The fact that many senior executives, including Coinbase CEO Brian Armstrong, have sold a significant amount of company stock (COIN) raises concerns. The sales came shortly after the double-digit rise in the price of COIN.

Coinbase executives divest COIN shares

According to documents filed with the SEC, Coinbase executives have sold a significant amount of stocks in recent days. These included Paul Grewal, Chief Legal Officer, and Jonnes Jennifer, Chief Accountant. Coinbase executives, including CEO Brian Armstrong, made a total of $6,886,552 in sales on July 6.

Popular crypto analyst Efe Bulduk said sales, “I wonder why? Why would anyone sell a company stock that would make 2x if the ETF was approved?” he commented.

CEO Brian Armstrong hits biggest stock sale this week

This week, Armstrong sold $5.8 million worth of stock in his biggest sale. It also sold $2.6 million worth of stock on May 25. Armstrong previously announced that he would sell his 2% stake in Coinbase within the next year. He aims to use the proceeds to fund science and technology developments at companies he co-founded, including biotech company NewLimit and scientific research company ResearchHub.

There have been multiple reports of Coinbase executives selling their shares, following a shareholder lawsuit accusing the CEO and investors of dumping shares to avoid significant losses in 2021.

What’s next for COIN?

Coinbase Global shares are up more than 125% this year, reflecting positive investor sentiment. However, regulatory pressures and sluggish trading volumes in the depressed crypto market raise concerns about the stock’s future performance.

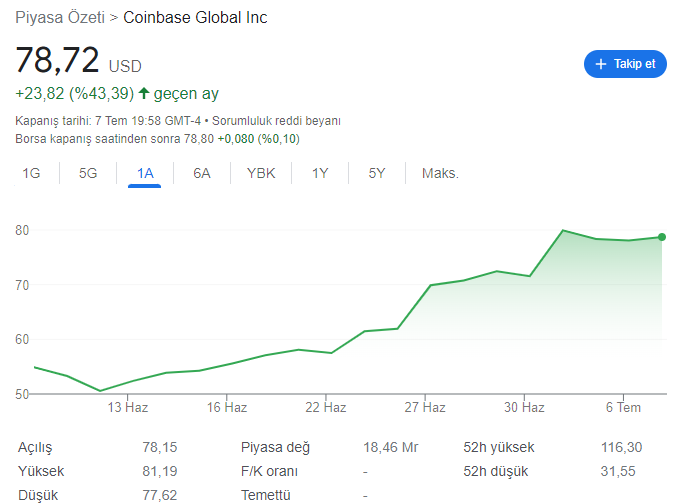

The COIN is currently trading at $78.72. It has earned 30.57% over the past year. The decline is due to the ongoing SEC litigation. The SEC alleges that the company offers some unregistered securities that pose a threat to Coinbase’s core trading business. cryptocoin.comAs you follow from , the case came to an end one day from the Binance case.

Meanwhile, the COIN stock price has been gaining in value over the past few weeks. The rally came about when BlackRock updated its Bitcoin ETF through the listing of Nasdaq and Coinbase as partners under a custody sharing arrangement.

The latest in the Coinbase case

The US-based exchange countered shortly after the SEC lawsuit. He claimed that the regulator has no say over the coins it lists on its platform. In response, the SEC alleges that the exchange deliberately violated the law. You can take a look at the details of the hot development in this article.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.