The February 2022 Comex contract is currently pegged at $1,790.10, while gold has fallen significantly this week, starting at around $1,841 on Monday. If we take into account the highest-valued gold, which traded from $1,854 on Tuesday to today’s low, the difference between the highest and lowest-priced gold traded this week is $78. Senior analyst Gary Wagner draws attention to last week’s decline with these statements and tries to get a technical portrait of gold. We also analyze the analyst’s own evaluations and analyzes. cryptocoin.com We have prepared for our readers.

“Selling pressure may push gold price to new lows”

Technically the most worrying issue seems to be that a model called the ‘Death Cross’ is coming soon. Currently, the 50-day moving average is fixed at $1,805.70 and the 200-day moving average is fixed at $1,805.50. In other words, the current difference between the short-term and long-term averages is $0.20.

According to Investopedia, the ‘Death Cross’ is a technical chart pattern that shows huge sales potential. When a stock’s short-term moving average falls below its long-term moving average, a death cross appears on a chart. Typically, the most common moving averages used in this pattern are the 50-day and 200-day moving averages.

However, it is necessary to understand that this technical chart model uses extremely long moving averages, which in essence translates into large latency compared to real-time data. There are many instances where a ‘death cross’ is not reliable in indicating further price declines as it is built from the lagging data generated. After all, there has already been a big sale. However, it could be a solid indicator that selling pressure could push gold to new lows.

“Data puts pressure on Fed to raise rates quickly”

On the other hand, it’s definitely something to be aware of, considering the key events that happened this week. First, the Federal Reserve’s FOMC meeting ended on Wednesday, confirming what many market participants are expecting, meaning a series of rate hikes will begin in March. Yesterday’s fourth-quarter GDP release came in extremely strong, which shows the annual GDP rate is up 6.9%. That gives the Federal Reserve the data needed to initiate a series of rate hikes this year and next year.

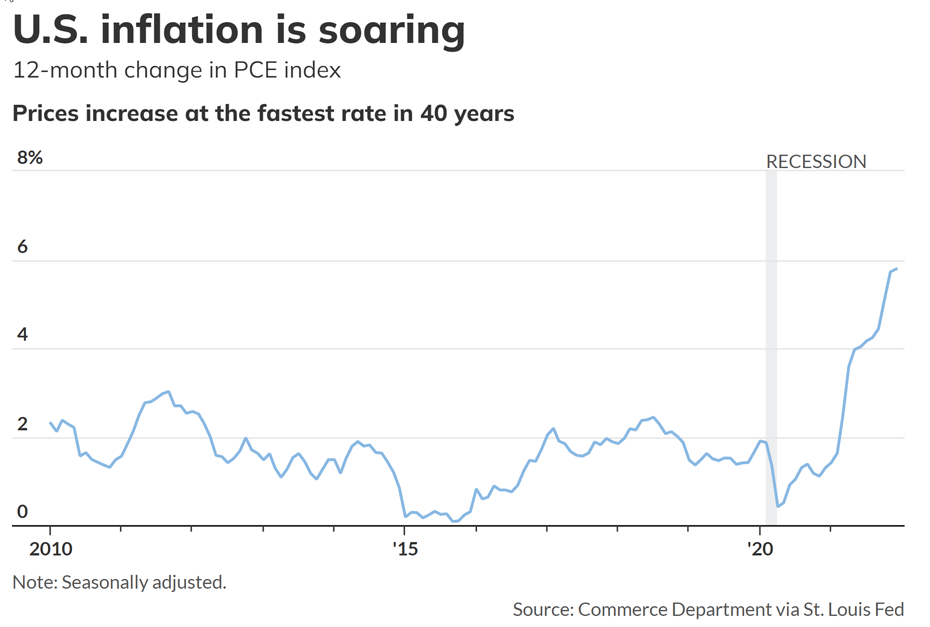

Today, the Department of Commerce, St. Louis Federal Reserve released the latest inflation data showing the component of the PCE index (the preferred index of inflation used by the Federal Reserve) joins the CPI, which has come the fastest in the last 40 years. The current PCE index rose 5.8% in 2021 after accounting for the sharp increase in December. That puts even more pressure on the Federal Reserve to raise rates quickly, with some analysts predicting the first rate hike could be as high as 0.5% to 1.5% to offset current inflationary pressures.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.