Capo, who gained popularity by knowing the collapse in early 2022, shared his new prediction. bitcoin and their predictions for Ethereum shared. It continues to draw attention due to its analyst forecasts.

capo The analyst, known by the pseudonym, announced on his Twitter account with 560,000 followers that ‘the time has come’. Capo explained that the rally is gaining strength to prevent the possible move of Bitcoin bears.

Koinfinans.com As we previously reported, trader Scott Redler also shared a similar forecast.

“Price action is ‘bullish’. Heatmaps are in ‘bull’ view. What I see is that many short positions need to be compressed. Price ready for $21.00.”

A short squeeze happens when traders who borrow units of an asset at a certain price and pocket the difference in hopes of selling them at a lower price have to buy back the assets as the trade moves against their bias.

Price action looking bullish. Heatmaps looking bullish.

It’s time.

— il Capo Of Crypto (@CryptoCapo_) October 22, 2022

According to data from Coinglass, traders have accumulated $3.63 billion worth of short positions in the last 24 hours.

My Outlook for Bitcoin and Ethereum is Bullish

Ethereum Sharing his price prediction for the rally, Capo shared a similar rally prediction. The analyst believes the price has strength to rise above $1,400. The analyst describes this level as where there is ‘unused liquidity’.

Simply put, traders often look for areas of high liquidity because they believe that investors with large positions will influence the price and move towards that area to easily find buyers or sellers.

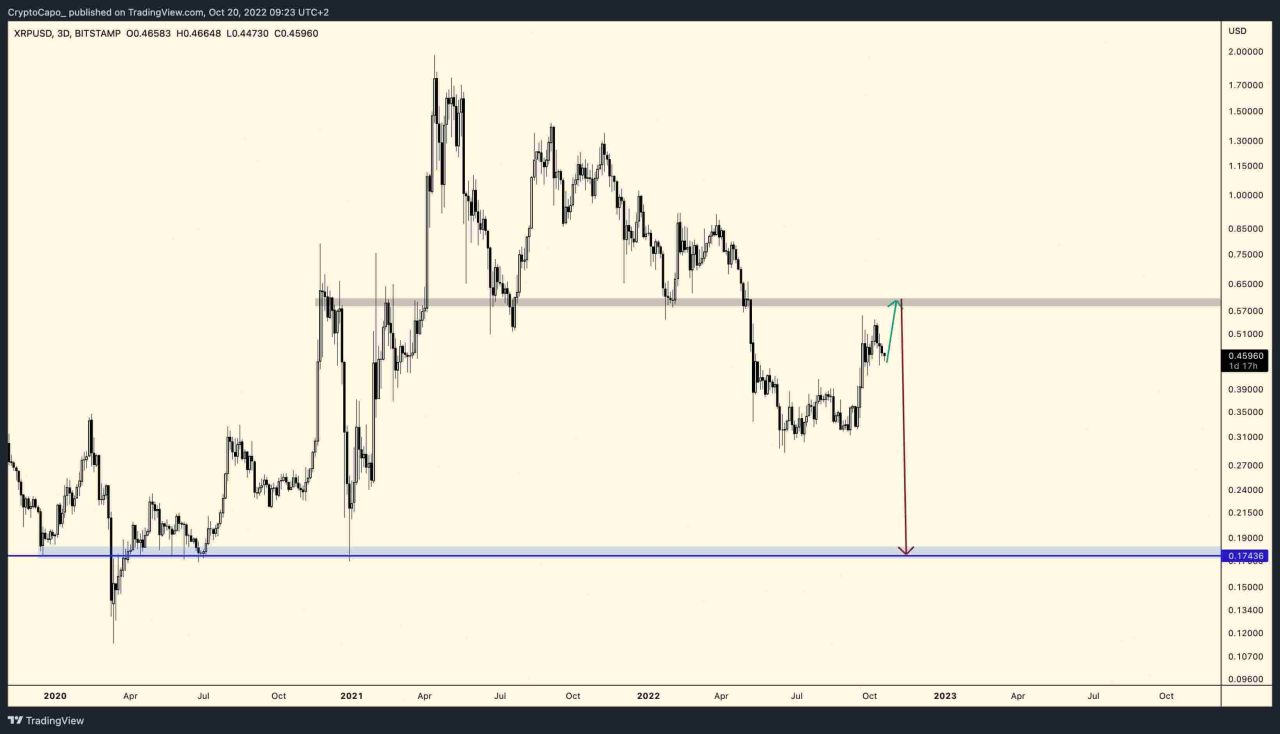

Finally, your predictions XRP Capo warned that the sixth-largest cryptocurrency by market cap is likely poised for a steep correction towards its $0.17 target.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.