Critical data has been announced in the USA. The eyes of those who follow Bitcoin, gold and the dollar were on the Core Personal Consumption Expenditures of May, which will come from the USA. Let’s look at the details.

Incoming numbers

The United States PCE Price Index for May produced mixed results. The realized annual rate was 3.8%, indicating a slight decrease from the previous figure of 4.3%. However, it fell short of market expectations of a 4.6% increase.

In May, the United States Core PCE Price Index showed stable numbers. The realized annual rate remained unchanged at 4.6%. Accordingly, it was in agreement with the previous reading. Market expectations for this index were slightly higher, predicting an increase of 4.7%. The PCE Price Index provides valuable information on inflation trends in the United States. Core inflation remained relatively stable, while the overall index fell modestly. These figures point to a complex inflationary environment. It can also affect the future actions of policy makers and market participants.

Uncertainty prevails in the gold market

Recent economic data has caused the gold market to seek direction. It also caused prices to remain close to unchanged levels. Gold futures for August futures were down 0.10% on the day, trading at $1,916 an ounce. It’s important to note that while core prices remain stubbornly high inflation, headline inflation is declining at a faster rate. The report pointed to a 0.1% increase in the headline PCE compared to a 0.4% increase in April.

Consumption data in the report point to an interesting situation. He points out that consumers create a safety net as personal income exceeds spending. Personal income exceeded expectations with an increase of 0.4%. On the other hand, personal expenditures lagged behind estimates with a modest 0.1% increase. These trends could lead the Federal Reserve to complete its tightening cycle after a recent rate hike in July.

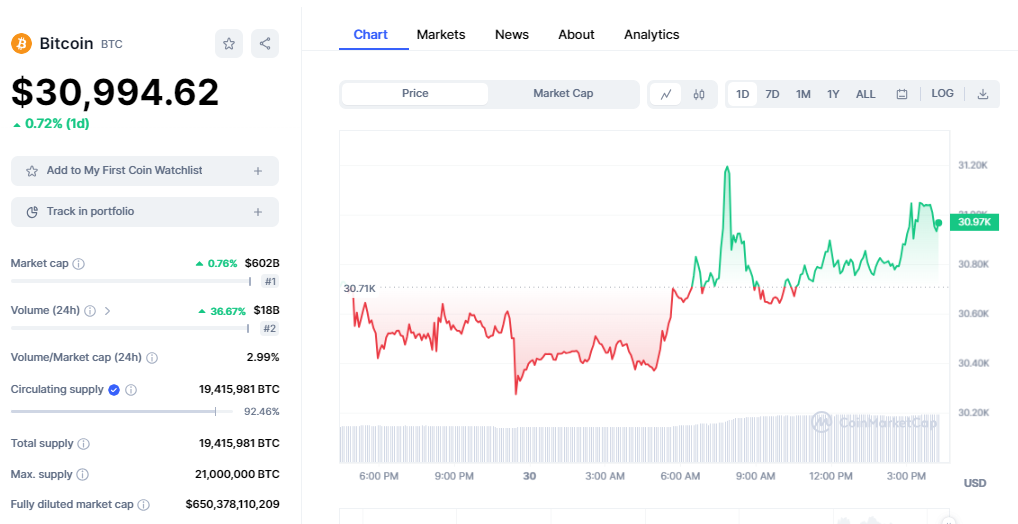

Dollar and Bitcoin

cryptocoin.com When we look at it as a whole, it is seen that there is a slight upward trend in the Dollar after the announcement of the data. Accordingly, the dollar is at the level of 26.07 TL. On the other hand, when we look at Bitcoin, we see that there is a modest increase in Bitcoin. Accordingly, Bitcoin, which reaches up to $ 31,200, is trading at $ 30,994 at the time of writing.

Andrew Hunter, deputy chief economist at Capital Economics, highlights the weak economic activity stemming from low consumption. He believes the rate hike in July will prompt the Federal Reserve to pause the tightening cycle. Despite this, Hunter points to a significant slowdown in real consumption growth. It also forecasts that total GDP growth will slow to 0.5% year-on-year in the second quarter. Although the Fed continued to raise interest rates at the FOMC meeting at the end of July, declining consumption growth and the deceleration of core inflation indicate that this may be the last increase in the near future.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.