Chainlink (LINK) price reached a new 2023 high of $16 on November 9, before the bears forced a pullback from last week’s exuberant highs. However, recent on-chain data trends show that Chainlink investors remain optimistic about a rapid recovery.

Chainlink’s bulls have fiercely defended the $14 price support level over the past week. Will LINK price recover or pull back?

The Majority of Chainlink (LINK) Investors Continue to Hold

LINK price fell 13% to $14, its lowest daily level of the week. Amid neutral market sentiment, recent on-chain movements show that most LINK holders remain positive.

As shown in the CryptoQuant chart below, Chainlink investors held a total of 149.9 million LINK tokens in wallets hosted on the exchange. Interestingly, this figure has now dropped to 148 million LINK. In essence, investors reduced their LINK exchange deposits by 1.4 million tokens this week, allaying concerns of a large-scale selloff.

Stock market reserves metric, crypto- It tracks real-time changes in the number of wallets where LINK tokens are deposited, hosted on exchanges and trading platforms. A sustained decline in exchange reserves is considered a bullish indicator as it causes a decrease in spot market supply. The withdrawal of 1.43 million LINK tokens at the current price of $14.20 represents a $20 million decrease in LINK spot markets this week.

Additionally, investors opting for long-term cold storage during a price correction indicates that they are waiting for an early recovery rather than exiting.

Despite Falling Prices, Chainlink Continues to Attract New Users

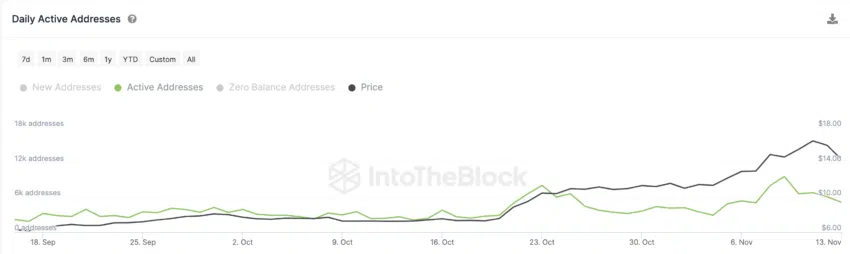

Koinfinans.com As we reported, Chainlink price has been in a downtrend since pulling back from the yearly peak of $16 last week. However, on-chain data trends show that this does not deter new users and investors from entering the ecosystem. On November 9, Chainlink active addresses reached a yearly high of 9,630 wallets. The chart below shows that it has consistently remained above 5,000 addresses since then.

The daily active address metric tracks the daily number of unique wallets conducting economic transactions. When a network consistently records a high number of active users, it often puts upward pressure on the price. Unsurprisingly, this helped LINK price maintain the $14 support over the past week.

As a result, investors exiting the market and network usage rate remaining stable suggests LINK is best positioned for a rebound if broader market sentiment changes.

LINK Price Prediction: More Consolidation Before $20 Rally

Extrapolating from the on-chain metrics analyzed above, if the bulls can hold on in the ongoing consolidation phase, Chainlink could recover towards $20.

Data from Global In/Out of the Money (GIOM), which groups existing LINK token holders by entry price, also confirms this prediction.

This data suggests that the bulls have formed a formidable support buying wall near $12. As shown below, 52,840 owners purchased 51.3 million LINK at an average price of $12.24. If these investors hold firm, they could trigger an immediate recovery as predicted.

However, if the bears break this buy wall, LINK price may drop towards $10.

Still, if the price of Chainlink breaks above $15, the bulls may regain control of the market. However, in this case, a resistance sell wall could be created by 55,130 owners purchasing 35.5 million LINK at the minimum price of $15.19. However, if this resistance is broken, LINK will likely rally towards $20.