Since Monday, Bitcoin price has made some impressive moves, climbing from Monday’s low of $43,444 to the current weekly high of $46,134. bulls, bitcoin It pushed its price higher with little resistance or pullback. However, strong resistance levels could trigger the end of the current bullish momentum.

Bitcoin price has continued to rise steadily and uncontrollably since reaching the $43,000 value area on Monday. There has been very little selling pressure in the last three trading days. However, some selling pressure can be expected near the $48,000 value area.

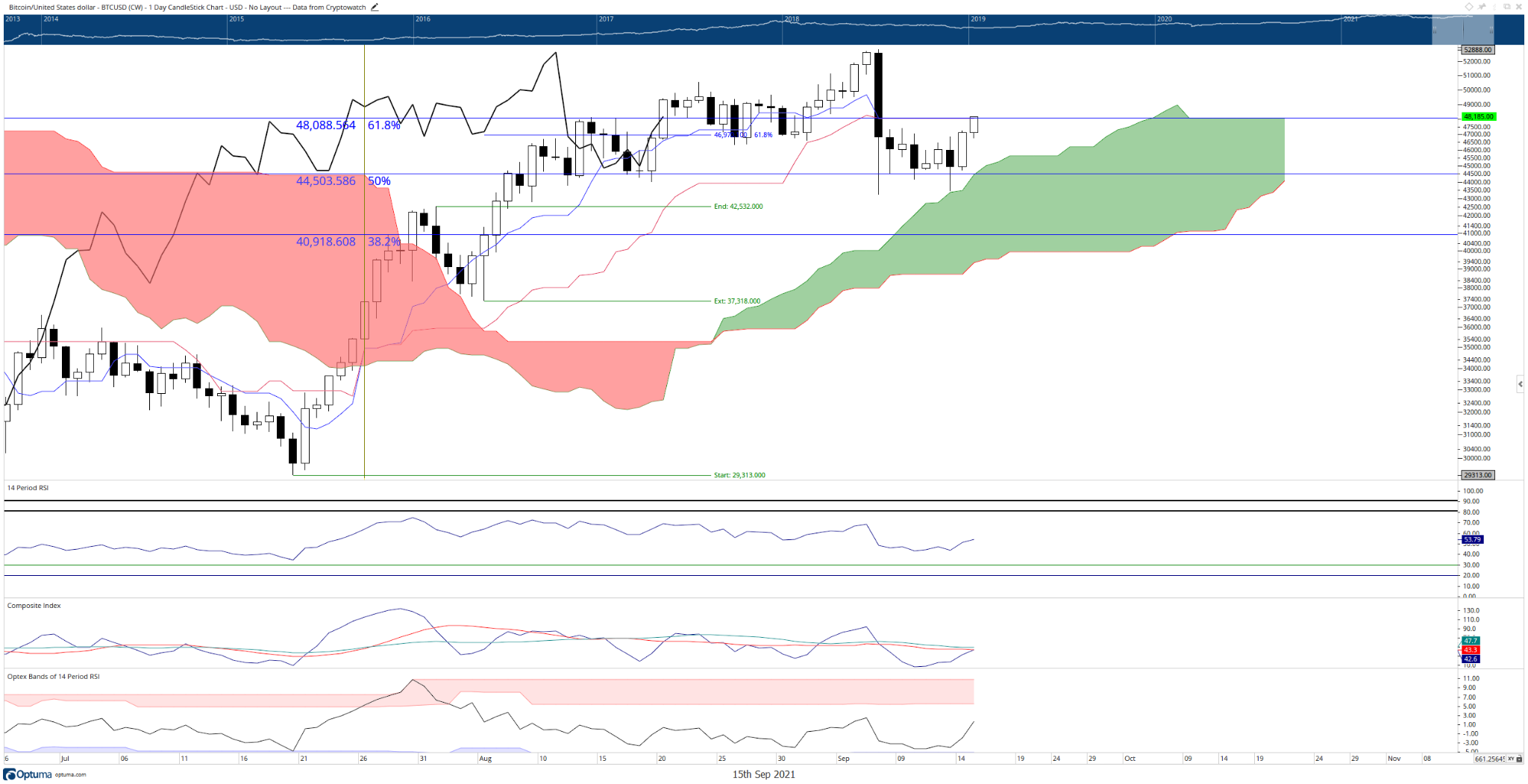

Here you can also take a look at Ichimoku, a technical analysis method that is very popular in global financial markets. Ichimoku analysis produces a wide variety of signals for buying or selling, as it includes different parameters. Tenkan-Sen and Kijun-Sen Lines, which are kind of moving averages, are at the forefront of these parameters. Currently, daily Kijun-sen and Tenkan-Sen are sharing the strong 61.8% Fibonacci retracement level at $48,000. The combination of these Ichimoku and Fibonacci levels creates a natural stop for Bitcoin price. So yIntense Fibonacci and Ichimoku resistance levels could further stall the upside momentum.

If the bulls make it to close above $49,500, Bitcoin will be in an undeniably bullish phase and likely to hit previous all-time highs.

On the other hand, the bears will need to see how the Bitcoin price reacts to the near-term resistance. If the bears can push the Bitcoin price further down and close anywhere below $46,700, testing the $40,000 area is most likely likely. So, a possible bull trap could create a BTC continuation move to the south.

The Relative Strength Index also shows a very neutral situation.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.