Digital asset manager CoinShares noted that large institutional investors have been more selective this year. More last week Ethereum (ETH), Polygon (MATIC), and an ETH competitor, he said.

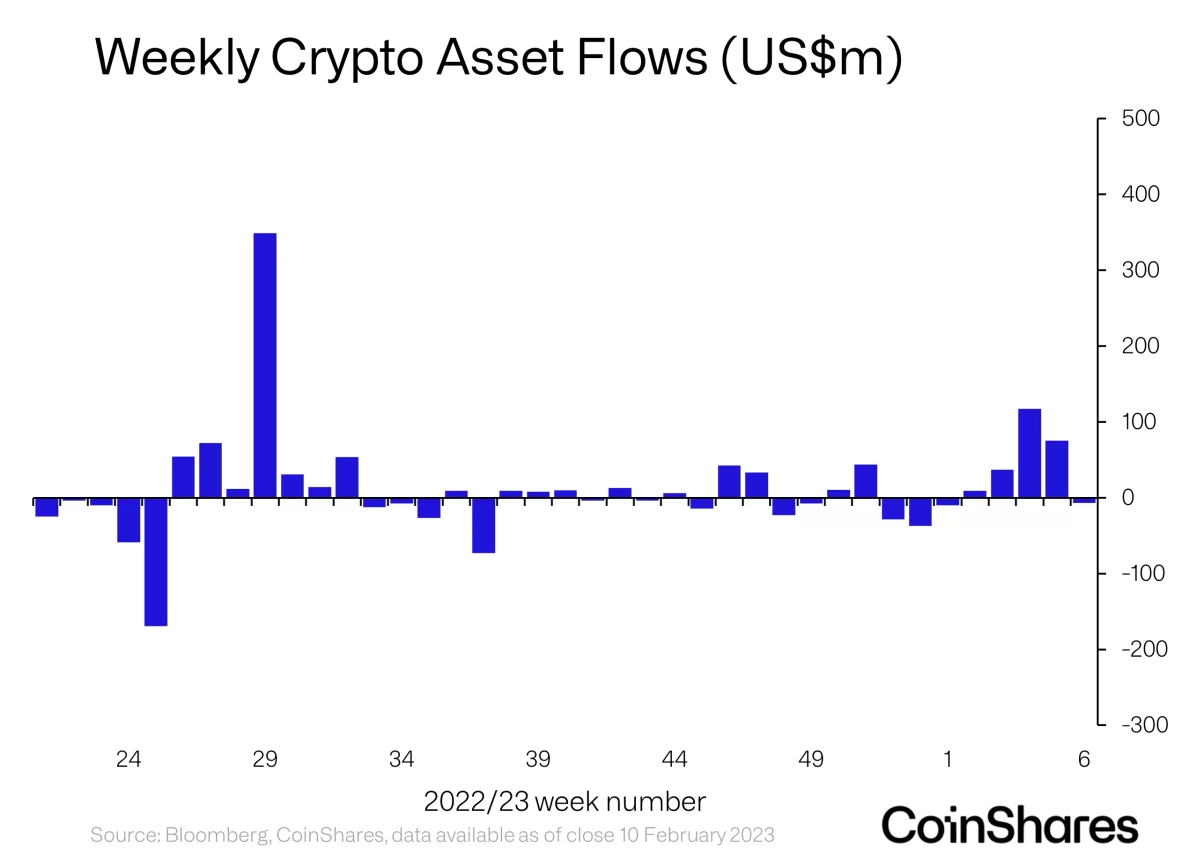

In its latest Digital Asset Fund Flows Weekly Report, CoinShares found that institutional digital asset investment products have experienced minor exits over the past week, despite the entry of certain altcoins.

“Digital asset investment products saw small outflows totaling US$7 million last week after a week of macro data that significantly beat expectations.

Investors appear to be more selective this year. While certain coins have performed well, a total of 10 altcoins saw a total of $4.8 million in entries last week.”

NEWS CONTINUES BELOW

CoinShares stated that the overall small outflows may be related to investors’ fears about possible rate hikes by the US Federal Reserve.

both long and short bitcoin (BTC) investment products experienced a breakout last week.

“Primarily focused on Bitcoin. There was a total outflow of US$10.9 million, but there was also a total outflow of US$3.5 million from short Bitcoin investment products.”

Ethereum investment products received $5.1 million inflows last week. In addition, MATIC products earned $0.4 million. Ethereum’s competitor Solana (SOL) products received $0.8 million in inflows last week, while ETH rival Cosmos (ATOM) investment vehicles gained $1.8 million. While there was a total inflow of about $5 million in 10 different altcoin investment products last week, multi-coin investment products that invest in a basket of digital assets also experienced an exit in the 11th week.

“Multi-asset investment products experienced a total exit of $2.4 million last week, which represents the 11th consecutive week exit. Investors seem to be more selective this year and certain coins like Ethereum are performing well, with $5.1 million inflows last week.

10 altcoins saw a total of $4.8 million in inflows last week.”