China is reacting to US export restrictions on chips with export controls.

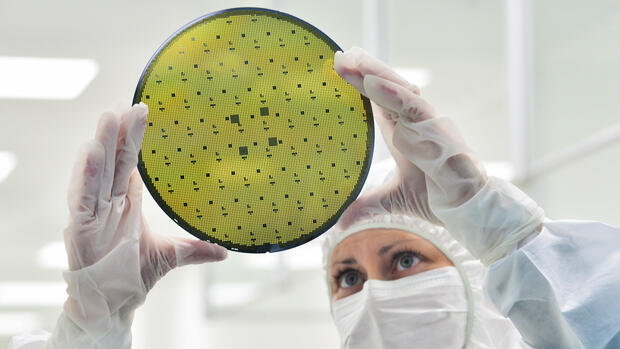

(Photo: dpa)

Beijing China will restrict exports of the industrial metals gallium and germanium from August. In the future, exporters will need special licenses to be able to deliver the metals to foreign customers, the Chinese Ministry of Commerce announced late Monday evening (local time). The export controls served to protect national security and national interests, it said.

The move comes in response to moves by many Western countries to reduce their dependence on the Chinese market and US restrictions on cutting off China’s supply of key semiconductors. A few days ago, the Netherlands announced that it would restrict the sale of chip production machines abroad.

Experts fear that should China reduce exports of the metals, this could have a negative impact on the European Union’s (EU) efforts to decarbonise its economy. The move also shows the limits of Western efforts to move their supply chains outside of the Chinese government’s sphere of influence.

China is the world’s largest producer of the two metals gallium and germanium, which are needed in the semiconductor, telecommunications and electric vehicle industries. According to a study by the EU, 94 percent of the gallium and 83 percent of the germanium worldwide come from the People’s Republic. The EU itself obtains 71 percent of gallium and 45 percent of germanium from China.

Neither metal is particularly rare. However, processing costs are high. Price competition from Chinese suppliers has forced many manufacturers in other countries to give up. Countries like Germany and Kazakhstan have reduced their funding.

>> Read also: Merck boss considers decoupling from China “not feasible in the next two decades”

The Commerce Department’s announcement follows the adoption of the EU’s new economic security strategy, which seeks to policing critical technology exports and could limit overseas investment in the name of national security. In this way, it wants to become less dependent on China, which repeatedly uses its economic power to exert political pressure.

West would need at least a decade to free itself from dependence on China

China’s actions make it clear “who has the upper hand in this game,” said Simone Tagliapietra, a researcher at the Brussels think tank Bruegel, in an interview. The harsh reality is that “it will take at least a decade for the West to break away from China’s commodity supply chains.”

Should China reduce exports as a result of the new export rules, the prices for the metals are likely to rise significantly. However, this would also result in opportunities for competitors from other countries. The recycling of raw materials could also become more important. This is how germanium can be recovered from the windows of decommissioned tanks and other military vehicles, according to an analysis by the US Department of the Interior.

With agency material

More: Scholz wants to leave the reduction of China risks to the economy.