Bitcoin price is stuck in a bearish zone below $20,500. It is currently fighting to maintain support above $20,000. As a result of massively long liquidations, the BTC price dropped below $20,000. However, he quickly regained his levels. However, Bitcoin is expected to still hit and wobble in the buy zone in the coming days. Here are the analysts’ comments…

What levels will Bitcoin see?

cryptocoin.com As we reported, at the end of last week, the bulls performed extremely well. It brought BTC and ETH prices closer to resistance levels. However, assets remained highly volatile. It began to lose its gains as key CPI rates rapidly approached. As previously reported, numerous factors can affect the asset’s price in July. CPI is one of them. Therefore, will the BTC price reach $10,000 as many investors believe? Can a quick recovery to $30,000 be expected?

In the bear market, similar fear spread in previous times, where the BTC price was expected to hit lows. One of the popular clues, BTC price may not even reach $15,000 right now, as assets did not reach these levels back then. The analyst is referring to the 2018 drop, where the price was cut in half, down nearly 50 percent. More traders believe the price will drop another 10 percent to mark lows. However, BTC price rebounded strongly before hitting lows. Similar price action and action can be seen right now.

Also, BTC price seems to be approaching the bottom, which can be considered a major buy zone. According to an analytics account named IncomeSharks in the tweet above, the star crypto could break down further in these regions for some time to build a base and reach $40,000 by the end of 2022. The overall market sentiment is currently pretty bearish as the BTC price is consistently failing to hold the $20,000 levels. On the other hand, multiple external factors are constantly affecting the price and suppressing low support. Although Bitcoin is stuck in a deep downside trap, it is expected to moderate the downtrend and start a strong uptrend very soon.

Bloomberg report: Bigger loss coming for BTC

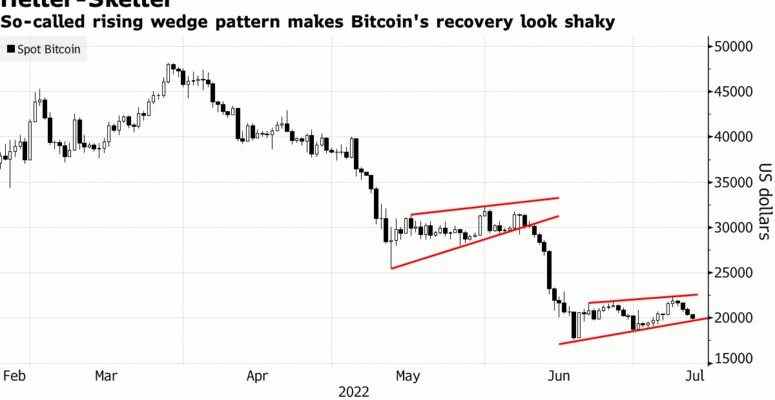

Meanwhile, a bearish wedge pattern suggests that Bitcoin, the world’s largest cryptocurrency, could face further losses, according to a recent Bloomberg report. When the above-mentioned pattern is accompanied by declining trading volume, it usually means a continuation of the downtrend. The same exact pattern occurred earlier in the second quarter. It was the harbinger of a 40 percent correction that plunged Bitcoin as low as $17,600 last month. The cryptocurrency’s performance was so grim that it recorded the worst quarter in more than a decade.

After Bitcoin managed to gain some ground last week, Sunday’s sell-off dashed the hopes of bulls hoping for an eventual recovery. Earlier today, the flagship cryptocurrency dropped to the $19,600 level. If the ascending wedge pattern ends, Bitcoin will likely converge to Scott Minerd’s extreme bearish price target of $8,000. To achieve this goal, the top coin will need to lose another 59%.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.