigger owners to cut their losses.

If selling pressure increases, watch for a possible decline to the next demand zone between $37,500 and $38,700. Here, 1.28 million addresses hold 553,000 BTC.

Bitcoin is trading at $43,051 at the time of writing this news.

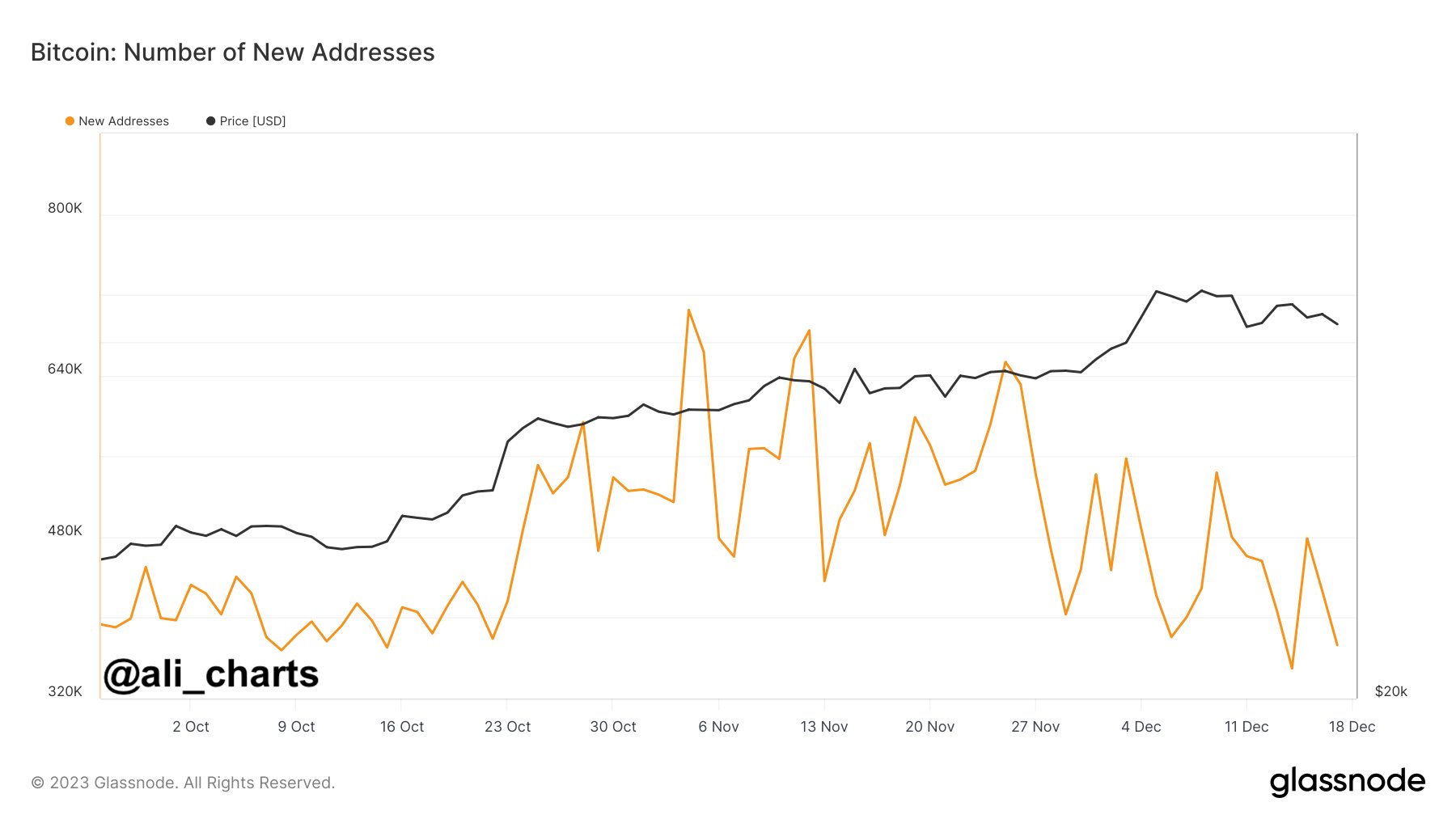

Martinez also crypto- According to data from analysis firm Glassnode, Bitcoin is signaling decline on-chain as network growth dropped last month.

There has been a noticeable decline in the growth of the Bitcoin network over the past month, casting doubt on the sustainability of BTC’s recent rally to $44,000.

For the bull rally to continue strongly, it is crucial to see an increase in the number of new BTC addresses. This will provide the necessary support for continued upward momentum.