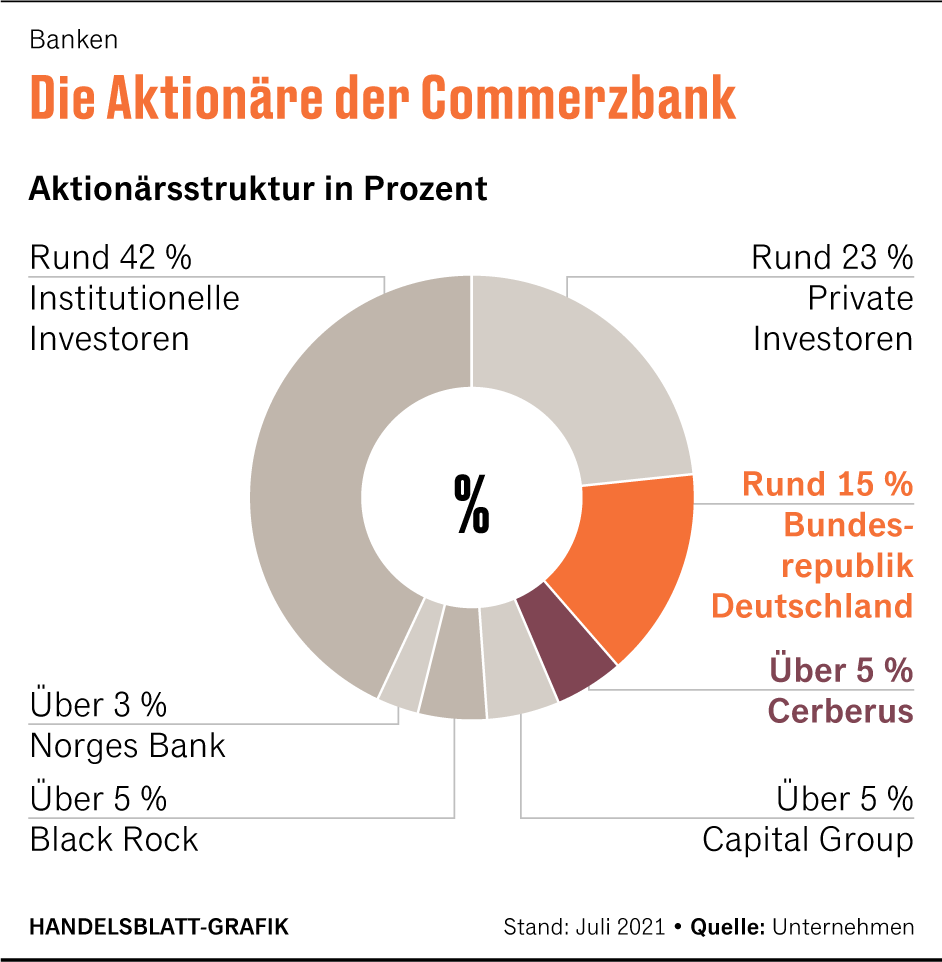

The future of the financial house will largely depend on the federal government and the US financial investor Cerberus, both of whom have a stake in the institute.

(Photo: dpa)

Frankfurt The federal government and the US financial investor Cerberus, as major shareholders, have a lot of influence on the future of Commerzbank – and both are exchanging ideas at the highest level. State Secretary for Finance Jörg Kukies had appointments with Cerberus co-boss Frank Bruno on April 22nd and June 29th this year.

This emerges from a response from the Federal Ministry of Finance to a request from the FDP MP Reinhard Houben, which is available to the Handelsblatt. During the conversation in April, Cerberus Germany boss David Knower and his colleague David Teitelbaum were also present.

On August 28, 2020, there was an even more top-class discussion group. In addition to Kukies, Federal Finance Minister Olaf Scholz, Cerberus co-founder and co-boss Stephen Feinberg and Chairman John Snow were involved. Snow has been working for the financial investor since 2006 and was previously US Treasury Secretary for a good three years under President George W. Bush.

The high-level discussions are also interesting because Cerberus is considering buying its 15.6 percent stake in Commerzbank from the federal government. The Handelsblatt reported on this exclusively three weeks ago.

Top jobs of the day

Find the best jobs now and

be notified by email.

However, there has not yet been an official offer. “The Federal Ministry of Finance has not received an offer that needs to be evaluated,” writes the ministry. “In due course, the inter-ministerial steering committee” will decide how to deal with state participation.

The federal government has been involved in Commerzbank since the state bailed out the 2008 financial crisis. Cerberus got around five percent in 2017. Insiders consider a timely sale of the federal stake to Cerberus or another interested party realistic, especially in the event that FDP boss Christian Lindner becomes the new finance minister.

After all, the Liberals have repeatedly spoken out in favor of the state withdrawing from Commerzbank. Should the federal government exit at the current rate, however, it would be left with a loss of around four billion euros.

Selling the state share was not an issue

In the recent talks between Kukies and the Cerberus top, a sale of the state Commerzbank stake to the financial investor was not an issue, government circles say.

From the point of view of Reinhard Houben, the economic policy spokesman for the FDP parliamentary group, this should not stay that way. “The accumulation of discussions between the Ministry of Finance and representatives from Cerberus and Commerzbank this summer shows that the channels for discussion are open,” he said. “So far, the political will to draw a line under its unsuccessful state participation on the part of the federal government is missing.”

The current book loss of the federal government of four billion euros illustrates the risks associated with disruptive government intervention in the market, says Houben. “The state is just not the better shareholder.”

Restructuring of Commerzbank

Commerzbank is at the beginning of a radical restructuring. 10,000 jobs are to be cut by 2024. Many within the institute would like the state to remain on board as an anchor shareholder for some time during the restructuring.

The likelihood that the institute will be taken over is currently viewed as low within Commerzbank. In addition to the poor share price, this is also due to the enormous risks associated with the restructuring of the bank. These could put off potential buyers.

The answer to the FDP request also shows that there have been numerous discussions between the management level of the Ministry of Finance and the top of Commerzbank since the beginning of the year. State Secretary Kukies spoke to the new Commerzbank boss Manfred Knof a total of four times – in January, March, June and July.

The chairman of the supervisory board, Helmut Gottschalk, who has been in office since April, made his inaugural visit to Olaf Scholz on July 28th. He also held talks with State Secretary Kukies in mid-July and early September.

More: Cerberus is considering buying state stake in Commerzbank – share rises sharply.