Computer chips are currently plentiful, but there is a lack of semiconductors for the automotive industry.

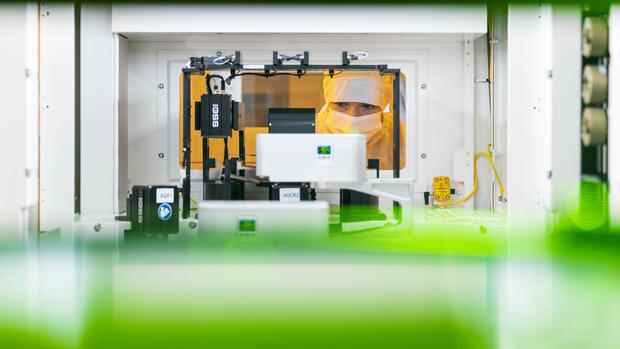

(Photo: Sven Döring for Bosch)

Munich Despite an impending recession, autochips are in demand like never before. Semiconductor manufacturers are far from able to deliver as much as car manufacturers need. That won’t change any time soon, says Albert Waas from the consulting firm Boston Consulting Group (BCG): “There are numerous plants in the planning stage and also under construction. But it takes years for the factories to run.”

Experts doubt that the currently announced projects will be sufficient at all. Because the semiconductor manufacturers do not invest enough in factories for chips of rather older generations, as they demand from the car manufacturers, explains Rainer Koppitz, head of the listed Munich electronics manufacturer Katek.

Since the beginning of the corona pandemic, the lack of semiconductors in the automotive industry has repeatedly caused supply problems and production losses worldwide. After the car manufacturers canceled many orders at short notice in spring 2020, the chip manufacturers looked for other customers. Supply chain problems, natural disasters and geopolitical tensions between the US and China have been exacerbating the situation ever since.

Car manufacturers do not accept higher prices

The Katek boss complains that the car brands themselves are partly to blame for the current misery. Because, in contrast to other branches, they would not commit themselves early to delivery quantities for the chip companies. If the components are scarce, the chip manufacturers would prefer customers from the medical technology or mechanical engineering sectors.

Top jobs of the day

Find the best jobs now and

be notified by email.

But that’s not all: According to Koppitz, many car manufacturers are not willing to accept higher prices if the components have to be procured at short notice via brokers, i.e. middlemen. In that case, production at companies like Katek will be at a standstill. Other customers are more willing to pay extra for “creative” procurement, says Koppitz.

BCG expects that supply bottlenecks will continue for selected chip types until at least 2026. Semiconductors made from the innovative materials silicon carbide and gallium nitride remained scarce. Such chips reduce the power consumption of electric cars and ensure longer ranges. However, they are also required for wind turbines or solar systems. Therefore they are extremely in demand. The supply of sensors also remains difficult.

>> Read here: The chip industry discovers Germany – the new Intel factory is just the beginning

At the same time, demand is growing: BCG predicts in a new study that the autochip business will grow by eleven percent annually up to 2026. No other segment of the semiconductor market will develop so dynamically, judges the consulting company.

This is because electric cars need significantly more chips than cars with internal combustion engines. Automated and later autonomous driving also ensure additional orders for corporations such as Infineon, ST Microelectronics and NXP.

The experts at the consultancy assume that there will be chips for an average of $1,170 in a vehicle in 2030 – almost twice as much as last year. This strong plus explains why the approaching recession leaves the auto chip producers rather cold. Even if the car manufacturers produce less, there are still significantly more semiconductors in every vehicle than before.

The supply bottlenecks could even worsen in the coming years. Because the USA has just announced far-reaching export restrictions to China. This affects the manufacturers of chip machines, among others.

US embargo hits chip production in China

This is critical because around half of all additional capacity for autochips is planned in China, according to BCG experts. It is currently completely open whether the manufacturers will get the necessary equipment there at all. It is not even certain whether the companies in the People’s Republic can maintain the current production.

The Dutch outfitter ASML, for example, has already prohibited its employees in the USA from having any contact with China. This also applies to the servicing of machines. Competitors Applied Materials, KLA and Lam Research are hiring staff from Chinese manufacturer Yangtze Memory Technologies, Bloomberg reports.

>> Read here: Many companies no longer buy new computers – PC giant Dell is reacting with an alternative

But that’s not all: the restrictive corona policy of the Chinese government is still worrying the customers of the chip factories there. According to the semiconductor industry, lockdowns could paralyze production or logistics at any time.

Never go back to normal waters

One thing could benefit the auto industry, at least in the short term: Computer builders are currently buying far fewer chips from contract manufacturers like TSMC in Taiwan. “Capacities in the chip factories that were previously reserved for PCs and smartphones are freed up,” says BCG consultant Waas.

Will it ever get better again with the supply of chips to the automotive industry? “We assume that the car manufacturers will not return to normal waters,” fears BCG consultant Waas. His advice: “It is becoming increasingly important for them to cooperate with the chip manufacturers in order to secure the necessary volumes.”

More: Hope for the automotive industry: Infineon strengthens European chip production.