Data platform CryptoQuant has announced some important statistics for the Bitcoin price. Among these were whale moves. Also included was the impact of USDT, the largest stablecoin. Here are the details…

What are cryptocurrency whales doing?

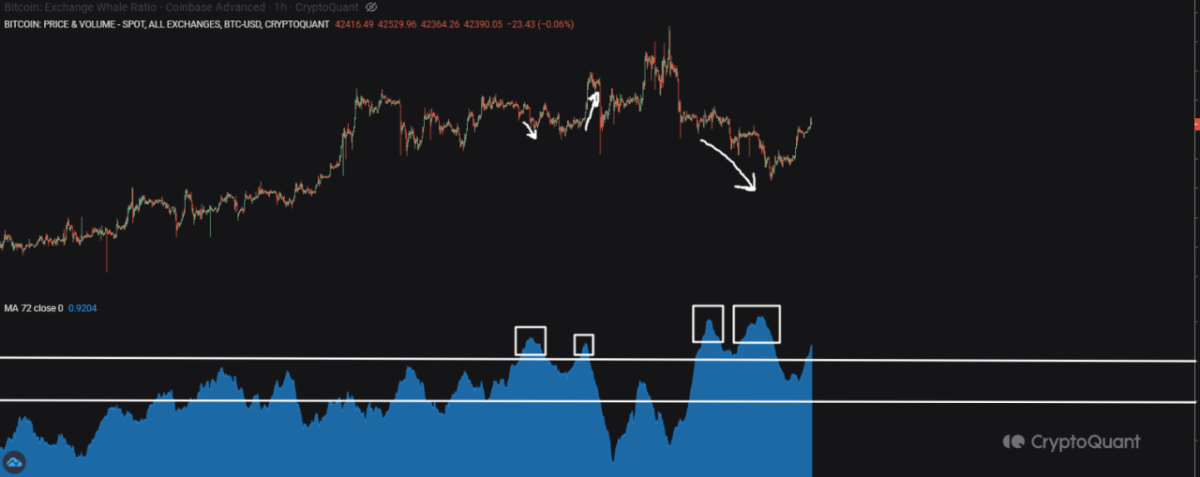

The cryptocurrency market is significantly affected by the actions of “whales”, which are large investors and institutions. An important metric that tracks the movements of these players is the Whale Rate. This ratio is calculated by dividing the market’s 10 largest transaction entries by the total entry. According to data analysis platform CryptoQuant, the Whale Rate is a critical factor that indicates market sentiment and direction. A high Whale Ratio means there are an unusual number of large transactions and may indicate a change in price trend.

The Whale Ratio is generally below 85% during bull markets, when prices are rising, and above 85% during bear markets, when prices are falling. This shows that whales tend to buy low and sell high, taking advantage of market fluctuations.

The proportion of whales is quite high

However, the Whale Ratio is not a simple predictor of price movements as it may change depending on the support and resistance levels of the price. For example, if the price is falling and reaches a support level where buyers are expected to enter the market, a high Whale Rate could indicate that whales are also buying and pushing the price up. On the other hand, if the price is rising and reaches a resistance level where sellers are expected to exit the market, a high Whale Ratio may indicate that whales are also selling and pushing the price down.

Currently the Whale Ratio is 93%, above the bear market threshold. This means there is a lot of whale activity, especially on platforms like Coinbase where large transactions are more common. This can have a significant impact on the price trend depending on how whales react to market conditions. CryptoQuant advises investors to pay attention to Whale Ratio and other indicators such as stock market entry and exit to better understand market dynamics and whales’ behavior.

Importance of USDT for Bitcoin price

In addition, the relationship between the circulating supply of the crypto market’s most popular stablecoin USDT and the price of the leading cryptocurrency Bitcoin also attracts a lot of attention. According to a recent chart from CryptoQuant, there is a high correlation between USDT supply and Bitcoin price movement, especially since the end of 2022. The chart shows that the circulating supply of USDT increased by nearly 30 billion last year, reaching over 100 billion by January 2024. Each increase in supply has a positive impact on the development of Bitcoin price, as it traditionally means more demand and liquidity for the crypto market. USDT is frequently used as a bridge between fiat and crypto, a buffer of volatility, and a medium of exchange for trading.

Bitcoin has previously rallied in the context of these USDT supply increases, setting new records above $69,000 in November 2021. The chart also shows signs of a recovery and increased liquidity in the Bitcoin market due to the prospect of a Bitcoin spot ETF and new capital inflows that could be caused by increased investor interest. Many experts believe that a Bitcoin spot ETF will increase the adoption and legitimacy of Bitcoin and also attract more institutional and individual investors to the crypto space. CryptoQuant’s data analysis reveals a strong positive correlation of 0.87% between USDT supply and Bitcoin price movement. This shows that as the supply of USDT increases, the Bitcoin price tends to increase and vice versa.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.