Up to twelve months delivery time: The business of the equipment supplier to the chip industry is running smoothly.

(Photo: Aixtron)

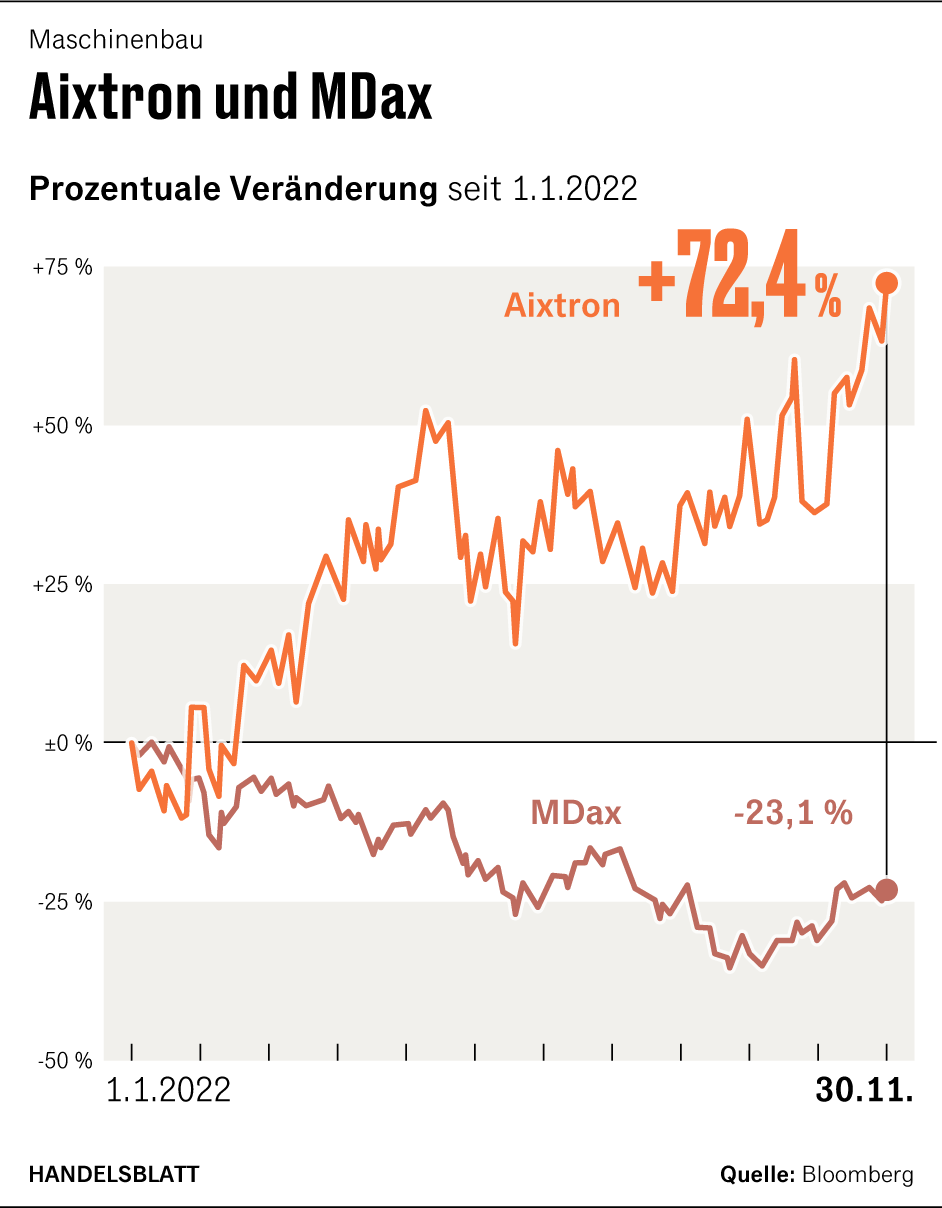

Munich The order books are full, investors are in a good mood: Aixtron’s share price has risen by around 70 percent since the beginning of the year. Only the armaments group Rheinmetall has developed better in the MDax than the semiconductor equipment supplier from Herzogenrath near Aachen.

Aixtron benefits from the boom in energy-saving chips made from the innovative materials gallium nitride and silicon carbide. The company manufactures the necessary machines. According to CEO Felix Grawert, this is just the beginning of the upswing. “We expect double-digit growth with silicon carbide and gallium nitride over the next decade,” the manager told Handelsblatt.

Semiconductor groups around the world are building numerous plants for these so-called compound semiconductors. “At the latest as soon as the chip manufacturers have received the building permits, they will order from us. Then we’ll have enough lead time,” said Grawert. At the end of the third quarter, Aixtron had orders for 369 million euros on its books, almost 40 percent more than in the previous year.

Aixtron shares with a lot of potential

At around 30 euros, the shares are trading at their highest level for more than ten years. Nevertheless, the Jefferies analysts expect the price to rise further to EUR 35 within a year.

Top jobs of the day

Find the best jobs now and

be notified by email.

The machines from Aixtron can be used, among other things, to produce optoelectronic components such as LEDs or solar cells. The machines are currently in particularly high demand for the production of so-called power semiconductors, which are increasingly made of composite materials.

These components are essential for charging stations or solar systems, and Apple uses them in notebook chargers. In electric vehicles, they ensure lower power consumption and thus a longer range.

It’s a niche in the chip market, because the component material used to date is silicon. The chip machines Multi-billion companies such as ASML, Applied Materials or Lam Research produce this process.

In the machines from Aixtron, chemicals – more precisely: organometallic compounds – are vaporized and fed into a reactor together with other gases. This is where the decisive chemical reaction takes place, in which the crystal, i.e. the compound semiconductor, is formed from the gaseous materials.

Grawert sees his company as a leader in this technology. Word got around in China six years ago. At that time, the Fujian Grand Chip Investment Fund tried to take over Aixtron. However, the investor failed with his offer of 676 million euros due to resistance from the US government and the Federal Ministry of Economics. Today, the market value of Aixtron is around 3.4 billion euros.

>> Read here: Infineon outlook inspires investors and analysts – share price takes off

Today, China offers the company enormous sales potential, but it also harbors risks. In this way, Aixtron can sell machines in bulk in the People’s Republic – as long as there are no export restrictions or local competitors are preferred.

Aixtron wants to continue to supply the Chinese

Grawert does not expect export bans, despite the German government’s recent tough approach towards Chinese investors in the chip industry: “We assume that we will be able to continue to deliver our systems to China in the future.” After all, systems of a comparable type are already being offered there by local manufacturers.

Most recently, Grawert raised the annual forecast at the end of October. The head of the company now promises an operating return on sales of up to 24 percent, one percentage point more than before. In addition, incoming orders are expected to increase to up to EUR 600 million this year, which is EUR 20 million more than previously announced. In 2021, the company had achieved sales of 429 million euros.

The CEO of Aixtron expects double-digit growth for years to come.

(Photo: Aixtron)

The machines from Aixtron are in the factories of the most renowned chip manufacturers, from the US group Intel and Infineon from Munich to TSMC, the world’s leading contract manufacturer from Taiwan. The automotive supplier Bosch also uses Aixtron in its semiconductor plants, as does the American silicon carbide specialist Wolfspeed.

>> Read here: European chip industry is sounding the alarm

Currently, two thirds of the proceeds come from Asia. In the meantime, however, customers are increasingly investing in factories in the West. The USA and the EU grant subsidies for this. “Due to their strong position in power electronics, Europe and America will play a larger role for us in the medium to long term. This will also be reflected in the sales mix for 2023,” explained Grawert.

Meanwhile, buyers are planning further billion-euro investments. Wolfspeed boss Gregg Lowe is looking for a location for a new factory. Germany is also under discussion, the manager told the Handelsblatt. In the spring, Lowe wants to decide where the excavators will drive up.

Lowe should place his orders with Aixtron early on. Customers currently have to wait between nine and twelve months for the machines to arrive.

More: Europe? No thank you! Why a large Japanese chip group scorns the EU billions