Cardano (ADA) The blockchain may move in the opposite direction of the desired performance, despite a big “hard fork” event coming in June.

Declining Channel Shows Down for Cardano Price

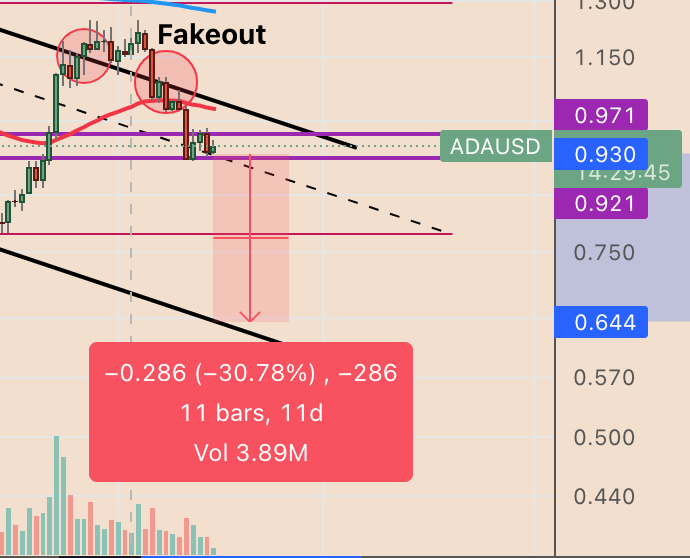

Cardano (ADA), which accounts for around 1.75% of the total cryptocurrency market cap, has been declining since September 2021 in a “descending channel” pattern that has successfully capped multiple upside attempts, as shown in the chart below.

Cardano price The channel got stronger as it broke above the upper trendline on March 27, although it managed to reverse completely in the subsequent sessions, showing the reluctance of the Cardano bulls.

ADA’s 200-day exponential moving average (200-days EMA; blue wave) retracement from the $2.96 high to $0.78 low, alongside the 0.236 Fib line of the Fibonacci retracement chart (close to $1.29), further bolsters the bearish bias. supported it.

As of April 15, Cardano price was consolidating between the $0.97-$0.92 levels and looks set to continue the pullback from the fake top around $1.25.

If the bearish channel pattern continues to trend sideways, ADA/USD could drop to its previous lower range around $0.78 while looking at the channel’s lower trendline around $0.65 as its primary downside target.

This ultimately means a 30% loss compared to today’s price.

Cardano Network Grows, but Things Are Not Going Good

Input Output Hong Kong (IOHK), the research and development firm behind the Cardano project, announced incredible network growth from April 2022.

IOHK also appears to be preparing the “Vasil” hard fork in June, a network upgrade to make Cardano’s blockchain more scalable.

Founder Charles HoskinsonIn a video released on April 12, a day after ADA slumped more than 10%, it did not go unnoticed by emphasizing the word “major” five times while explaining the importance of the hard fork for overall network growth.

Although the ADA price showed a recovery trend after these statements, it could not maintain its momentum and continued to follow a horizontal course with the effect of macro factors.

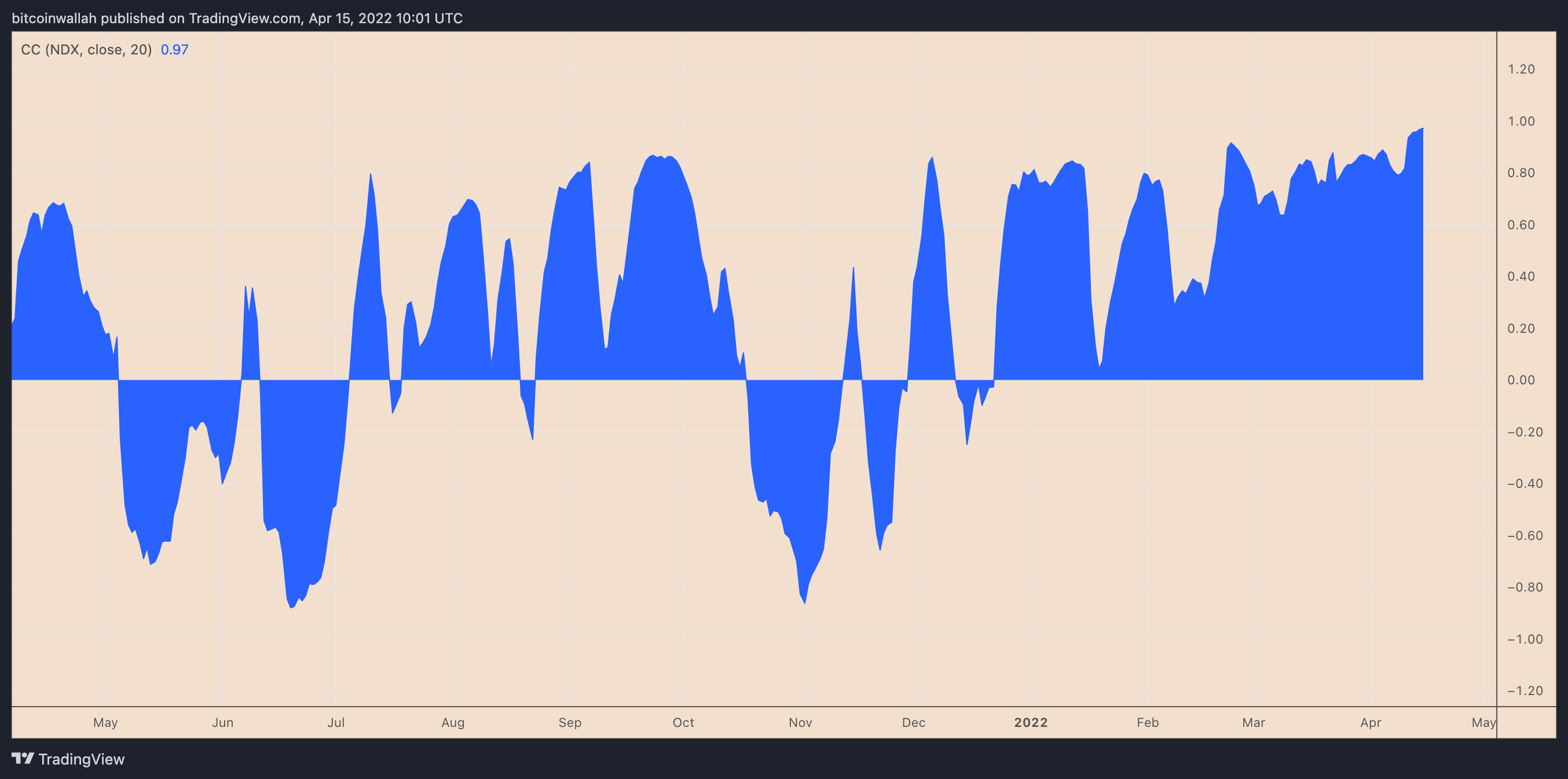

Notably, like Bitcoin, ADA’s correlation with the Nasdaq-100 (NDX) rose to a record high, reaching 0.97 on April 15 against 0.79 at the start of the year.

In other words, the ADA price is currently on par with the tech-heavy index, which wiped out more than $1 trillion from market cap in April.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.