Ethereum (ETH) has begun to see an increase in demand for call options as investors anticipate a positive outcome for spot ETF applications pending with the U.S. Securities and Exchange Commission (SEC).

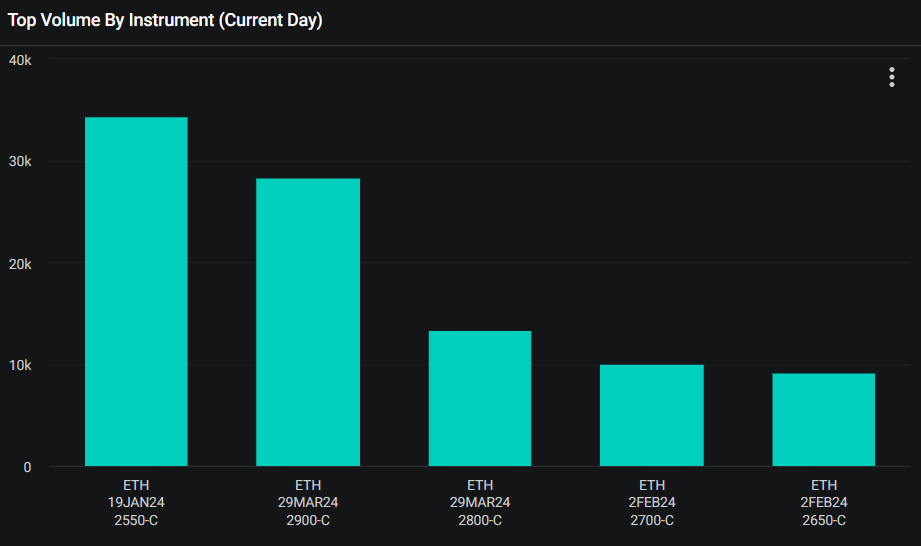

According to data from Deribit, the largest cryptocurrency derivatives exchange, there is a significant increase in open interest in the Ethereum call option with a $2,250 strike price expiring on January 19. There are more than 24,600 call options under this condition, and the unpaid interest is $62 million, the largest proportion of all contracts.

Options are investment products that allow investors to gain exposure to spot and futures markets through leveraged betting on underlying assets. Call options give the owner the right, but not the obligation, to purchase the underlying asset at a predetermined price (strike price) on or before a certain date (expiration date). Put options give the owner the right, but not the obligation, to sell the underlying asset at a predetermined price on or before a certain date, i.e. the asset is not owned.

The fact that call options are trading in large quantities with a strike price of $2,250 can be interpreted as many investors expecting Ethereum to rise this much by the time it expires on January 19. This implies bullish sentiment for the cryptocurrency, which is currently trading at $2,460, down 2.75% in the last 24 hours, according to CoinMarketCap.

Spot Ethereum ETF Expectations Rising

The most likely reason for the recent increase in Ethereum call options is the expectation of spot Ethereum ETF approval. Spot ETFs are funds that directly track the price of the underlying asset, in this case Ethereum, by holding a large amount of the cryptocurrency itself.

Luke Nolan, Ethereum researcher at CoinShares, told The Block that there is a 70% chance of Ethereum spot ETF approval this year. Stating that the earliest date is the first quarter, Nolan pointed out the possibility of an approval coming later.