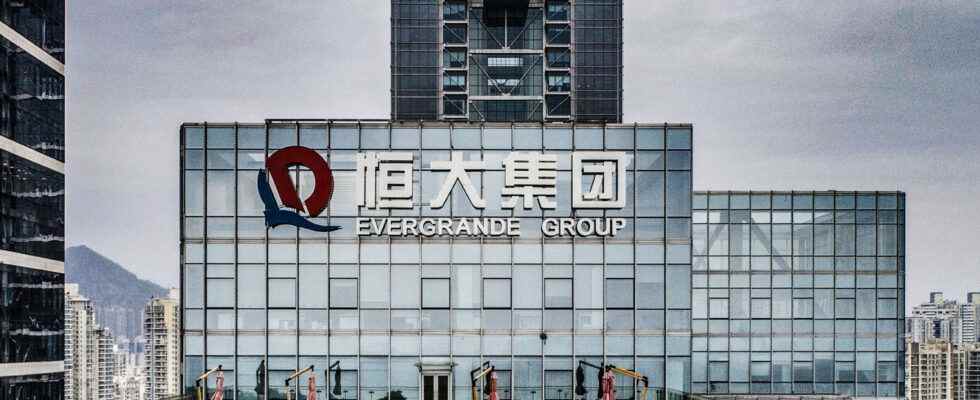

Marty Bent, co-founder of Bitcoin mining firm Great American Mining, said he is happy to keep Bitcoin in his wallet while uncertainty over the legacy financial system continues. As the probability of Chinese real estate giant Evergrande defaulting on its $305 billion debt grows, experts weigh how the firm’s bankruptcy could affect the traditional and crypto market. So what can the “Evergrande Crisis” bring to the crypto market? We answer with the help of analyst Brian Quarmby..

What experts think about the “Evergrande Crisis”

Speculation on whether the real estate investment giant will default has coincided with a downturn in crypto and stock markets, with many analysts split on whether traders should buy the dip or want to take profits in preparation for further bearish momentum.

At the time of writing, Bitcoin (BTC) is down about 13% since the downturn that started on Saturday, while the S&P 500 is down 1.7% and Hang Seng is down 2.8% in the same time frame. Some experts argue that Evergande’s debt crisis may represent another moment for Lehman Brothers. It refers to the major investment bank’s declaration of bankruptcy on $600 billion of debt that started the global financial crisis.

Ray Dalio: Evergrande crisis is manageable

But speaking at the Greenwich Economic Forum on Wednesday, Bridgewater Associates co-chairman and co-chairman investment office Ray Dalio downplayed the importance of the Evergrande default and suggested the debt was “manageable”. Dalio thinks Evergrande’s debt will not cause structural damage, as the Chinese government may take action to restructure the firm and close deals with the company, although it will annoy investors:

The Lehman moment produced widespread structural damage through the system that wasn’t fixed until the Treasury’s borrowing and then the Fed’s encounter with quantitative easing, but it’s not that kind of concussion.

Can China rebuild Evergrande?

Ming Tan, director of credit rating agency Standard & Poor’s (S&P), predicts that the Chinese state will intervene to restructure Evergrande. Speaking to the Financial Times on Monday, tan also speculated that “profitable parts of the business being acquired by Evergrande’s competitors” could appear in the restructuring, and that debt obligations could be undertaken directly by a consortium of Chinese commercial banks or the local central bank. Popular cryptocurrency analyst Lark Davis also tweeted that he wasn’t too worried:

Most analysts seem to believe that Evergrande will not lead to a global contagion like Lehman did…. Can we go back to the bull run now, please?

Not everyone is that optimistic

Jim Cramer, host of CNBC’s Mad Money, claimed that Evergrande’s debt problems will likely affect the crypto market because almost half of the reserves backing the leading stablecoin Tether (USDT) are held in commercial paper.

Cramer urged investors to be cautious as Evergrande awaits a potential government bailout.

I know crypto lovers never want to hear me say “sell” but if you have a big win like I do, I beg you. Don’t let it be a loss; sell some. The rest is long, then let’s wait and see if China changes its stance towards the Evergrande bailout plan.

Tether denies the allegations

While Tether refuses to hold any commercial paper issued by Evergrande, analysts have warned that the fallout from Evergrande’s restructuring could have significant impacts on the broader commercial paper markets. Cramer said:

Tons of Chinese businesses are ready to be crushed by this fiasco and are exposed to Evergrande, which could lead to real trouble.

Marty Bent, a podcaster and Evergrande co-founder, also rang alarm bells in his Monday newsletter. Bent argued that an Evergrande default would reveal “how open the Western world is to the Chinese economy” through investments in major real estate players, their debt instruments and debt issued by the Community Party of China (CCP). He added:

Evergrande is sinking and dragging other big real estate developers in China down with it. The world is witnessing another Lehman moment.

Bent also questioned Evergrande’s claim that he was likely to be bailed out by the government, noting the party’s recent push to rein in Chinese capitalism and tighten regulations on the real estate market:

CCP came out and stated that they do not plan to stop real estate developers currently falling towards bankruptcy. It will be interesting to see if they will continue this stance as things go bad.

The podcaster additionally stated that while he is not sure how the fallout from Evergrande will affect Bitcoin in the short to medium term, he is “thankful” that he can hold Bitcoin as a hedge against the fiat-backed global financial system. Evergrande’s share price is falling steadily in 2021 as credit woes increase. After opening the year at around $14, the price now sits at $2.20. This is equivalent to a loss of more than 84%.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.