While the hard sales in the global markets caused Bitcoin to regress to $ 33,000, we have been observing that Bitcoin has been struggling to diverge positively in recent days.

Because we saw that the 3-4% hard sales in the US indices had an effect of 10% or more on the Bitcoin side. As of this week, we observe that the effect of the sales in the markets on Bitcoin has eased.

DXY

After the FED decisions announced yesterday, we saw that the dollar index rose above 97 points today. This data seems to be the reason for the pressure on Bitcoin for now.

Technical resistance is found in the 97.62 region in the dollar index. With a pullback from these levels in DXY, we can see a relief rally in Bitcoin.

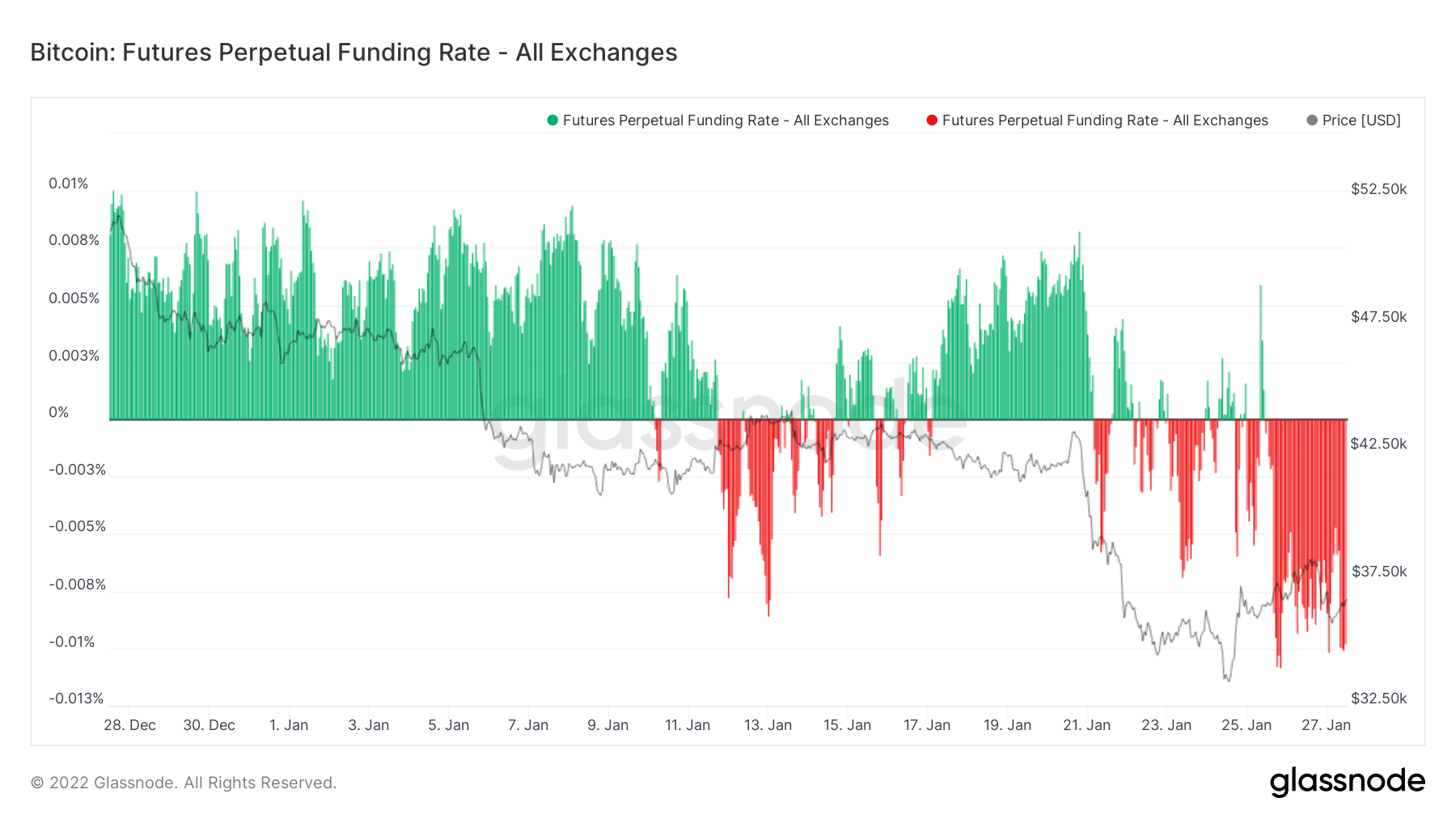

FUNDING

When we look at the funding rates, we observe that the weight of shorts in the stock markets has increased. This shows that the longs are completely cleared and there are not many obstacles for the rise.

Our next move may be to accumulate more shorts and then squeeze them until the target in the dollar index hits.

We will be following together whether the market maker, who has been chopping the longs for the last 3 months, will show mercy to the short sellers.

*Not Investment Advice.