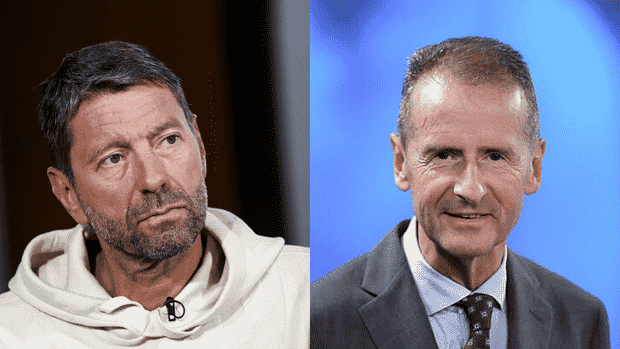

Dusseldorf The early dismissals of the CEOs of Adidas and Volkswagen, Kasper Rorsted and Herbert Diess, have come under criticism from shareholder protection groups. “It is very critical when a recently extended board is thrown out at a very high cost,” says Marc Tüngler, general manager of the German Association for the Protection of Securities (DSW). “Then the responsibility and liability of the supervisory board must be discussed.”

Both Dax companies have announced in the past few weeks that they will part with their top managers despite long-term contracts. According to estimates, severance payments in the double-digit million range are likely to be incurred. Tüngler is therefore in favor of choosing shorter terms when extending the contracts of controversially acting CEOs. One, two or three-year contracts are legally possible and common practice abroad.

He expects more “clear edge” from the inspectors. “Sometimes you have to have the guts to end the contractual relationship after a first or second term that isn’t absolutely convincing,” says Tüngler. “That’s still quite difficult for German supervisory boards.”

Markus Dufner, Managing Director of the Umbrella Association of Critical Shareholders, sees it in a similar way: “When CEO contracts that have just been extended are terminated a short time later, that is very surprising and gives rise to speculation.” It is very strange, he says. that supervisory boards assessed the performance of a top manager so differently within a few months.

Top jobs of the day

Find the best jobs now and

be notified by email.

“Then people like to say that the contract was canceled by mutual agreement,” explains Dufner. “The whole thing then has the aftertaste of a golden handshake.” Such practices contradict the principles of good corporate governance. “The German Corporate Governance Code should develop strict guidelines to prevent such abusive practices,” says Dufner.

This was already controversial when the contract was extended

The resignation announced by Herbert Diess in July raises questions among the shareholders’ protectors. The car manager was already controversial last summer. Nonetheless, Diess received a new four-year contract.

“How is it possible that his contract was extended until 2025, even though he was already being heavily criticized and rumors of termination were circulating?” asks Dufner. “Why is Diess getting a consulting contract now?”

>> Read also: This is how he got kicked out VW boss Herbert Diess

The abrupt end by “mutual agreement” at the end of August is also piquant in view of VW’s shareholder structure. The state of Lower Saxony is the second largest shareholder after the Porsche/Piëch family, which holds the majority of the voting rights via the Porsche SE holding. It is represented on the supervisory board by Prime Minister Stephan Weil (SPD) and Economics Minister Bernd Althusmann (CDU).

In the case of Adidas boss Kasper Rorsted, the contract was extended early in August 2020 to 2026. “The payments for him after his early departure will probably be in the tens of millions,” says Dufner. It is difficult to explain why a CEO who has made major strategic mistakes by making his company too dependent on the Chinese market is still being rewarded.

Adidas announced last Monday that Rorsted would be leaving the sporting goods manufacturer early next year. It is “the right time to initiate a change in the position of CEO to enable the company to restart,” said Thomas Rabe, Chairman of the Supervisory Board.

>> Read also: Share weakness, China business, lack of innovation: That’s behind Rorsted’s end at Adidas

At the time of the 2020 contract extension, Rorsted was not as controversial as Diess. However, the public image of the top manager was scratched. The Dane had been heavily criticized for his initiative not to pay rent for shops that were closed in lockdown during the corona pandemic. Rorsted even had to apologize publicly for this.

What is remarkable about the departures of Rorsted and Diess are the high severance payments resulting from the long contract terms, says Markus Kienle, lawyer and member of the board of the Protection Association for Investors (SdK).

One is therefore fundamentally very critical of severance payments due to the premature termination of the Management Board mandate or the employment contract. “Severance payments are generally prohibited if the company has the right to terminate the contract or if the premature termination is the responsibility of the board member,” explains Kienle.

Tens of millions as compensation under discussion

The exact amount of the severance payments cannot be calculated because the employment contracts are not published, says Kienle. At VW, however, up to 30 million euros are under discussion for Diess for the remaining three years. At Adidas, around 20 million euros can be expected for Rorsted.

However, Kienle warns that these calculations should be treated with extreme caution and caution. They are derived from the most recent remuneration reports from companies. This could also include components, in particular long-term variable remuneration that is paid for other financial years but has only now become due.

The German Corporate Governance Code recommends capping severance payments. According to this, payments to a member of the Management Board in the event of premature termination of the activity “should not exceed the value of two annual salaries and should not compensate more than the remaining term of the employment contract”. However, this is only a recommendation and is not legally binding.

According to stock corporation law, the severance payment must be in reasonable proportion to the previous performance and tasks of the member of the Management Board and the current situation of the company. In addition, it may not exceed the usual remuneration without special reasons. What is appropriate, however, is a decision by the supervisory board on a case-by-case basis.

There are arguments for long-term CEO contracts

The practice of agreeing on shorter contract terms, which is quite common abroad, is still rarely followed in Germany. And there are reasons for that: “In practice, it is not very realistic if the board member was previously appointed for a maximum period of five years, but you deviate from this when appointing a new member,” says Renate Prinz, partner at McDermott, Will & Emery Rechtsanwälte. She specializes in corporate and banking supervisory law, in particular in advising on corporate governance issues.

A new, shorter appointment must be factually justified. And it is unthinkable for a listed company for a supervisory board to declare that a longer period would not be appropriate in view of the current performance. “That would be a de facto withdrawal of confidence, which can actually only lead to dismissal,” says Prinz.

For shareholder representative Marc Tüngler it is therefore also clear: it is in the best interests of the company to retain board members for as long as possible. “If there is no success at some point, this suggestion falls on the toes of the supervisory board,” he says. It could be doubly expensive if the CEO is “cramped” by the head of the group, even if development stagnates or goes down. “Then it’s better to end with severance pay horrors than endless horrors.”

More: These are Germany’s most powerful supervisory boards