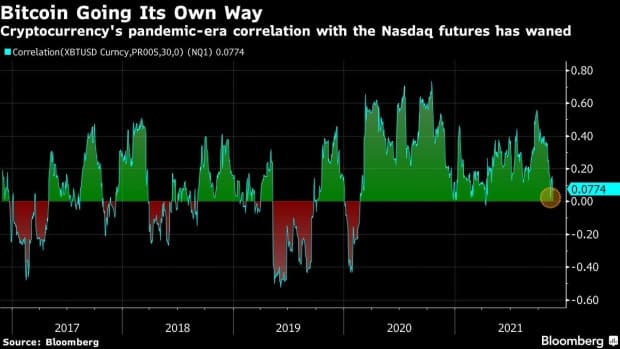

The world’s largest cryptocurrency Bitcoin (BTC), has so far acted in great correlation with the US stock markets. On top of that, several institutional players have also started to have exposure to BTC over the past few months. So what does the deterioration of the correlation between Bitcoin (BTC) and the Nasdaq mean?

BloombergAccording to the latest report of bitcoin‘of Nasdaq one hundred and the pandemic period correlation has approached almost zero in recent days. The correlation peaked in September 2021, a significant number showing that Bitcoin and tech stocks are moving in parallel. The correlation between the two has always remained positive since February 2020.

The Nasdaq value has risen 11% since September 2021. On the other hand, Bitcoin experienced an increase of close to 40%. This was a key indicator proving that Bitcoin ‘taken’ the role of an inflation hedge. It would not be wrong to say that Bitcoin’s latest rally, approaching $ 70,000, is based on the increasing ‘price pressure’ in the global economy.

Bitcoin Volatility Raises Suspicions Once Again

According to many investors, although Bitcoin is seen as a reliable asset (hedge asset) away from volatility, the volatility experienced in recent days, BTCIt once again raised suspicions against him. BTC is down more than 10% after reaching its highest level and is trading below $60,000.

speaking to Bloomberg Carsten Menke“The lack of consistent and negative correlation between bitcoin and stocks clearly shows that bitcoin is not yet a safe haven”. Also highlighting the stress in financial market times, Menke added that Bitcoin, like other risky assets, tends to ‘suffer’.

in Hong Kong Esme Pau, analyst at China Tonghai Securities he shares the opposite view. Pau stated that it is a “sensible” way to buffer Bitcoin (BTC) against inflation.

“I think investors should focus more on ‘long-term investing’ and should not be treated as representative of ‘short-term’ changes in correlation,” he said.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.