Venture capital giant Andreessen Horowitz (a16z), Ethereum (ETH) competitor announced that the two altcoins managed to outperform Ethereum on two different metrics. Here are the details the company has announced.

Looking at the latest daily data according to the venture capital giant (as of May 12), in terms of the number of active addresses, Ethereum has 5.5 million addresses, but it belongs to Binance. Binance Coin (BNB) the number of active addresses stood at 9.4 million; Another important Ethereum competitor, Solana (SOL), was ahead by a significant 15.4 million active address count.

The firm underlined that instead of dealing with the data superficially, it examines the daily transactions in detail and that this difference can be clearly seen in the 30-day average. As of May 12, Ethereum’s daily trading volume was 1.1 million on average, while this number was 5 million in BNB and 15.3 million in Solana.

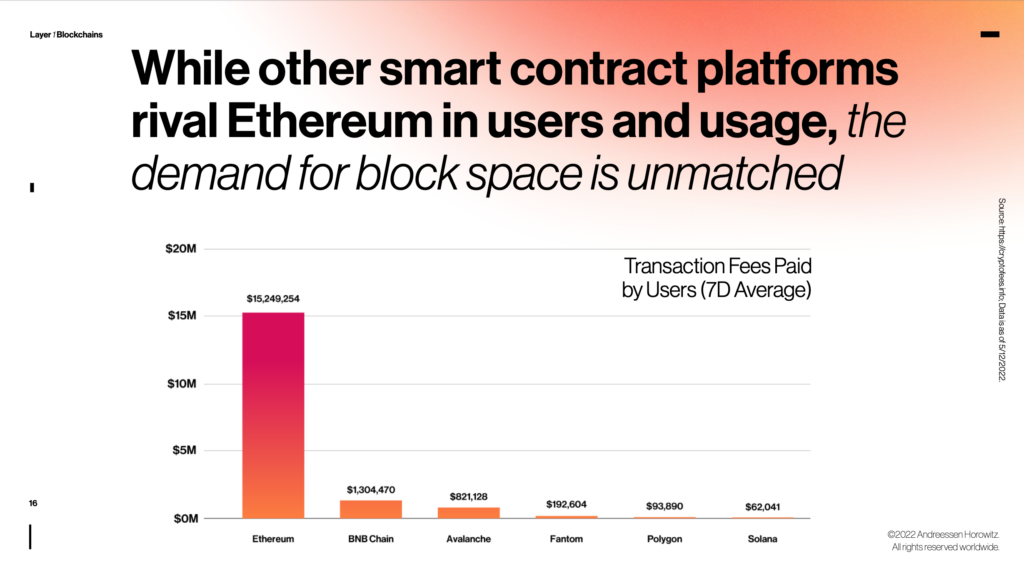

Despite the significant differences in the number of active addresses and daily transaction averages, Ethereum (ETH) is in much more demand than its competitors. The leading smart contract platform earned $15 million in transaction fees over the last seven-day average; BNB $1.3 million Left (LEFT) while he was able to get $ 62,041. Although these values vary depending on the transaction fees in the network, it is also possible to measure the values where the demand can be measured most clearly, according to the company.

Ethereum also has an edge in hosting developers and attracting new developers, the company’s report says.

“You can think of Ethereum’s popularity as a double-edged sword. Since Ethereum rewards decentralization over scaling throughout its existence, other blockchains have managed to attract users with the promise of better performance and lower transaction fees. According to some names in the community, this is a detail that can create a security vulnerability.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.