Cryptocurrency exchange giant Coinbase has announced the crypto assets it is investing in amid macroeconomic instability.

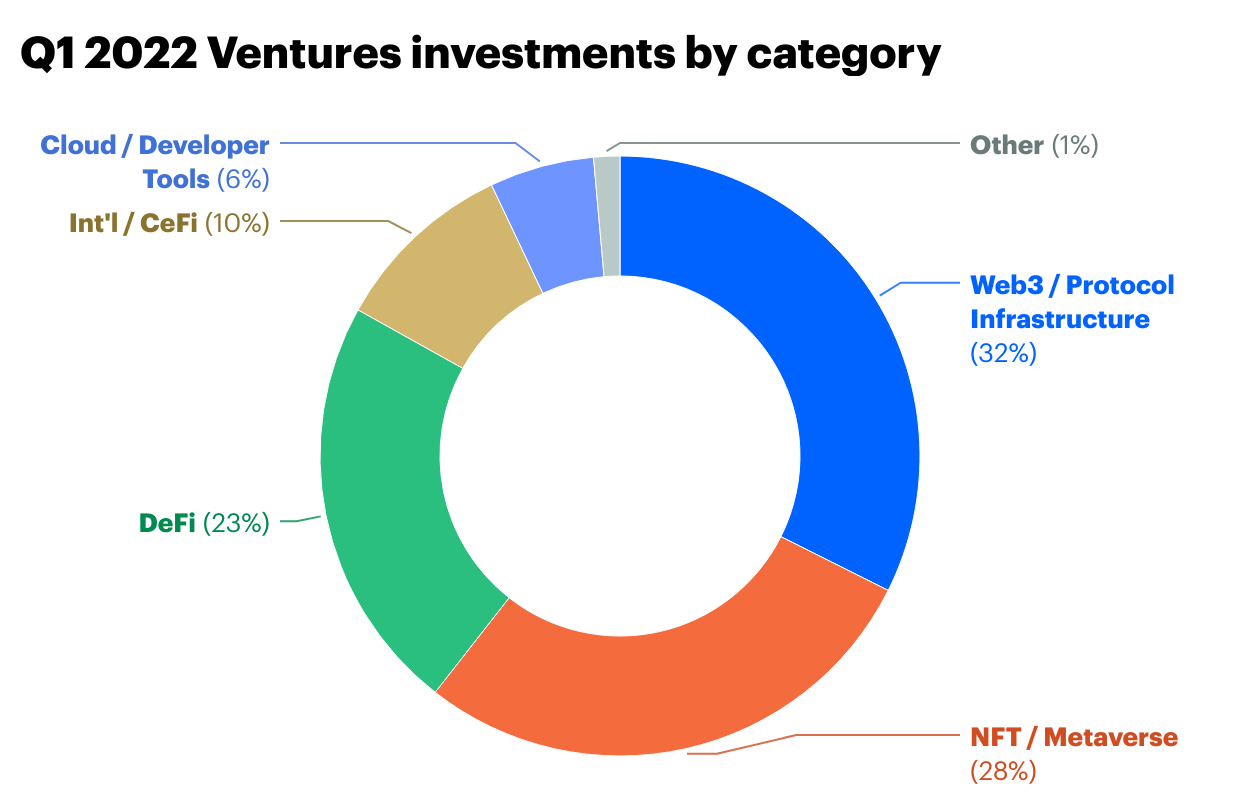

In a new blog post, the top US-based crypto exchange platform has revealed a detailed breakdown of its crypto portfolio in Q1 2022 and shared information on how it plans to navigate an unstable macro environment for the rest of its financial life.

“Many crypto investors are quite nervous in the face of a shaky macro picture… However, our strategy will not change much. It is worth remembering that some of today’s most successful projects were financed in the 2018/2019 bear market.

in this light Compound (COMP), OpenSeaPoligon (MATIC), Arweave (AR), starkware, Blockfi, Near Protocol (NEAR) and Messari Our early investments in projects like these come to mind.

Therefore, regardless of the broader market conditions, we will continue to invest in quality founders and projects that move the industry forward.”

Coinbase says it invested in Web 3.0 and cross-chain platforms in Q1 because the value of many networks grew, which created demand for capital flows across numerous blockchains.

“The increased value around multiple networks has demonstrated an increasing need for value from one chain to flow into another. As a result, we continue to see cross-chain infrastructure being built to facilitate activity between blockchains. (Coinbase Ventures Q1 investments include: LayerZero, ZK Link (TBA), LiFi, Foxchain, Socket, Composable Finance (LAYR)).”

In addition, the head of the US crypto exchange later claims that layer-1 blockchains are still innovating and summarizes the platform’s investments in this area.

“We are currently witnessing the existence of new experimental tier-1s that are still in development.

[Eski Diem çalışanları tarafından geliştirilen genel amaçlı bir L1 olan] to Aptos, [modüler blok zinciri] to Celestia (CELT) and [bir Proof-of-Archival/Arşiv Kanıtı konsensüsü olan] Our investments in Subspace show that the industry has not finished innovating on the core layer.

Coinbase is also an Ethereum (ETH) competitor. Polkadot (DOT) He says he is also investing in his parachains, which are project-specific blockchains that run in parallel across the Polkadot ecosystem.

“We were particularly active in the Polkadot ecosystem in the first quarter…

We have invested in 4 of the 5 currently released parachains (Acala (ACA), Moonbeam (GLMR), Parallel Finance (PARA) and Astar (ASTR)). In addition, we dived deep into DOT waters in the first quarter with the investments we made in Satori and Moonwell.”

Coinbase also states that it has invested in blockchain gaming platform Joyride, Vietnamese gaming guild Ancient8, and Yuga Labs, creator of the popular Bored Ape Yacht Club’s non-fungible token (NFT) collection.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.