Popular yet controversial star of the cryptocurrency world Cardanoshows a steady growth both on an ecosystem basis and on a community basis. Although the local token ADA offers investment opportunities from time to time, it generally struggles to achieve the expected performance momentum. As such, investors buy ADA as a relative ‘safe haven’ choice, although not as much as Bitcoin, and diversify their investors. What we have compiled for you in this technical analysis IntoTheBlock We will dive deep into the current state of the network with its data and take a closer look at the current performance.

If we examine the summary data, three of the five basic technical analyzes offer a “bear” view, two offer a “bull” view, and one offers a “neutral” view. From these data, “net growth of the network” presents a ‘bear’ outlook with a low rate of 0.2%, “addresses in profit” presents a ‘bear’ outlook with a 0.85% decrease, and “large transactions” presents a ‘bear’ outlook with a 0.23% decrease.

“Concentration”, which consists of the mixed value of addresses with a bearish and bullish appearance, has a ‘neutral’ appearance with 0.07%.

On the other hand, “BAVI” data, which consists of “Volume at the buying price – Volume at the selling price” data, is ‘bullish’ with an increase of 7.63%, and “FMM” data, which is the signal that evaluates the upward or downward momentum by combining the futures price, volume and open positions, is 0.75. The increase provides additional support to the ‘bull’ outlook.

Cardano Investors are in Profit

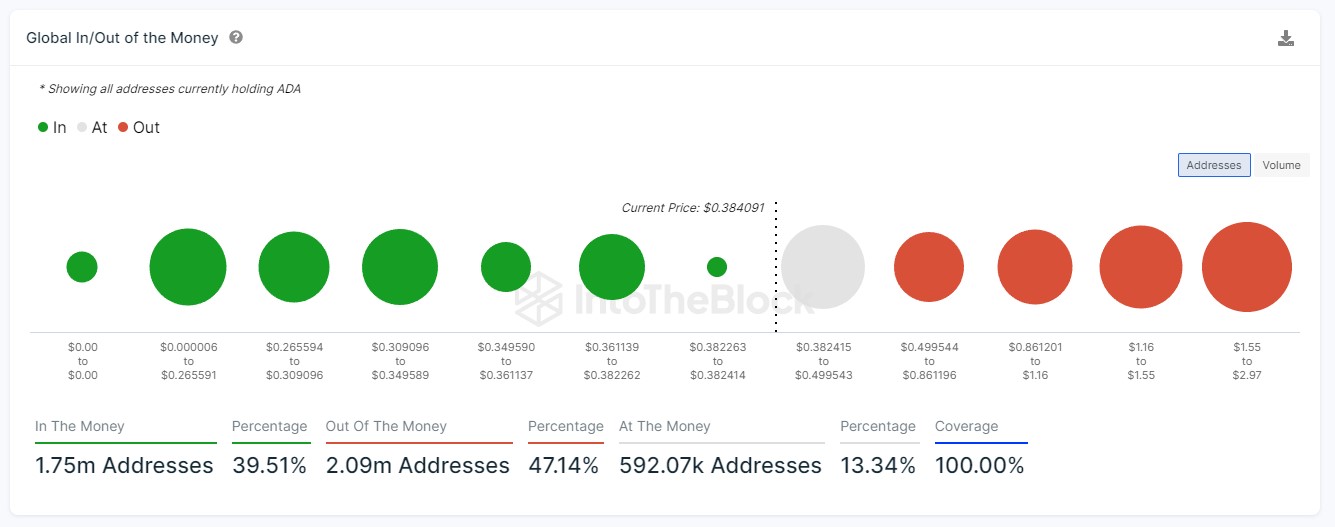

The “Global In/Out of the Money” metric, which measures the profit/loss ratio of existing investors, shows 39.51% profit, 47.14% loss and 13.34% neither profit nor loss. It is important to underline that this data is calculated at the current price of $0.384278.

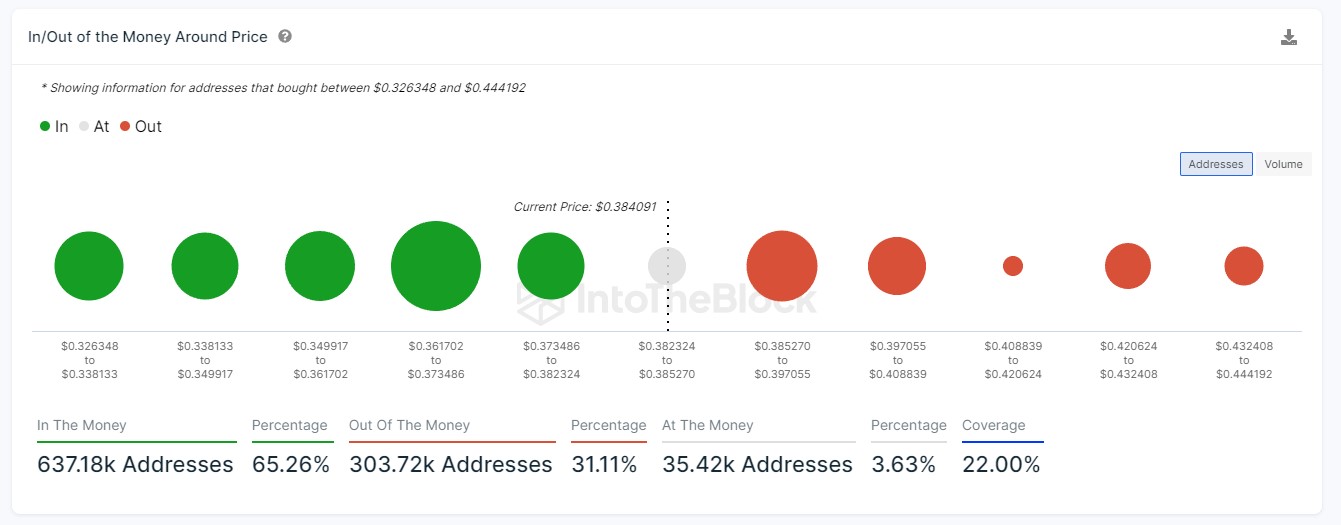

However, 65.26% of the addresses that bought Cardano assets between 0.326348 and 0.444192 dollars made a profit, while 31.11% made a loss. A low rate of 3.63% preserved its money.

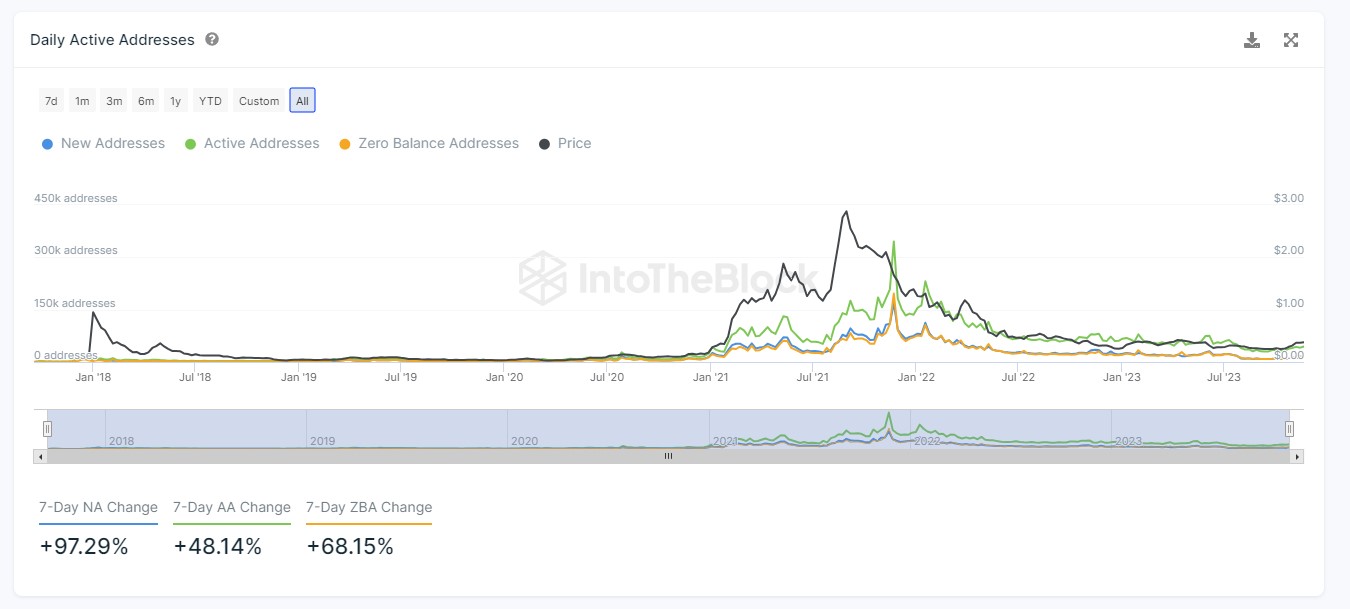

The “Daily Active Addresses” metric, which measures the activity of the Cardano network, is progressing quite positively in general. In the last seven days, the rate of increase in new addresses was recorded as 97.29%. In addition, active addresses increased by 48.14% in the last seven days, while addresses with zero balance increased by 68.15%.

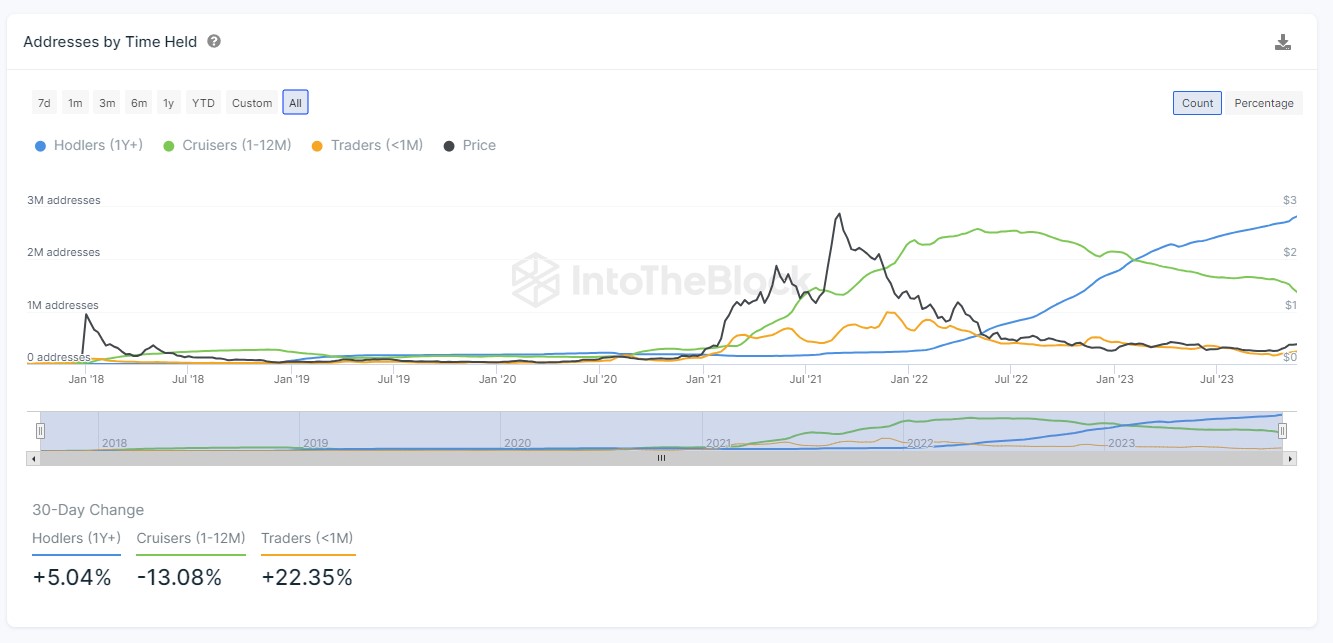

The ‘holding time’ metric for ADA assets held by addresses is also very active. While the rate of addresses holding assets for more than 1 year increased by 5.04%, the rate of addresses holding assets for 1-12 months decreased by 13.08%. Trader addresses held for less than 1 month increased by 22.35%.