Bitcoin Its price continued to show strength, gaining 10% last week amid increased market volatility. Earlier today, BTC price surpassed $68,000 but has since retreated partially. As a result, it is currently trading at $67,195 with a market cap of $1.320 trillion.

Investors Watch Bitcoin Options Expiration

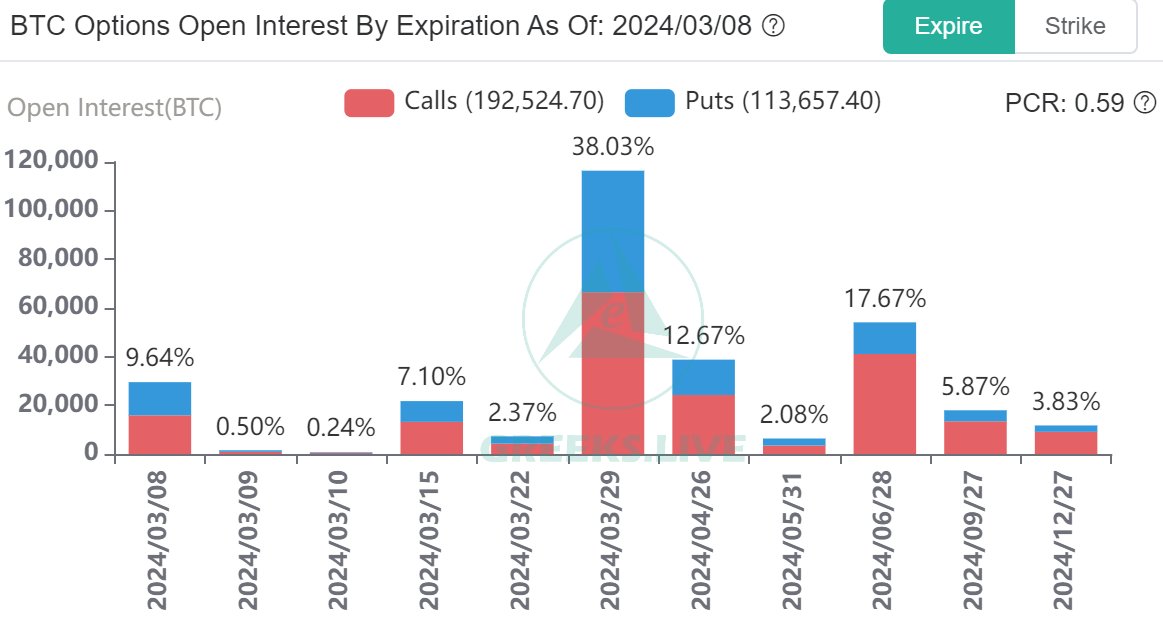

Investors are carefully watching the expiry of Bitcoin (BTC) options. As the crypto market moves towards a major event, options data determines market dynamics for upcoming expirations. A total of 29,000 BTC options will expire, and the Put and Call Ratio of 0.86 accompanying these options indicates a mix of bearish and bullish trends. The maximum pain point was calculated at $60,000, reflecting the maximum number of option contracts expiring worthless and a staggering notional value of $2 billion.

Amid these expectations, market volatility has reached its highest level in nearly a year. Bitcoin’s turbulent journey has seen it briefly reach a new all-time high of over $69,000, but then decline sharply by more than 10%. According to Greeks.Live’s report, all major futures implied volatilities (IVs) rose, while ultra-short-term IVs reached 100%.

Growing enthusiasm for the US currency-driven spot bull market is attracting global attention as Bitcoin’s future is recognized as a promising store of value. This has led to an increase in options trading volume and positions. Options are increasingly preferred due to their versatility, providing protection for spot buyers as well as high leverage opportunities for long and short positions.

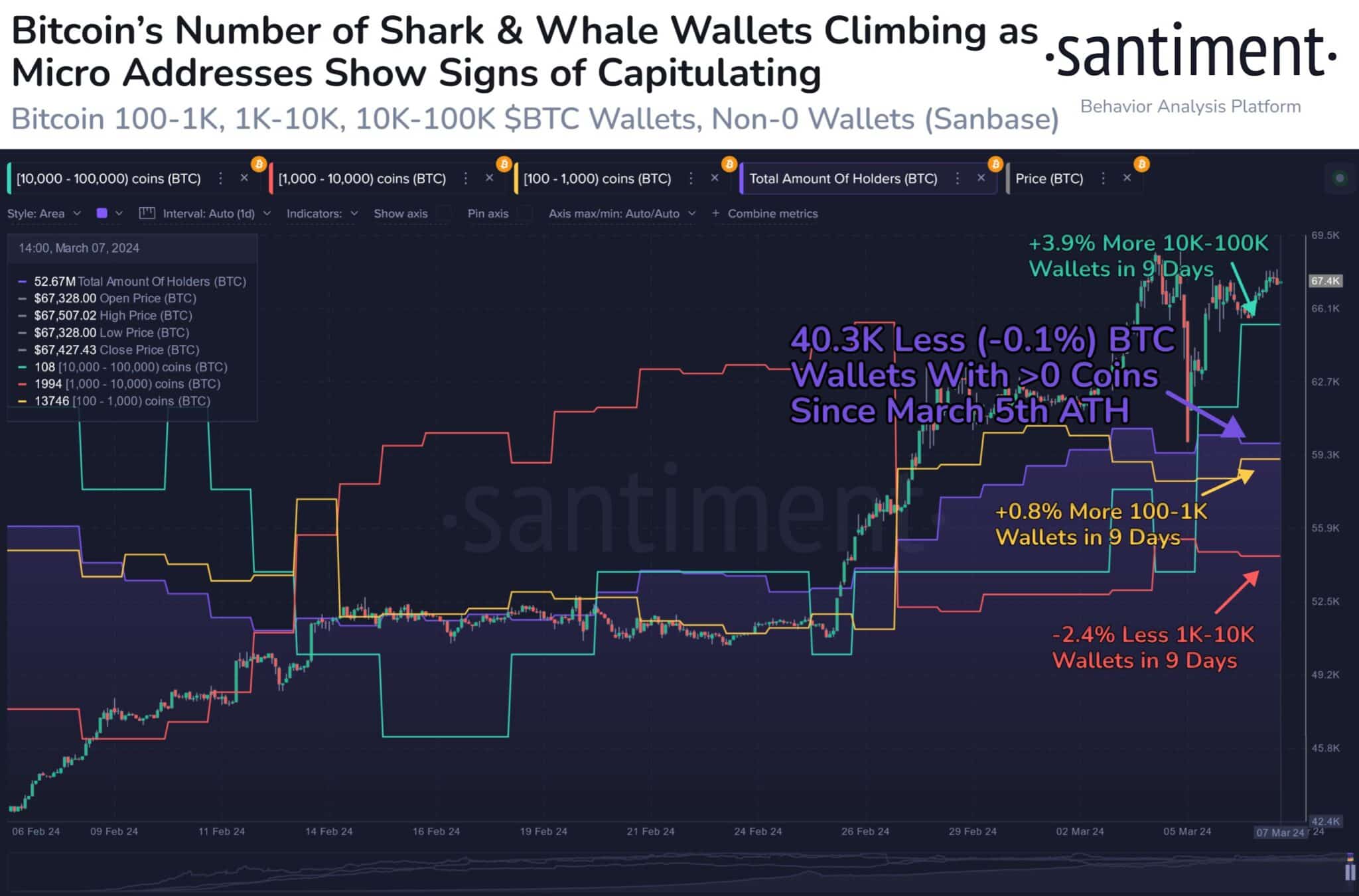

On-chain data shows that Bitcoin whales and sharks continue to accumulate despite the current volatility. Despite market turbulence following all-time high volatility, sharks and whales remain active, according to on-chain data provider Santiment. However, there appears to be a decline in non-zero Bitcoin wallets, largely as small traders switch to selling. This combination is often interpreted as bullish.

On Thursday, March 7, the U.S. Securities and Exchange Commission (SEC) delayed BlackRock’s request to trade options on the spot Bitcoin ETF until April 24. The SEC had previously solicited public comments on whether Nasdaq would allow options trading on BlackRock’s spot Bitcoin ETF. Additionally, BlackRock has filed with the SEC to allow the Global Allocation Fund to purchase spot Bitcoin ETFs.

The SEC also claims that Cboe Exchange, Inc. and Miax Pearl LLC also postponed decisions on spot Bitcoin ETF options. The SEC said in its application:

“The Commission finds that a longer period is appropriate to allow sufficient time to act on the proposed rule change.”

The filings, filed Thursday, include the SEC’s filing with Cboe Exchange, Inc. and revealed that Miax Pearl LLC was postponing its decision on whether to allow options listing and trading on spot Bitcoin ETFs.