Netflix recently announced its details for the January-March period. Netflix announced that it lost 200,000 subscribers during this period, and fell far short of the expected performance, failing to meet expectations. The loss of audience resulted in Netflix shares losing 26% after-hours. Considering that Netflix has not lost subscribers in the last 10 years, the loss of 200,000 subscribers made financial headlines. So can Bitcoin really change the fate of Netflix?

— Note Jerome Powell (@alifarhat79) April 20, 2022

Interestingly, at Mark Zuckerberg, the company’s share price had plunged more than 26% in February when Meta published its earnings report.

After the news that cryptocurrencies show a volatility after every development, it can be seen that the stock markets also show a rapid volatility. What shall we say, a coincidence of fate?

In fact, popular crypto analyst Benjamin Cowen thinks that the stock market is starting to follow in the footsteps of crypto at this stage, and the opposite narrative doesn’t quite apply.

watching $NFLX drop -26% after hours reminds me how stocks became more like #cryptorather than the other way around

— Benjamin Cowen (@intocryptoverse) April 19, 2022

Could Bitcoin Change the Fate of Netflix?

Natalie Brunell of Coin Stories to Netflix’s balance sheet Bitcoin (BTC) He shared a tweet that he suggested he should consider adding.

Maybe $NFLX should get some #Bitcoin content (and BTC on its balance sheet). 🤷🏻♀️

— Natalie Brunell (@natbrunell) April 19, 2022

It’s not surprising to make such a suggestion today, and it may be a very sensible suggestion in the long run, but considering Bitcoin’s recent performance, the asset does not seem to be in a structure that will save lives in the short term.

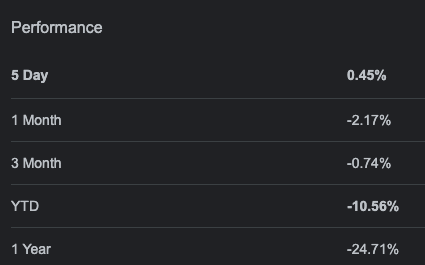

At this stage, the price of Bitcoin has lost almost 11% compared to its position on January 1, 2022. Compared to April 20 of 2021, the asset has lost 25%.

Looking at the overall performance of Bitcoin, it can now be seen that after more strong rises, sharp declines increase. Leaving aside the sudden collapse on May 19 last year, it fell from $7969 to $4776 on March 12, 2020 and lost 40% of its value.

Therefore, if the company adds Bitcoin to its balance sheet, it will also expose its valuation to the harsh volatility of the crypto market. In the long run, however, the leading crypto asset seems to have the potential to protect the company’s fate and blow up its valuation, provided its fundamentals remain intact.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.