Crypto analyst Akash Girimath assesses the 80% probability of a rally for Bitcoin (BTC) before 2023. An analyst with a large following predicts a double-digit jump for BTC. We have compiled the Bitcoin predictions and analyzes of two analysts for our readers.

Bitcoin price and performance over the years

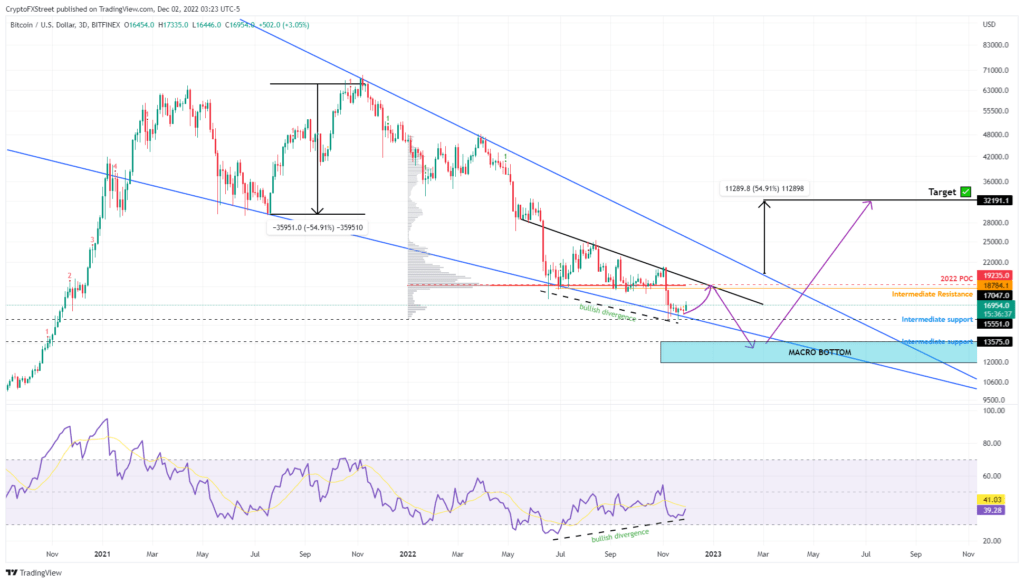

Bitcoin price performance depends on what stage of the cycle it is in. If it’s in a bull run, monthly returns tend to be positive. However, the average return tends to decrease in bear markets. Currently, BTC has not yet formed a bottom. The bottom at $15,550 could be a bottom for the market. However, it is impossible to know for sure. Judging by the previous cycles and Bitcoin price action, more declines are actually possible. An ideal place for a macro bottom would be the range from $31,575 to $11,898. Due to the volatility, it is also possible to retest $10,000.

What insights can Bitcoin’s monthly and annual performance provide? Over the past 13 years, the Bitcoin price has mostly increased with an average monthly return of 14.32% over the period. In 2022 alone, the average monthly return was -7.39%. It also fell well below the 13-year average of 14.32% for BTC price. Based purely on speculation, the price of Bitcoin would need to rise about 81% from its current position of $17,000 for the average return of 2022 to reach only 0%.

Bitcoin forecast: 81% rise possible in December 2022?

Bitcoin price is unlikely to increase 81% in under 30 days. Looking back 13 years, BTC’s average monthly return in December was only 12.34%. From a conservative perspective, only a 10% to 15% rise is possible. If such an outlook materializes, it would mean that the Bitcoin price would rise to $19,500. Interestingly, this level coincides with the target projected for the previous weekly Bitcoin forecast.

Outliers in the leading crypto’s ten-year lifespan show the highest return in December at 470%. This happened in 2013 when BTC was extremely volatile. But 2017 saw a 54% rise. Therefore, it is not out of the question that the Bitcoin price could rise to $30,000.

In fact, the technical data presents a bullish wedge pattern that could trigger a 54% increase in Bitcoin price to $32,191. Also, three critical on-chain metrics focusing on investor health, selling pressure and smart money actions point to all the conditions needed for BTC price to initiate a bear market rally as the year draws to a close.

The bullish outlook for bitcoin price makes sense. However, investors need to consider the other side of the argument, namely uncertainty. Things are likely to get worse as the Fed tries to cut rate hikes from 75 bps to 50 bps. Whenever the Fed turned from a hawk to a dove, the markets suffered a bearish fate. This was most recently after the Great Recession of 2008, which led to a 35% drop in the S&P 500.

cryptocoin.comAs you follow, Bitcoin price and the stock market are highly correlated. So it’s possible that the leading crypto might do the same and trigger a massive crash. Traders should keep in mind that a breakdown of the $16,700 support level will be the first sign of waning buyer interest. However, a loss of the $15,550 support level will likely create a lower low. It will also tip the odds in favor of the bears. The invalidation of the bullish view could trigger another Bitcoin sell-off to the potential macro lower zone from $13,575 to $11,898.

Bitcoin prediction: A rally is on the way, but…

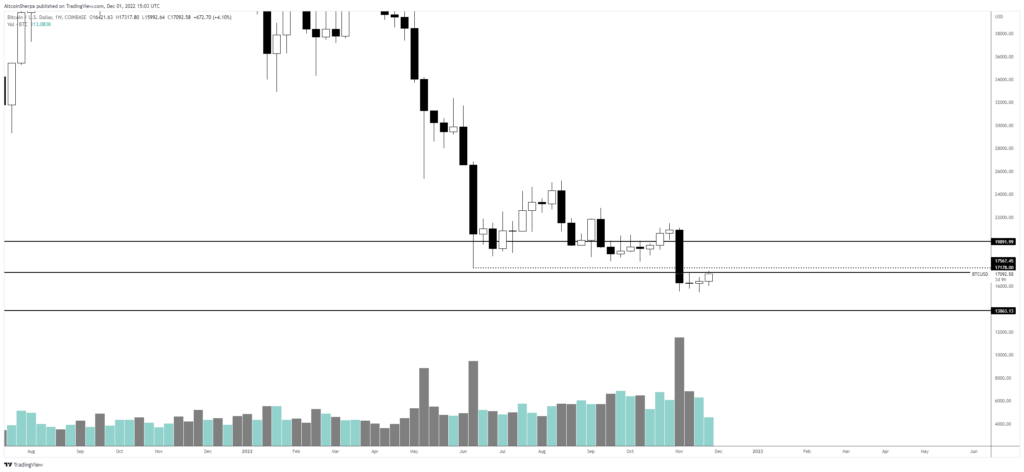

The analyst, nicknamed Altcoin Sherpa, expects Bitcoin (BTC) to start a rally towards $18,000. However, he states that this is a warning. Because the leader thinks that crypto money has not seen the bottom yet. The analyst believes that Bitcoin will see a reversal once it reaches its predicted mark. Therefore, he expects altcoins to perform well as Bitcoin goes through its cycle. In this context, the analyst makes the following statement:

The general idea: BTC has not hit macro bottom yet. However, I think we will see Bitcoin eventually hit $18,000. There they will wait for a breakdown and short it. Altcoins continue to do well over the next few weeks, and that’s true for BTC as well.

According to altcoin Sherpa, much of Bitcoin’s downward momentum has dissipated recently. However, the leader remains unconvinced that the crypto asset has reached the bottom of the bear market. For this he says:

BTC: There is a group of neutral candles. There really isn’t much to say about it. I think most of the momentary downtrend is over. However, I don’t think it’s a macro dip. Still, I wouldn’t dismiss it going to $18,000-19,000 before potential new lows.

The analyst says that if Bitcoin breaks the $17,500 level, it will likely go up to $19,000. He also notes that if it goes to the $20,000 range, it will be a good selling opportunity for investors. He expresses his views on this matter as follows:

I think we should see $ 17,500 clear in Bitcoin. If that happens, I’m guessing the next one will probably be $19,000.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.