Altcoin projects are on the rise in the new day after a long-term sideways movement. Current data shows that whales are in accumulation mode ahead of important upcoming news.

Altcoin whales chase Cardano

According to the latest report from IntoTheBlock, increased whale activity on the Cardano network is noteworthy. The report, which examines the activity on the network together with the data, emphasized that whales have increased their accumulation recently.

Accordingly, in the last 30 days, there has been an increase of 1,500% in the entries to these wallets. In addition to large whale transactions, the transactions of small investors on the network are at the peak of the last 3 months. The broad group of investors trading in the $10-100 range represents 28% of the total transactions.

Despite all the activity on the network, most of the ADA investors are waiting at a loss. According to IntoTheBlock, only 22.2% of all traders are in profitable positions at current values. 73.2% of them continue to be in loss.

On-chain metrics paint bullish picture for LTC price

According to Santiment’s predictions, the LTC20 halving event will coincide with August 10. 80 days into the halving, the Litecoin network recorded a significant increase in on-chain activity. According to Santiment, the halving event is scheduled to take place at block 2,140,000. On this date, the mining reward will decrease from 12.5 LTC to 6.25.

Halving events are often regarded as ascension catalysts. Ahead of the event, three metrics hint at a possible rally for LTC:

- Social volume or number of mentions of Litecoin on social media platforms.

- Transaction volume or value carried on the Litecoin network.

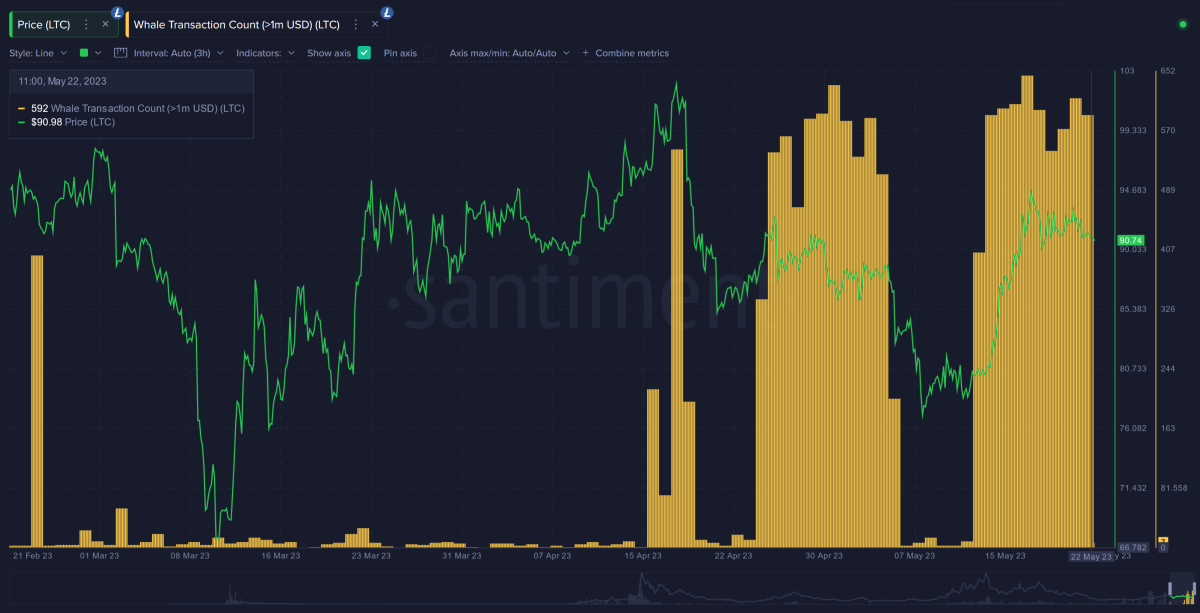

- Whale activity or transaction count of large wallet traders.

Increasing social volume

Based on Santiment’s data, the discussion about the LTC20 is growing. Thus pushing Litecoin into a “crowd discovery” phase where investors are showing increased interest.

On-chain transaction volume is growing steadily

As crowd participation and interest among investors increased, the value carried on the Litecoin network increased. Since May 8, there has been a steady increase in Litecoin’s trading volume.

According to Brian Quinlivan, Santiment’s director of marketing and on-chain expert, if transaction volume continues to increase, it will be a sign of growing interest from large wallet investors or “big players” in the ecosystem.

Increase in network activity and unique addresses

The volume of unique addresses interacting on the Litecoin network has skyrocketed recently, reaching a one-year peak in the second week of May. While the LTC price bottomed out, addresses were buying the altcoin at a discount before the halving event.

The number of active addresses has dwindled over the past week, but experts expect a rebound as the LTC20 halving nears.

Altcoin whales target $100 in LTC price

Quinlivan says the bullish metrics on Blockchain and the increased anticipation surrounding the upcoming halving event likely mean that average trade returns in the short to medium term could cool before a rebound.

In the two months after the halving event, around mid-June, Quinlivan expects an uptick in investors’ expectations for LTC, arguing that whales could push the price towards a bullish target of $100 before a final drop or correction in price.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.