The ‘stricter cryptocurrency regulations’ from the US continue to weigh on the altcoin market. Still, a few coins are about to end the week with double-digit gains despite the hurdles. In this article, we have compiled technical analyzes for 4 altcoins that are close to breaking their critical support under the influence of macro developments.

Binance Coin raises selling risk amid Binance-CFTC lawsuit

BNB price flirted with the green ascending trendline after the Wall Street Journal broke news of the claims and evidence during the ASIA PAC session earlier this morning. As a crypto exchange, Binance is allegedly breaking US rules and laws. The CFTC lawsuit adds to the pile of lawsuits recently filed by the Internal Revenue Service (IRS) and federal prosecutors against BNB. cryptocoin.com In this article, we have included the accusations that Binance is secretly operating in China.

BNB will be stuck in courts and court rulings for several months and possibly years to come. This could be about 10% bearish pressure for the BNB price in the first place. Such a situation means that $300 can no longer be protected and price action should remain around $290 as support for now until positive case developments.

Because these cases can last for months or even years, price action can continue and only react when there is a result. This will make room for BNB to bounce back to that red descending trendline. According to technical analyst Filip L., “expect a breakout to be difficult, but if it does, a return towards $345 is possible.”

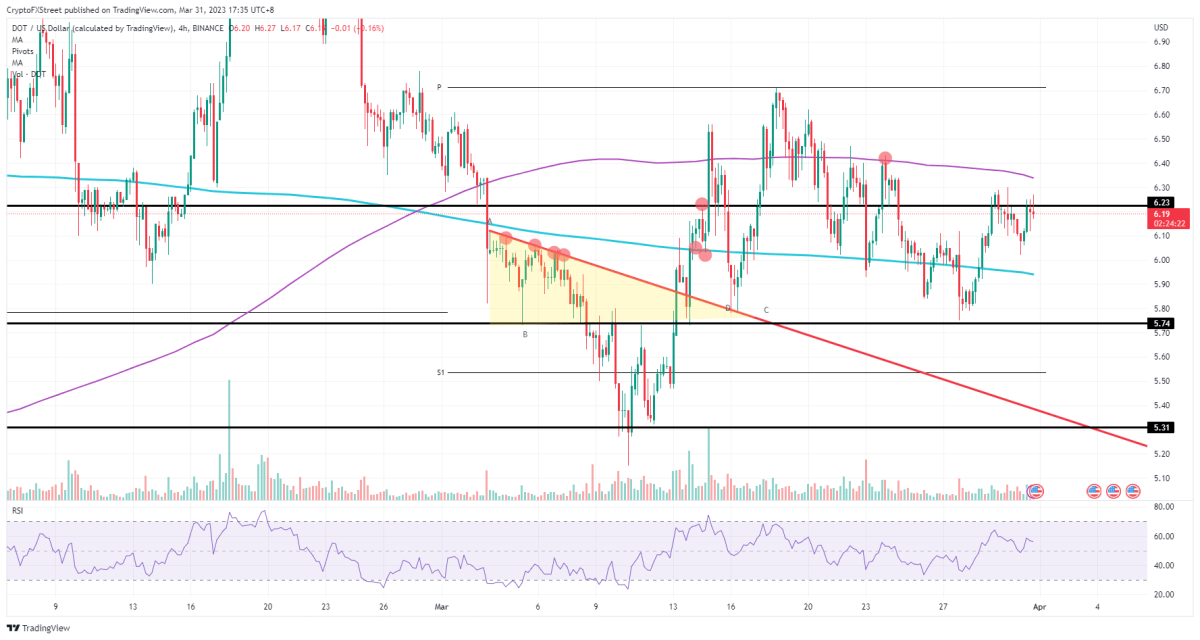

Polkadot (DOT) surrenders to altcoin bears with Lido news

Polkadot (DOT) is taking a big hit from MixBytes, the developer of decentralized financial staking service Lido. In a blog post, he said he would suspend the staking program in Polkadot (DOT) and Kusama (KSM) until August 1. The developer stated in the statement that data and growth did not meet business rationale expectations to sustain investments longer.

Lido shifting from Polkadot to Ethereum forces altcoin bulls to decline

Polkadot price even sees the risk of increasing cash outflow, as MixBytes continues by saying in a blog post that occasional inefficiencies and bottlenecks have proven to be a huge challenge. On the contrary, it looks like the Ethereum network will replace both DOT and KSM. This means that from now until August 1st there will be quite a supply of DOTs in the market.

DOT will have bears gearing up to start price action quickly on this one. While there is still more time until August 1st, the headline will be priced in pretty quickly. This means that the DOT will say goodbye to $6 and start trading around $5.74, but there is a risk of further drop towards $5.31.

With additional supply coming, this opens up space for DOT bulls to buy in addition to price action. As always, the first move will be negative as the bulls can buy the additional volume at a small discount around $5.90. According to analyst Filip L., “Expect a quick turnaround as this additional volume in the bulls’ wallets will see DOT rise to $6.70.”

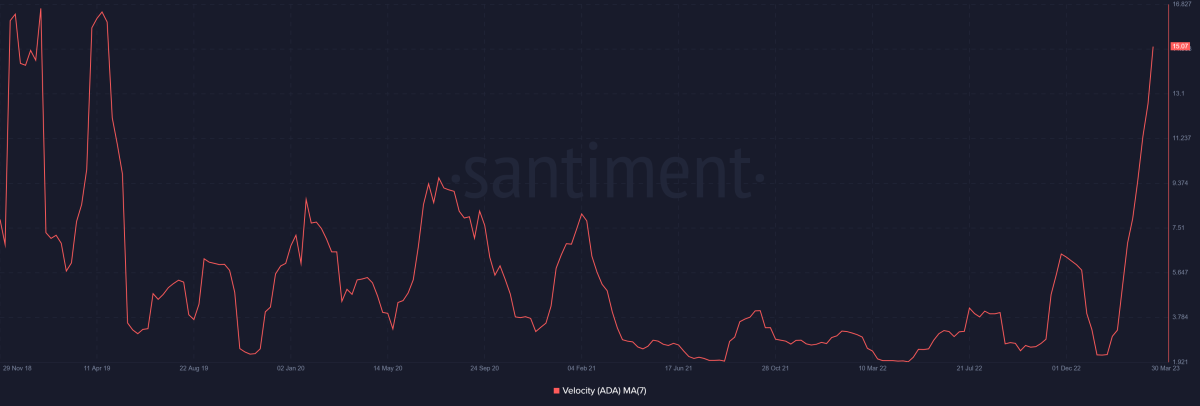

Cardano price has a bumpy road after 25% recovery

The recent recovery in Cardano price has been a motivation for ADA investors to recoup the losses they had to bear on their investments for a long time. ADA rallied more than 72% after falling to the ATH level of $0.2404 towards the end of December 2022.

This triggered the mobility among investors who have been idle for a while. Sitting at these addresses, ADA began to change hands, which can be seen in the increase in its speed. Rising activity, which is at the highest level in nearly four years, shows that investors sold and may continue to sell their ADA to make up for losses seen in Q3 and Q4 last year.

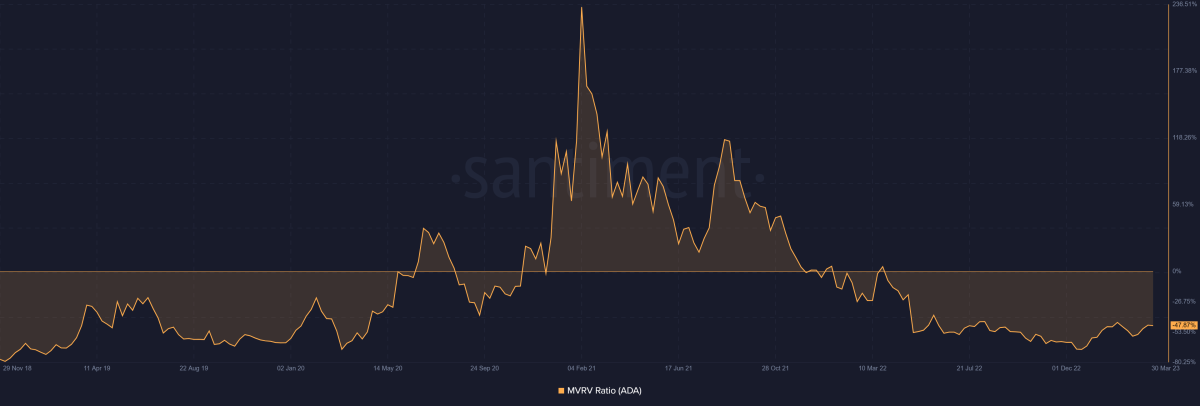

This behavior could intensify going forward if Cardano’s condition improves. The Market Value to Realized Value Ratio (MVRV) highlights that while the average return on investments is still negative, it is improving.

In the short term (30-day period), demand has pushed the indicator into positive territory above the neutral line, although the macro time frame shows that there is some time before this happens.

However, even minimally improving conditions can be enough to trigger a sell-off among desperate investors, leading to corrections.

Altcoin bulls face 11% rally or 19% drop

Cardano price, which is trading at $0.3772, is also trying to break the critical resistance level of $0.3984 at the 200-day EMA. Turning this level into a support base could lead ADA towards the 2023 high of $0.4206, signaling an 11% rally. RSI supports this expectation as Cardano, sitting in positive territory, has room for growth.

However, failing to breach or sell in the hands of investors could result in a drop in Cardano price. According to analyst Aaryamann Shrivastava, such a situation will lead to a retest of the critical support at $0.3527. Losing the same invalidates the bullish thesis, resulting in a 19% drop to the March low of $0.3014.

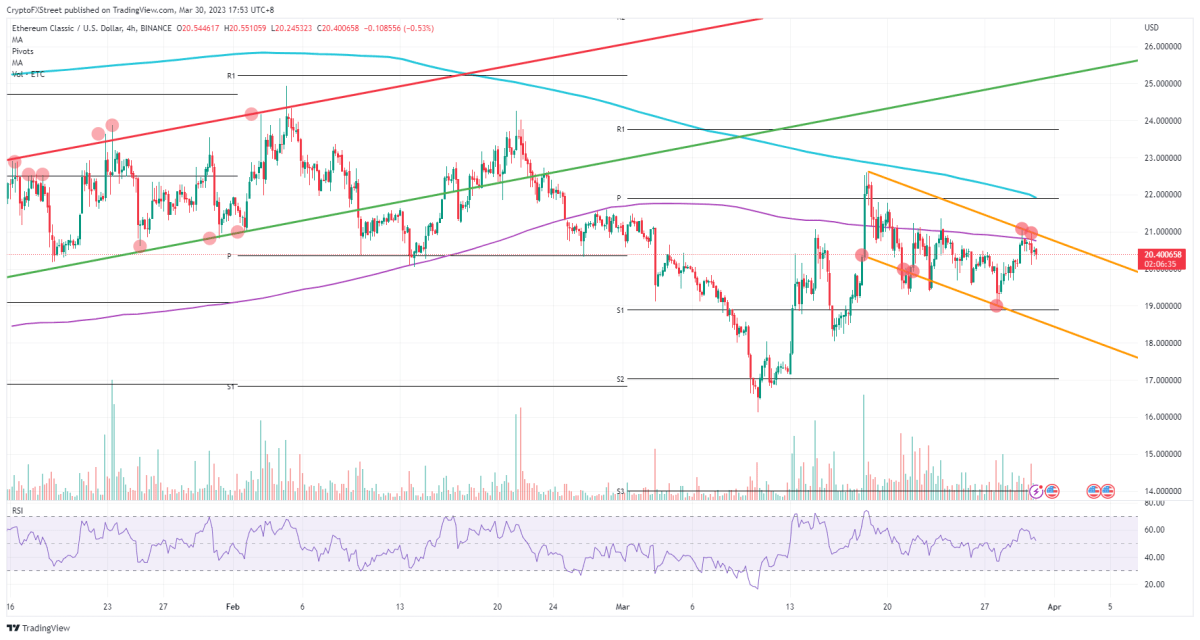

Ethereum Classic (ETC) price is about to break the $20 support

Ethereum Classic price is under the scrutiny of bears as the price action shows no possibility of further upside anytime soon. A few altcoins and rising, ETC traders are left empty-handed. These traders can be expected to start switching to XRP to get the most cash inflows as ETC bleeds.

ETC will see a small cash outflow as the price action moves further down. Once $20, a quick bearish cycle could see $19 and the lower barrier of the trend channel as support. As seen in the past, a quick false break with more than 10% loss on hand is unthinkable.

With several altcoins and cryptocurrencies performing explosively in price action, many traders may now stay away from them as their price levels are too high and too risky to get involved. ETC will see a significant entry when it exits the descending trend channel and could reach $25 fairly quickly with a 20% gain nearby.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.