Chainlink (LINK), seemed to have started 2022 on a fast and strong rise, but LINK investors faced a serious decline this week.

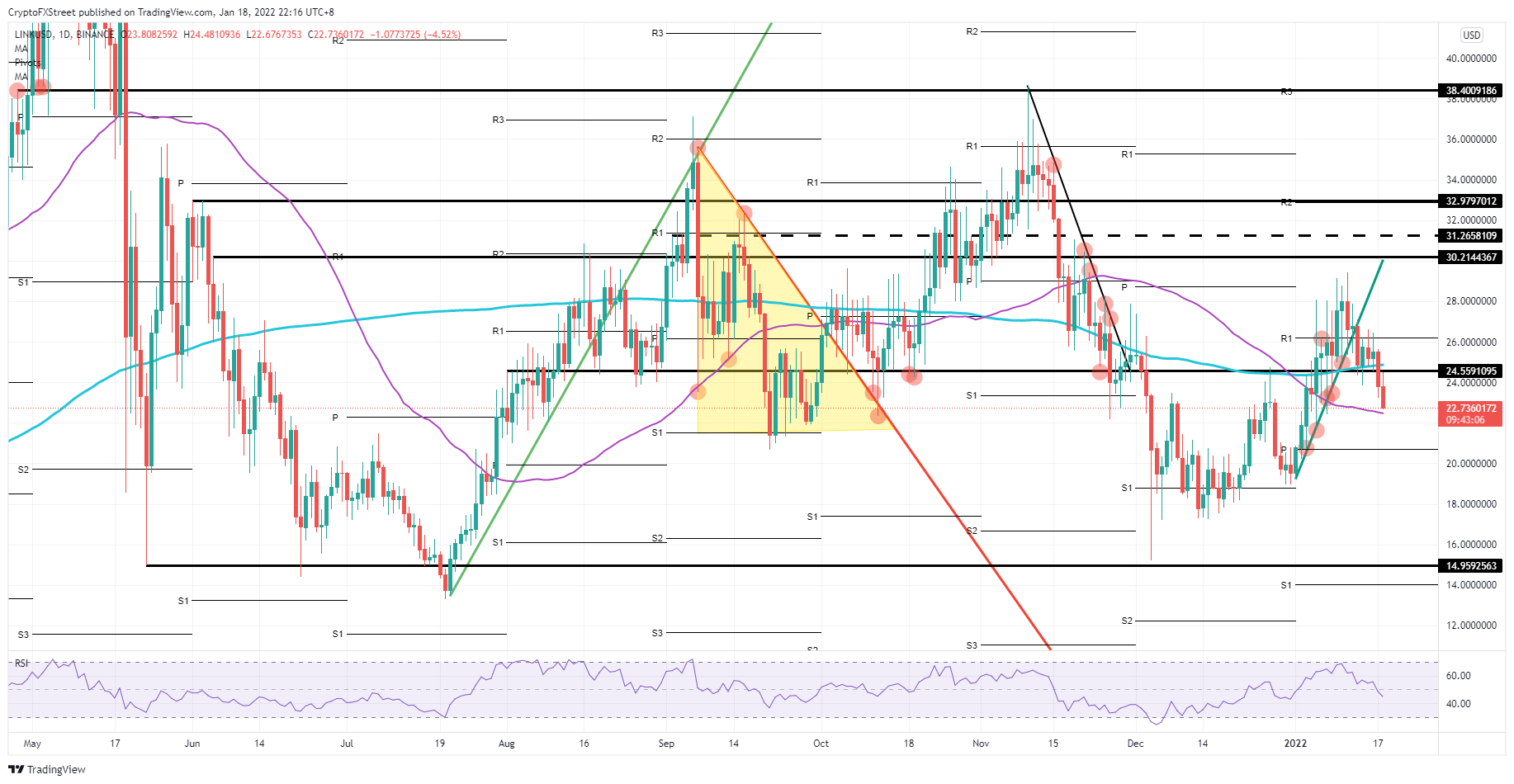

chainlink price It is now approaching the 55-day ‘simple moving average’ (SMA) that has acted as support and resistance several times in the past. A break lower could result in price action falling towards $20.7 in the best-case scenario or $15 in the worst-case scenario.

Chainlink Prepares for Worst-Scenario with 35% Drop

Chainlink investors are walking a tightrope as bears try to push them to a wall and get them to ‘hand over all their money’. Further declines below $24.55 as the price action depreciates further, the 55-day SMA will start to come into play as the last line of defense as there will be at least a 12% loss. A break of the 55-day SMA below $22.50 will open the way to the monthly pivot around $20.70,.

However, this is not where the pain will end for LINK bulls, as the monthly pivot is not expected to hold as the monthly pivot broke down quite a lot in December.

While the current market sentiment is likely not to turn into risk overnight, further pressure on the monthly pivot is to be expected with a possible break below $20. A significant penetration could create an accelerated sell-off towards $15.00, which coincides with May 23 and December 04 lows.

A bounce from the 55-day SMA or monthly pivot is possible if the sellers respect the Relative Strength Index (RSI), which until then will be trading in the oversold zone.

This is for sellers to make a profit. LINK should see a slowdown in selling pressure and a slight increase in buying volume. A bounce from one of these levels is possible, but it needs to be managed with a fairly tight stance and respecting the levels in between before reaching broad support at $15.00.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.