Jurrien Timmer, global macro manager at Fidelity Investments, described Bitcoin (BTC) as an important technology that could be the Apple and Amazon of the future.

Jurrien Timmer, global macro manager at Fidelity, one of the world’s largest investment firms, recently shared Bitcoin in social media post on the current status made remarkable statements. Timmer, Bitcoin the future apple Recalling that he survived the last bear season, he made a new entered the renaissance era suggested.

The Apple of the digital asset age: Bitcoin!

Timmer explained the bullish cycles in Bitcoin when technology stocks peaked in the early 2000s. to the dot-com frenzy surviving the dot-com bubble apple And Amazon reminded me of companies like Thanks to the great interest in many stocks in those years astronomical to levels but then the vast majority of these shares fell seriously and almost disappeared.

Although the dot-com bubble wiped out many empty projects, the companies that remained in those days worldwide domination provided. Cryptocurrency according to Timmer bull seasons also hosts similar situations, but each time from these cycles right side Bitcoin is happening. Timmer considers Bitcoin in this direction. the future apple describes it as:

In the process, long-term winners like Apple and Amazon were separated from the losers. The same has been proven so far for crypto. Assuming that Bitcoin is the Apple of the digital asset era, it might make sense that Bitcoin not only survives the crypto winter, but even thrives and takes market share from other digital assets.

Following in the footsteps of gold

of bitcoin in a long period of adaptation and over time a store of value The manager stated that it will gain importance as a following in the footsteps of gold made the analogy:

Bitcoin is a desirable but unproven coin, just like gold has been for millennia. Literally, money is a store of value, a unit of account, and a medium of exchange. I don’t see many people paying with gold at Starbucks. Obviously, gold is nowadays mostly used as a store of value.

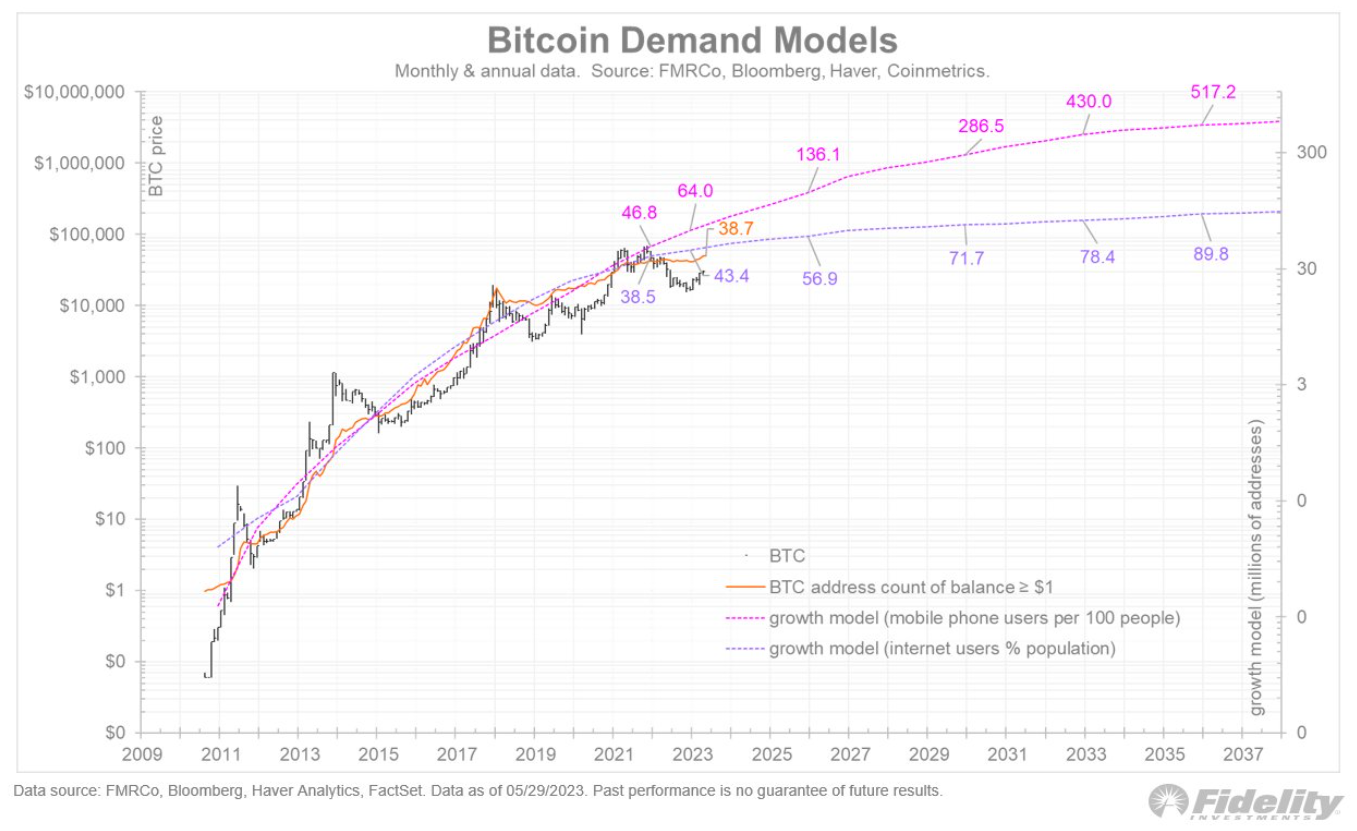

On the other hand, the adoption curve of Bitcoin mobile phones And of the internet compared with historical adoption curves. Stating that the adoption curve of Bitcoin has slowed down after the crypto winter of 2022, the Fidelity executive still we are at the very beginning of everything implied with these words:

The crypto winter of 2022 has slowed Bitcoin’s adoption curve. On the other hand, today, the number of Bitcoin addresses with balances of more than $1 is well below the mobile phone model and even slightly below the internet curve. This shows us a huge adoption potential.