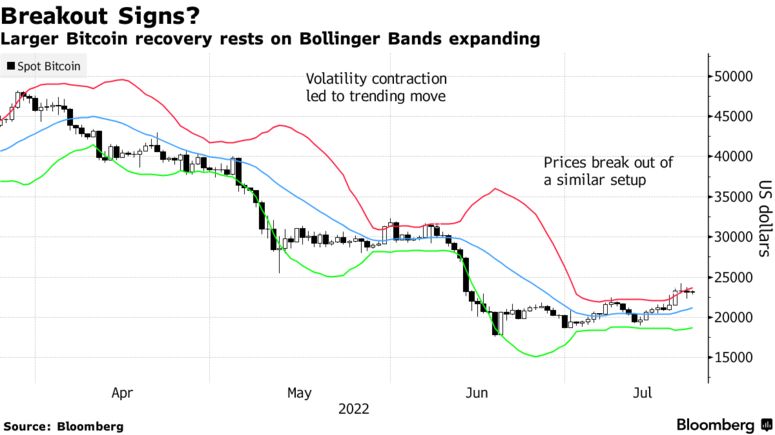

According to the Bollinger Bands indicator, the leading cryptocurrency Bitcoin may be on the verge of rising to the $25,000 level. Here are the details.

Bollinger Bands are used to identify market trends in stocks, cryptocurrencies and other assets. It is an indicator often used by traders as it is also successful in identifying overbought or oversold conditions. Created in the 1980s by John Bollinger, an American asset manager and technical analyst, Bollinger Bands are defined as a series of three lines plotted on asset prices. Prices typically move between the lower band and the upper band during a range-bound trading period.

The upper band indicates that Bitcoin (BTC) is ready to break out of the current range and break higher. For now, the key resistance level for the bulls to watch is $25,000.

Besides, the bulls managed to ignore Tesla news that pushed Bitcoin below the $23,000 level earlier this week. Koinfinans.com As we reported, the leading electric car manufacturer liquidated 75% of all Bitcoin holdings during the second quarter of 2022.

At the time of writing, the leading cryptocurrency Bitcoin is trading at $ 23,288. As soon as the US Federal Reserve official wraps up its July 26-27 meeting and announces the much-anticipated rate hike decision, the cryptocurrency is likely to experience some volatility next week.

A massive 100 basis point hike due to higher-than-expected inflation would be bad news for Bitcoin bulls. On the other hand, if the Fed sticks to a 75 basis point increase, Bitcoin could experience a slight relief rally.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.