BitStamp, one of the world’s largest Bitcoin exchanges, has decided to delist two altcoins linked to FTX. According to the announcement, the exchange plans to definitively close its operations.

Bitcoin exchanges close their listings to these two altcoins

BitStamp, one of the largest exchanges in the industry, announced that it has suspended FTT and CEL transactions. Users must complete all transactions in these cryptocurrencies by November 22. Users who are not aware of the announcement will have a chance to withdraw money for a while. According to the official announcement:

We are stopping FTT and CEL transactions on 22 November 2022 at 15:00. If you plan to do more transactions, please do so before the deadline. Withdrawals will be possible after this date.

According to the announcement, users who do not withdraw their funds before November 22 will not lose any funds. Bitstamp has announced that it will allow users to make withdrawals even if their trading is stopped. According to the exchange, withdrawals will be active after the specified date. In addition, CEL investment transactions will be closed after this date. FTT investment transactions will also be open for a while.

Pay attention to these

Bitstamp users will not have a chance to trade CEL and FTT tokens after 15:00 on November 22. After this date, all token transactions will be suspended. Users’ individual accounts will contain trading history for both tokens. Both tokens have fallen victim to the mismanagement of the teams behind them, as a result of Celsius’ explosion that resulted in a disastrous 90% drop for token holders and massive losses for the banking platform. The CEL price has lost more than 90% of its value after the events in May.

Celsuis and FTX Token (FTT) walk away from the market

The collapse of the company was primarily caused by the liquidity crisis and poor fund management. According to Celsius’ bankruptcy filing, the company only has $167 million in cash on hand. It now needs to close the $1.2 billion deficit on its balance sheet. There is no need to explain further what happened at FTT. The actions of Sam Bankman-Friend and his partners caused an $8 billion gap in their balance sheets, backlogs and a market crash. cryptocoin.com We have covered the background of the event in this article.

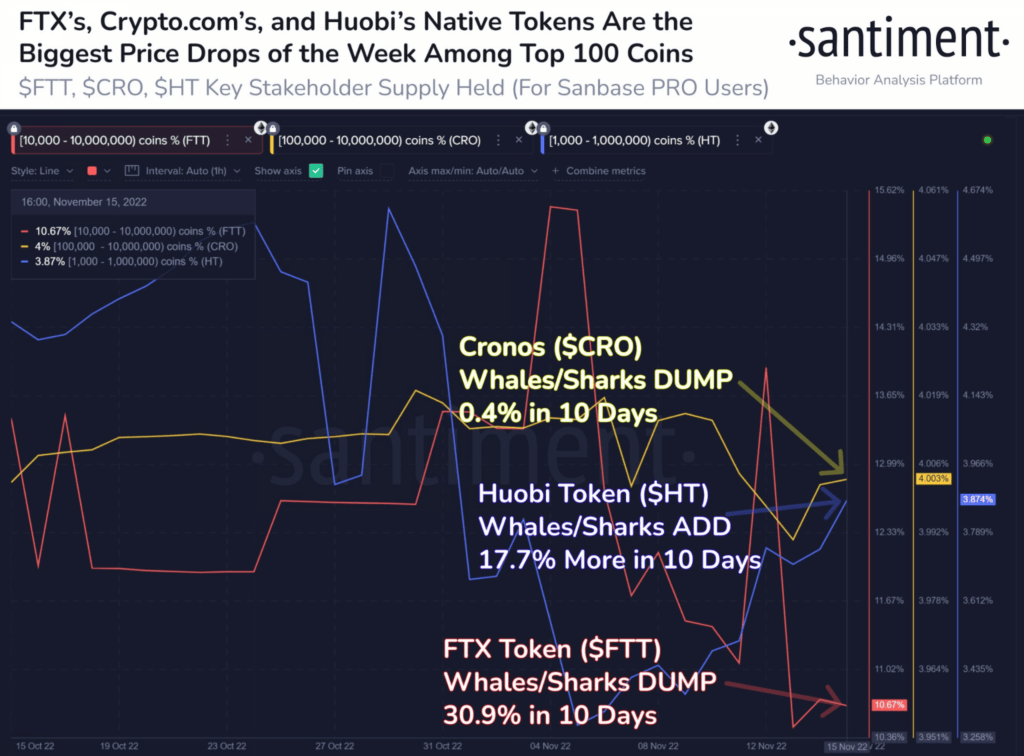

Meanwhile, whales have disposed of 30.9% of their FTT balances in the last 10 days. In fact, the network growth of all exchange tokens, including FTT, has continued to drop over the past few days. The pace of each of these tokens has seen some volatility in the past week, with both ups and downs. FTT recorded the fastest speed compared to the rest of the exchange tokens. This indicates that the frequency of exchanges between addresses is increasing.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.