Bitcoin (BTC) The price failed to hold the $40,200 level and has dropped 18% overall over the course of this month. Bitcoin reached the $69,000 level in November 2021 and peaked. The price has lost 40% since that peak. At the time of writing, Bitcoin price was trading around 38,600.

Bitcoin Price Momentum Continues To Weak

Bitcoin price is testing support near its 100-week moving average. However, the upward momentum has slowed considerably. BTC can maintain a wide trading range until it makes a decisive break or breakout.

Many technical indicators are neutral on the daily and weekly charts and bearish on the monthly charts. This could increase the risk of a price drop, especially if the $37,500 support fails to hold.

A series of higher price drops since Jan. 24 have supported buying activity on the dips. Still, the $46,710 resistance capped the rallies over the past three months. For now, BTC expects a countertrend reversal signal next week according to DeMARK indicators, which typically precedes a brief spike in price.

Many altcoins in the market also outperformed Bitcoin, showing that investors and traders are avoiding excessive risk. For example, at a time when the Bitcoin price lost 4% of its value. Ethereum (ETH) Shares fell 5%, while Avalanche (AVAX) fell 6%.

Dogecoin (DOGE) performed better in April after experiencing a 20% price increase earlier this week. The move stemmed in part from Twitter accepting a takeover offer from Tesla CEO Elon Musk. The meme coin has saddened its investors by wiping out most of its gains over the past few days, even though it is still well ahead of Shiba Inu (SHIB)’s 18% loss over the past 30 days.

Ethereum Classic’s native cryptocurrency ETC, a blockchain project created in 2016 when Ethereum’s blockchain was split into two separate chains, fell from its high in March to become one of the worst-performing cryptos in April.

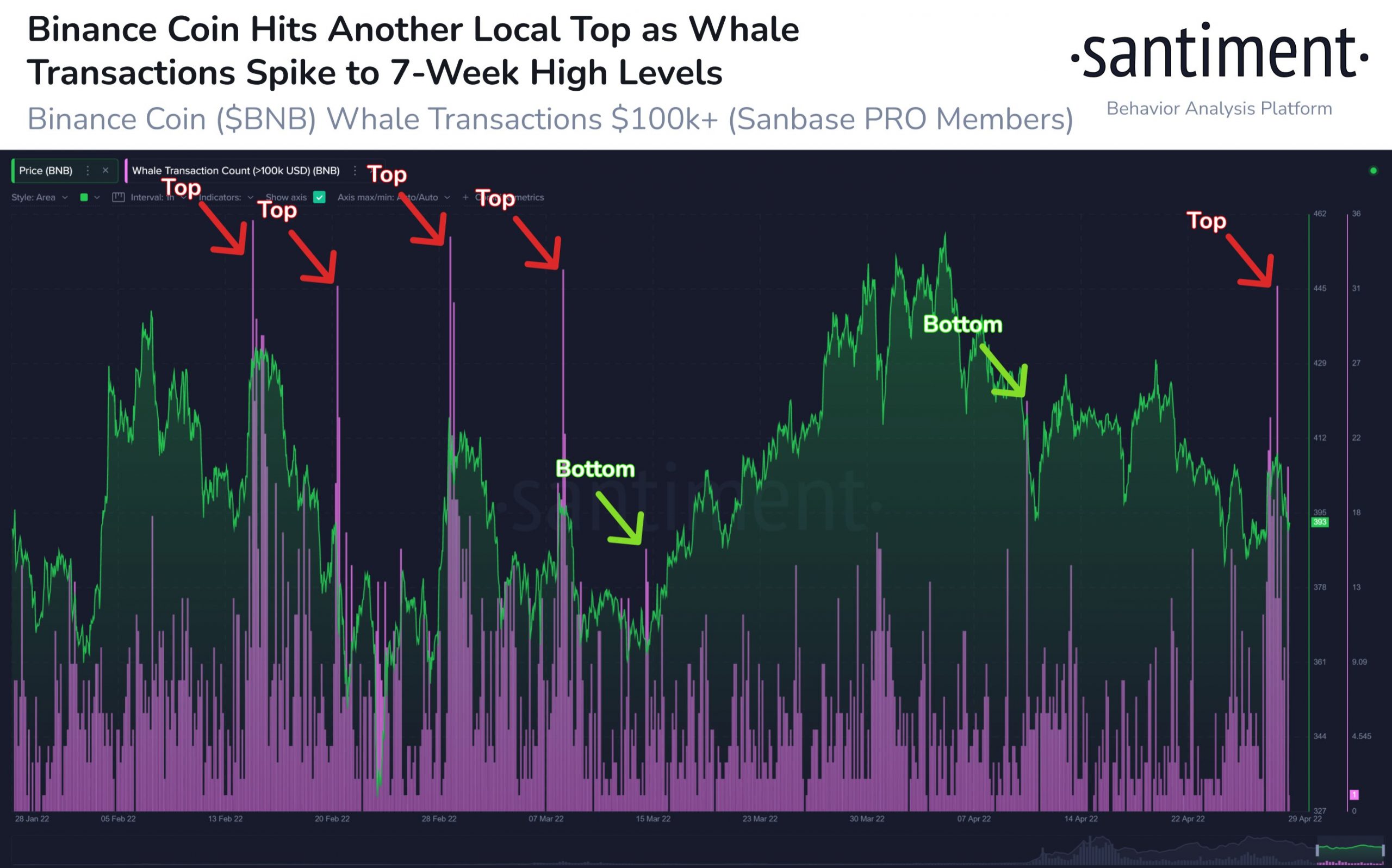

Binance Coin (BNB), on the other hand, has witnessed a very active whale transactions since the beginning of March. In cases where the activity of more than 100,000 assets increases, the price direction change can be observed more easily. According to Santiment, caution is necessary, as the largest increase occurred on a local hill.

ApeCoin (APE) price, on the other hand, rose from $19 to over $27.50, making a profit lowered the price of APE to $20.48. Thursday’s volatility pushed ahead of pockets of virtual land for sale on the popular Bored Ape Yacht Club (BAYC) ecosystem, confirming last week’s rumors. NEXO, the token of the Nexo crypto loan protocol, which offers credit cards and loans to retail users, rose within 24 hours after Binance, one of the world’s largest exchanges, listed the token. The token peaked at $3.64 in February, just 13% off its all-time high.

The overall cryptocurrency market cap is $1,758 trillion and Bitcoin’s dominance rate is 41.8%.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.