One of the leading analysts of the cryptocurrency markets has issued an alarming warning ahead of the upcoming Bitcoin halving event. Analyst Rekt Capital claimed that Bitcoin could retreat further during this critical period when miners’ rewards will be halved.

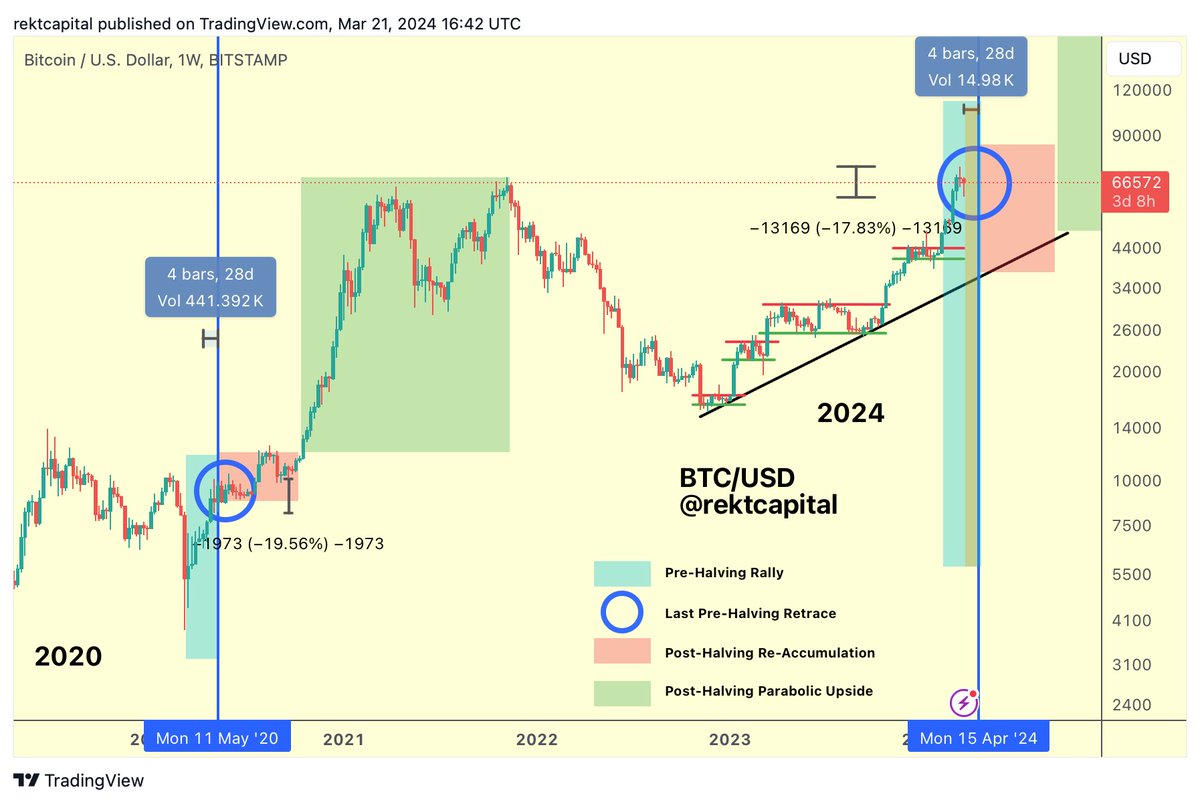

Rekt Capital stated that, based on historical data, the leading cryptocurrency has entered the “danger zone” of corrections between 20% and 40%. According to information provided by Rekt Capital, Bitcoin has historically experienced withdrawals approximately 14-28 days before the halving. As of now, BTC has retreated by almost 18% with 26 days left until the halving. However, it is difficult to make an accurate prediction on how deep this pullback will be.

“Two days have passed since Bitcoin officially entered the ‘danger zone’ (orange) where historic pre-halving pullbacks began. Historically, Bitcoin has made pre-halving pullbacks 14-28 days before the halving. Currently, BTC is about 26 days away from halving and has pulled back almost 18% in total since last week.

It is still unclear whether the withdrawal has reached its base. But what is clear is this: Bitcoin has recently entered the ‘danger zone’ time window. “Technically, there is still room for additional downside.”

NEWS CONTINUES BELOW

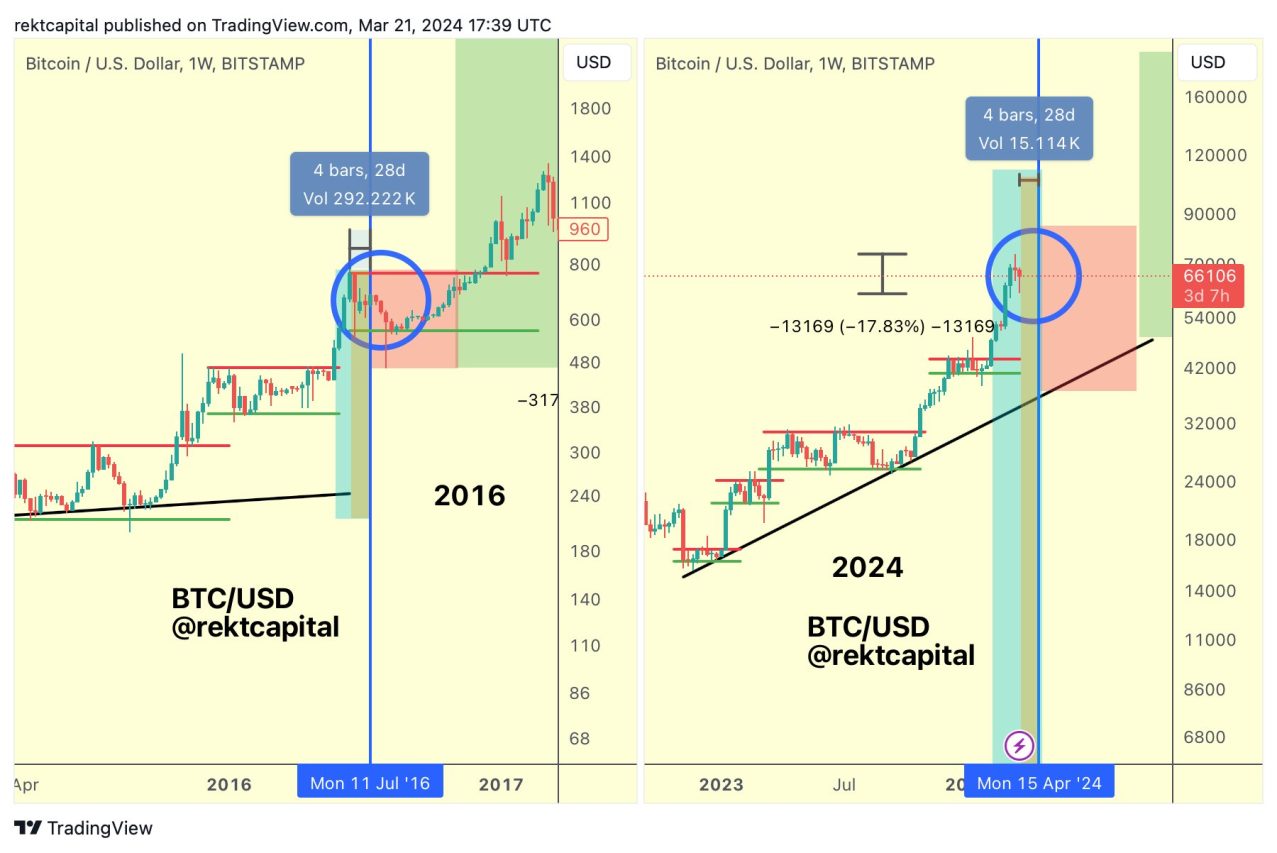

Rekt Capital emphasizes that the similarities in past cycles for Bitcoin are striking. These similarities become especially important during the retreat periods before the halving. In 2016, Bitcoin experienced a pullback approximately 28 days before the halving. Surprisingly, in 2024, this withdrawal period began approximately 32 days earlier.

What is particularly interesting is that in both periods (2016 and 2024), Bitcoin had long downward wicks when it entered a retreat period. to create. However, the difference this time is that it is a short-lived reaction rather than a strong, long-term decline like in 2016. The analyst emphasizes that this situation is critical for Bitcoin to maintain its current high levels.

Rekt Capital also predicts when Bitcoin could reach the peak of the current bull market cycle.

“When can Bitcoin peak in this bull market? Bitcoin tends to hit its bull market peak 266-315 days after breaking its all-time high. Bitcoin broke its all-time high last week. The next bull market peak could thus occur in 266-315 days. This corresponds to the end of November 2024 or the end of January 2025.”

However, the analyst says that historically Bitcoin has taken longer to reach highs each cycle, which could push the peak of the current bull market to December 2024 or mid-February 2025.

“Historically, the amount of days Bitcoin has spent beyond former all-time highs has increased by approximately 14 days to 35 days…

If we add 14-35 days to the initial bull market peak range of 266-315 days, the total increases to 280-350 days. This could push the peak of the Bitcoin bull market to mid-December 2024 or mid-February 2025.”

As a result, although it is difficult to make a definitive prediction about the future of Bitcoin, investors and analysts should take a balanced approach considering these similarities. When creating strategies based on historical data, it is important to also consider current market conditions.

You can access current market movements here.