Bitcoin As expectations and speculations about the approval of the spot ETF increase, the BTC price has risen by over 22% in just one month. Analysts pointed out that after this rally triggered by institutional investors, retail investors could continue the rally. While the support of these investors helped overcome the resistance at $43,000, expectations are for it to exceed $50,000. So how possible is this?

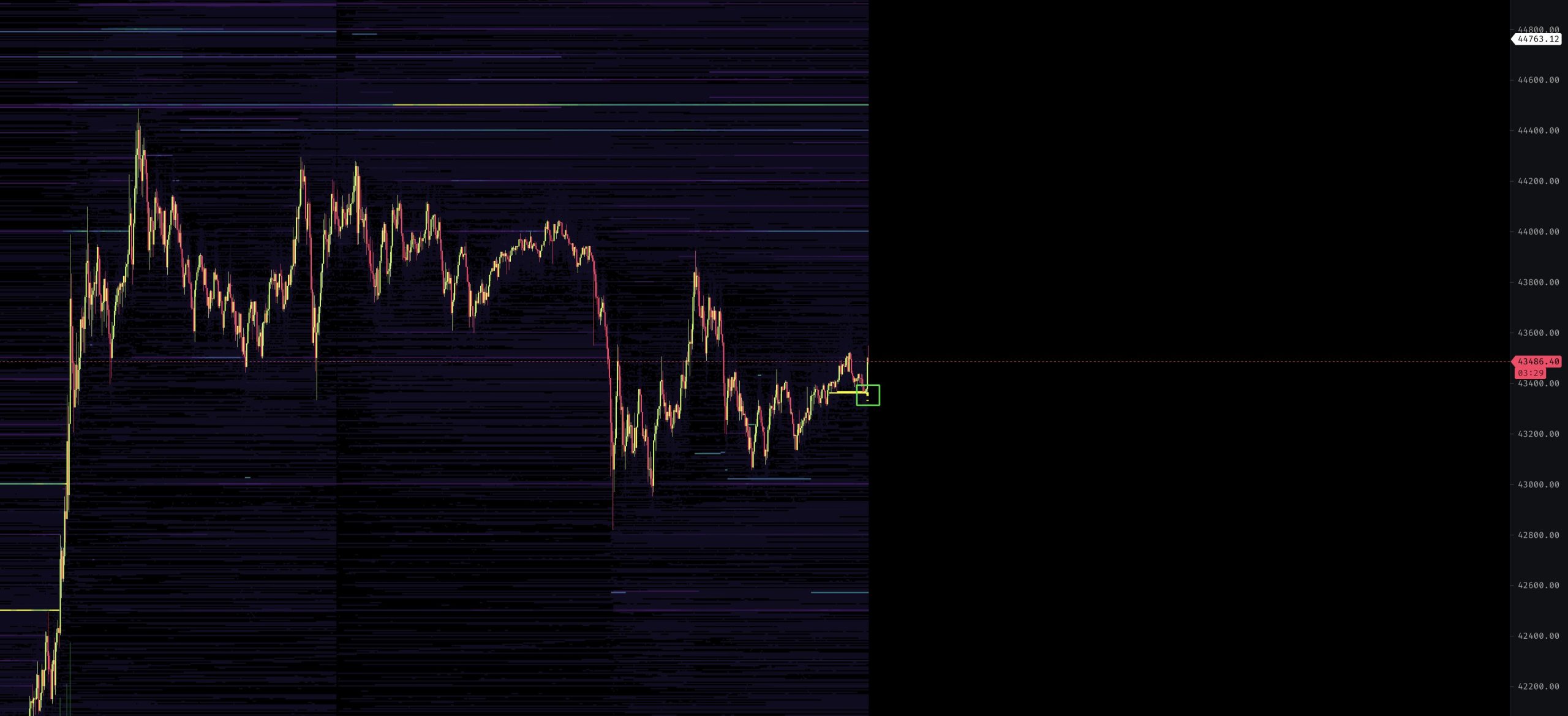

In a post on X, CredibleCrypto explained that the 30 million spot bid emerged from near support levels. He had previously predicted that Bitcoin could break below local BTC lows.

However, rising quotes from below indicate a major bullish sentiment. He believes that if spot BTC purchases continue, the BTC price may even reach $50,000 next week.

Analyst Skew drew attention with his comment on Binance Spot that “bids have been sold and appear to be filled.” Binance and despite futures closing on Bybit, bids are pushing the price higher. Traders should determine their preferences by paying attention to confirmations such as the RSI bounce from 50 and the price holding the 4H 21EMA.

On the other hand, analysts such as Michael van de Poppe, John Bollinger and Ali Martinez also predict that Bitcoin will rise towards $ 50,000. Analysts are confident that there will be strong upward momentum and the BTC price will end the year on a strong note.

Bitcoin Miners Hold Their Assets

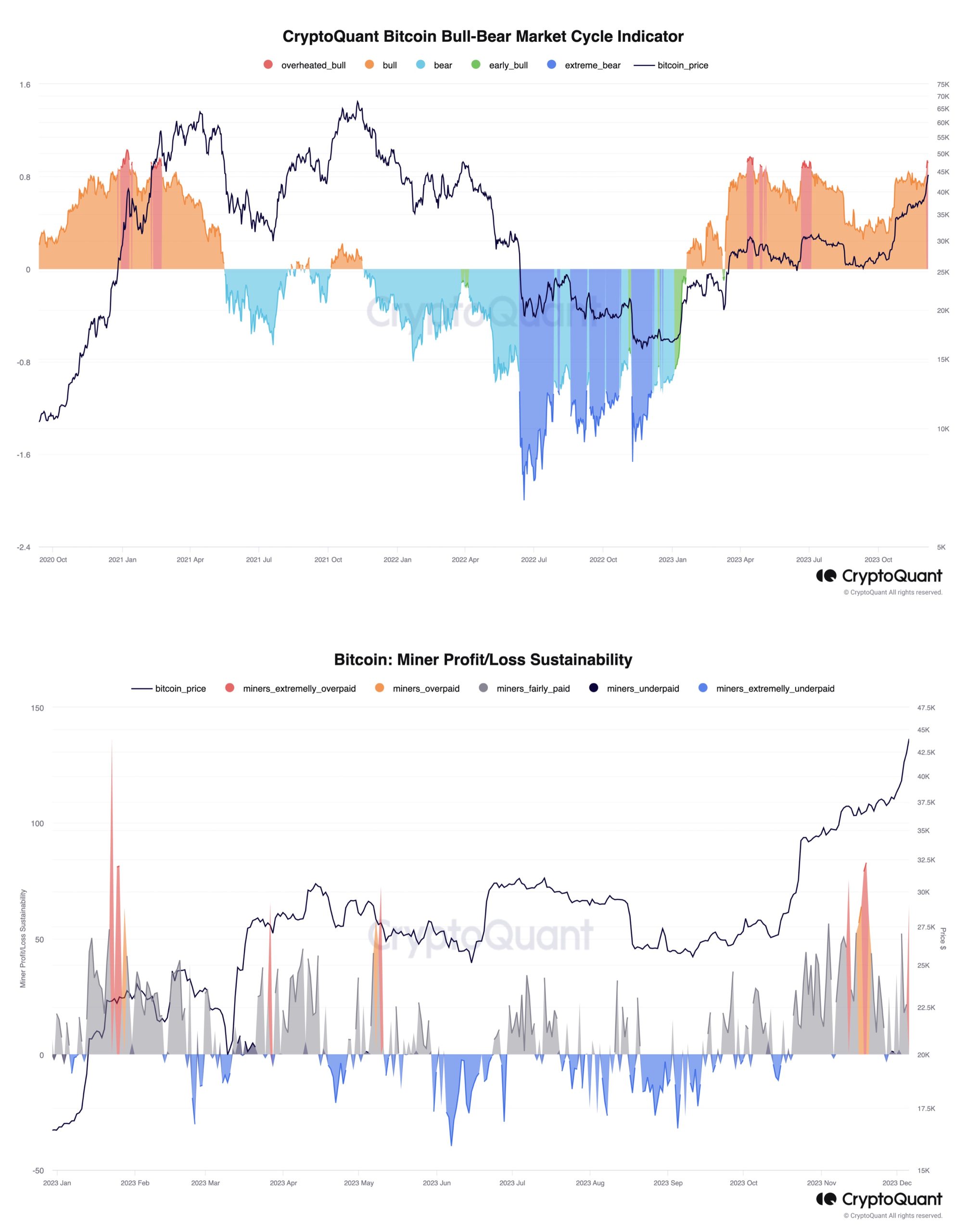

CryptoQuant head of research Julio Moreno warned that some on-chain metrics show BTC price is “overheating” after the recent rally.

The Bull-Bear Market Cycle Indicator is showing an overheated bull phase for the first time since July. Additionally, Miner P/L Sustainability shows that the block reward is growing much faster than the mining difficulty.

However, this overheated bull phase and increasing profits for miners is happening due to the Bitcoin blockchain. Miners are pushing this momentum even higher by holding their BTC assets.

BTC price is currently trading at $43,200 and is holding previous gains at $39,700 due to the CME gap. The 24-hour lows and highs are $42,880 and $43,951 respectively. Additionally, trading volume has increased slightly in the last 24 hours.