said Mike McGlone, senior macro strategist at Bloomberg Intelligence. Bitcoin (BTC) may be on the verge of a 60% price drop says.

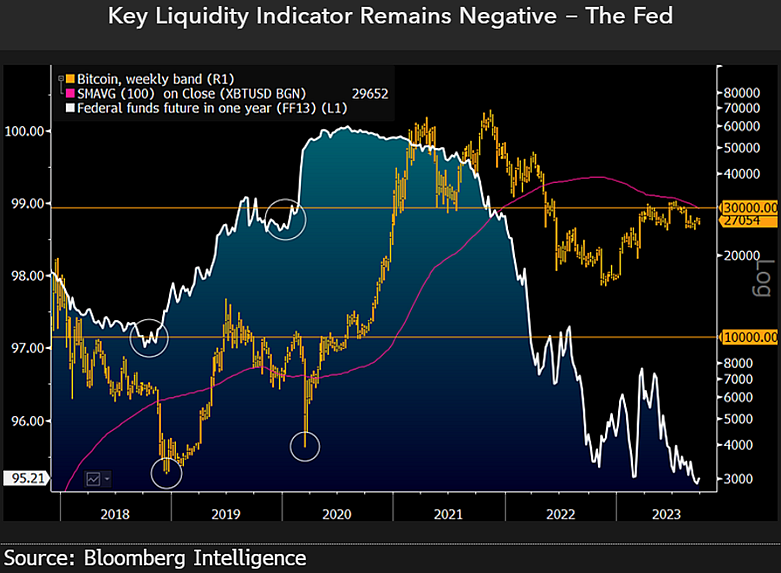

McGlone says the key indicator for BTC is that liquidity remains negative and global rates continue to rise “despite signals of recession.”

The analyst still believes the US will enter a recession by the end of 2023. Stating that Bitcoin’s most important resistance is the $ 30,000 level, McGlone says that the best crypto asset’s “risks are inclined towards $ 10,000.”

McGlone also generally crypto- The biggest risk to the industry, he says, will be the pressure of a recession-related stock market decline.

Crypto weakness in 3Q (third quarter) could be a burst of recovery or recessionary trend. Our bias is for the latter, as nearly all risk assets vest in 2023 and carry over into the quarter. Despite signs of contraction in the US and Europe and the deflationary effects of the housing crisis in China, most central banks are still tightening.

NEWS CONTINUES BELOWThe relative underperformance of the Bloomberg Galaxy Crypto Index (BGCI) may reflect real changes for an asset class rising to zero interest rates. U.S. Treasury yields, which rose in 1987, peaked the week before the crash, while crude oil peaked in July 2008. We see parallels. Bitcoin’s declines preceded the Federal Reserve’s pivots; This could highlight cryptocurrency’s leading indicator nature and what might be needed to revive liquidity.

BTC is worth $27,705 at press time, up 1.33% in the last 24 hours.