The Central Bank of the Republic of Turkey, in the statement it shared after the Monetary Policy Committee Meeting, included statements that made one think that it could lower the interest rate again in December. The CBRT also announced October inflation data.

The Central Bank of the Republic of Turkey, for the first time on October 21, while the dollar rate was above 9, contrary to the expectations of all economists, it went down in interest rates. The CBRT lowered the interest rate by 200 basis points to 16%. After this decision, the dollar exceeded the 10 TL threshold in the following days.

With the decision announced last week for November, the CBRT decreased interest rates again. With the new decision, the interest rate was reduced by 100 basis points to 15%, while the dollar also broke new records. In the 5 days after the decision, the dollar broke the record after the record and finally saw 13.46. While the dollar rate was around 12 TL today, a new statement came from the CBRT.

October inflation was announced:

The Central Bank of the Republic of Turkey shared the summary of the meeting after the Monetary Policy Group Meeting. In the summary shared by the CBRT, it was reported that consumer prices increased by 2.39% in October, and annual inflation increased by 0.31% to 19.89%. The year-end inflation expectation was increased by 1.68% to 19.31%. The rates of annual inflation on the basis of groups for October are as follows:

- Unprocessed food group: 29.20%

- Processed food group: 25.71%

- Energy group: 25.76%

- Core goods group: 2,49% increase in October, 0.92% decrease in annual inflation – 18,46%

- Durable goods group: 20.24%

- Service group: 15.43%

- Current year-end inflation expectation: 19.31%

- Inflation expectation for the next 12 months: 15.61%

- Inflation expectation for the next 24 months: 11.76%

- Inflation expectation for the next five years: 7.96%

The CBRT will continue on its way to lower interest rates:

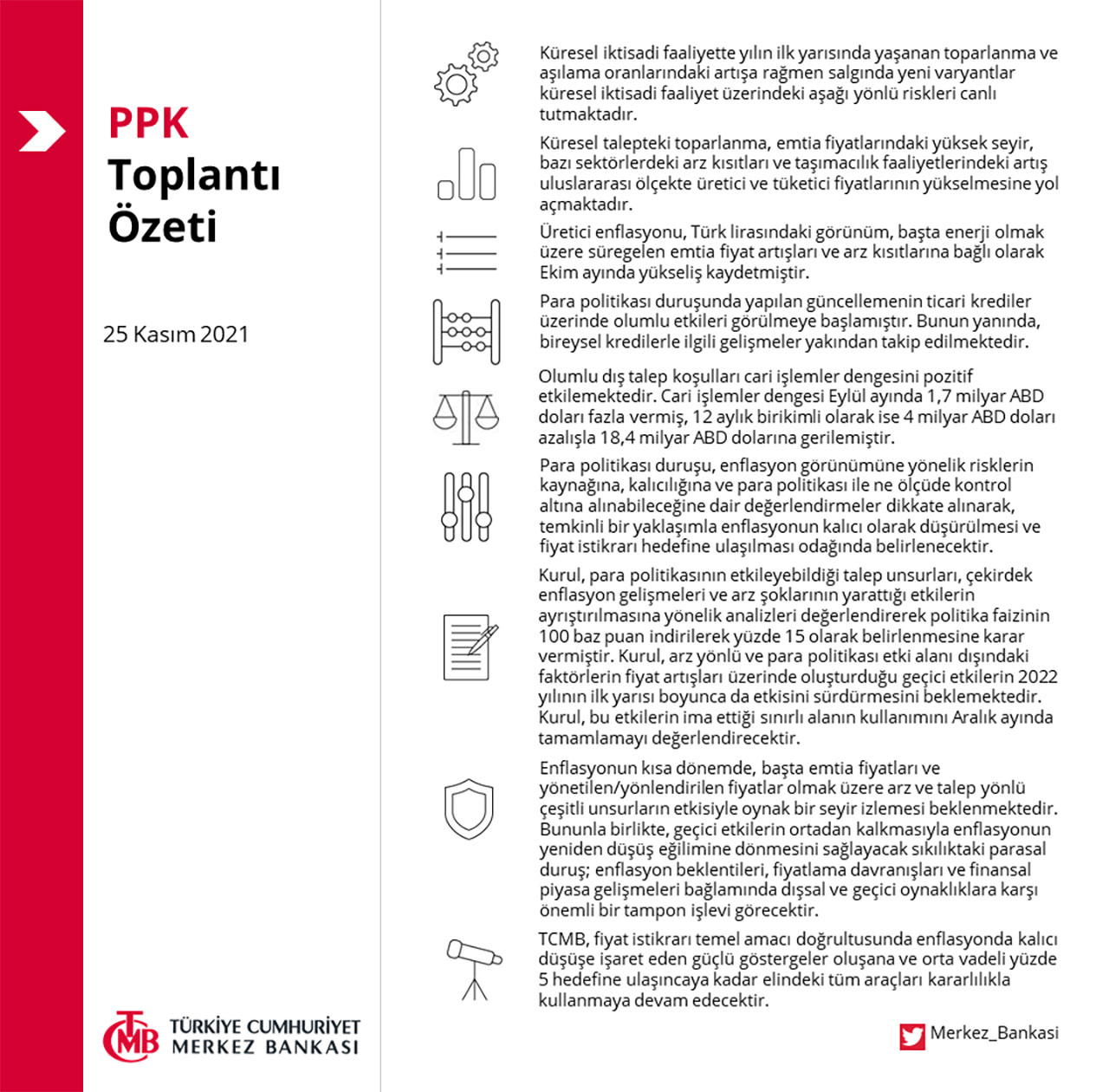

Click for full summary

The Central Bank of the Republic of Turkey, under the heading of monetary policy in the coming period “until strong indicators pointing to a permanent decrease in inflation in line with the main objective of price stability and the medium-term 5% target is reached. will continue to use all the tools at its disposal.” he stated. interest rate decision will be in the direction of decrease again explained as follows:

“The Board evaluated the analysis of demand factors that can be affected by monetary policy, core inflation developments and the effects of supply shocks and decided to reduce the policy rate by 100 basis points to 15 percent. The Board decided to set the policy rate as 15 percent. expects the effects to continue throughout the first half of 2022. The Board will consider completing the use of the limited space implied by these impacts in December.“

RELATED NEWS

Why Do Dollars and Inflation Rise When Interest Rates Fall?

Reactions came to the Central Bank’s statement: