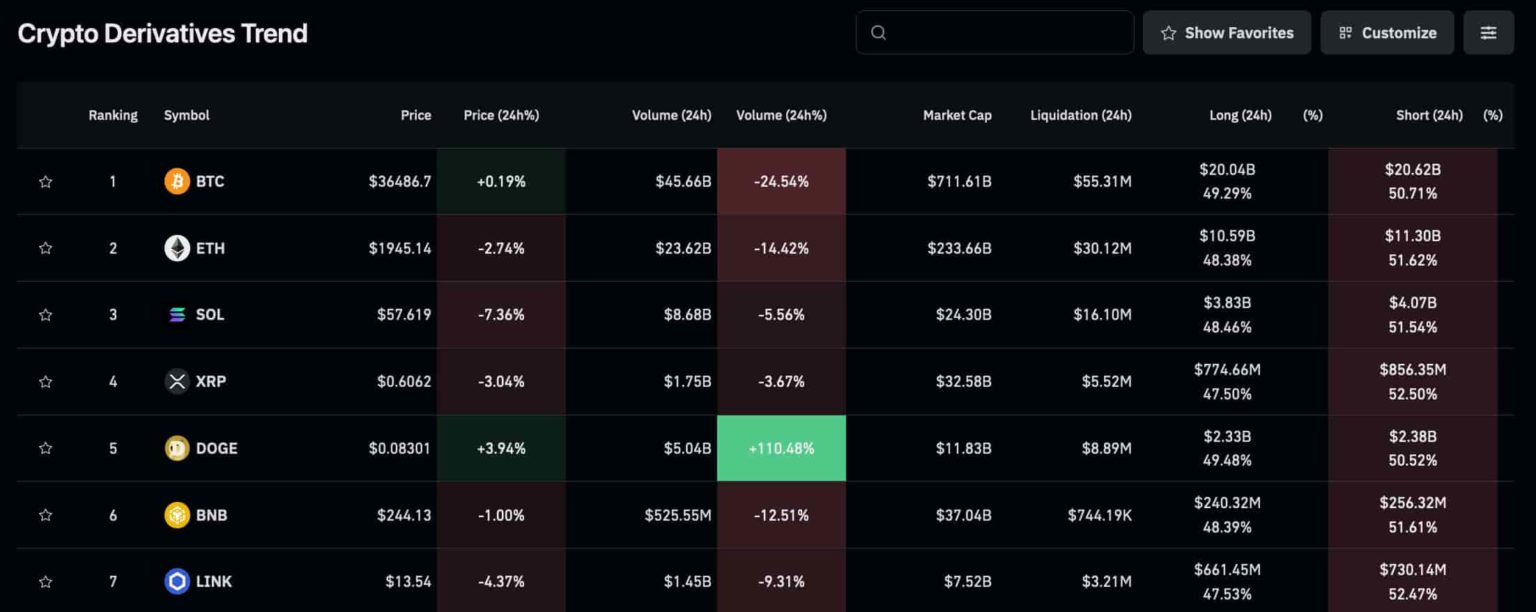

dogecoin (DOGE) recorded a large increase in derivatives volume over a 24-hour period with a significant weighting relative to market capitalization. This increase means that the cryptocurrency market’s interest in the leading meme coin has increased.

The volume of Dogecoin derivatives more than doubled in one day. At the time this news was written, speculators were trading $5.04 billion worth of DOGE using derivative products.

Koinfinans.com As we reported, this increase followed the price increase of Dogecoin in the spot market. It traded at $0.083, with a daily gain of around 4%. Meanwhile, other cryptocurrency Its units were recording losses in price and derivative volume.

Interestingly, the volume increase occurred while maintaining the balance between long and short positions. Investors opened a total of $2.33 billion (49.48%) and $2.38 billion (50.52%) in each position, respectively.

Derivative Statistics for the top 5 Cryptocurrencies

It is also possible to see the performance of other cryptocurrencies on the same “Crypto Derivatives Trend” dashboard used to retrieve Dogecoin’s data.

While Bitcoin (BTC) derivatives volume decreased by 24.54% to $45.66 billion. It accounted for 6% of the $711 billion market value. Meanwhile, Ethereum (ETH) lost 14.42% of its daily volume. In this context, it decreased to $23.62 billion and constituted more than 10% of the market value of $233 billion.

At the same time, Solana (SOL) lost 5.56% in derivatives volume to $8.68 billion. XRP Ledger (XRP) had the smallest volume among the top 5 with $1.75 billion and a daily loss of 3.67%.

Essentially, XRP’s derivative volume represents 5.3% of its $32.58 billion market cap. This creates a slight bias towards short positions, with a 52.50% advantage over long positions. By comparison, DOGE’s current volume represents 42% of its $11.83 billion market cap.