Analyst Benjamin Cowen, who has a wide following in the cryptocurrency market, has offered an important analysis of Bitcoin (BTC) price movements, trying to predict when the cryptocurrency could reach a potential bottom. Cowen’s analysis offered an in-depth look at the factors affecting Bitcoin’s price, noting in particular the similarities between 2016 and the current cycle.

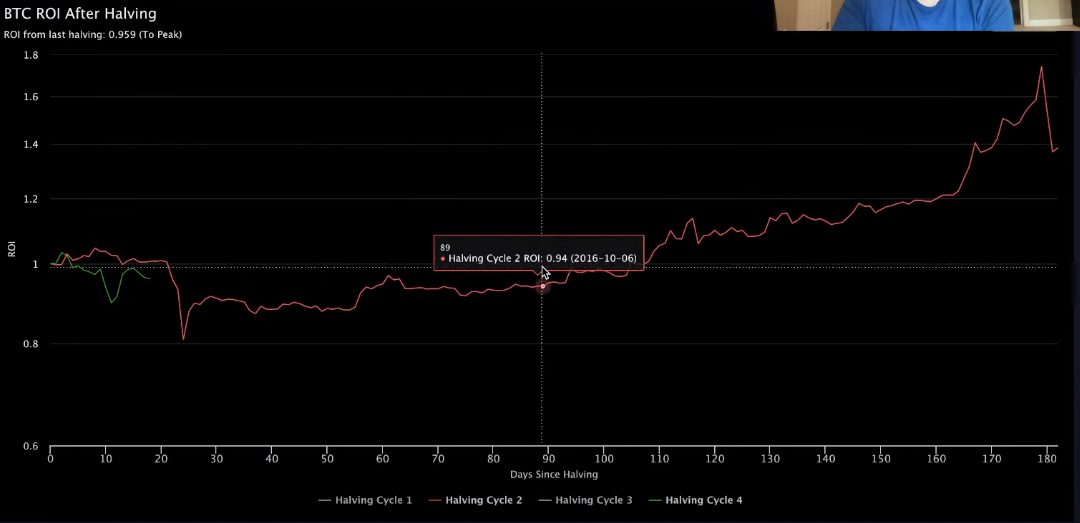

According to Cowen’s analysis, current Bitcoin price movements are more similar to the halving cycle in 2016 than in 2020. Halving is an event in which Bitcoin’s block reward is reduced by half and usually results in a large increase in Bitcoin price. Cowen thinks that similarities between cycles can play an important role in predicting future price movements.

Based on his analysis, Cowen said, “It seems to me that it’s mimicking 2016 a lot more than the other two cycles, which kind of makes sense. “So many people who have been following Bitcoin for a while are comparing this cycle to the 2016 cycle rather than the 2020 cycle,” he said.

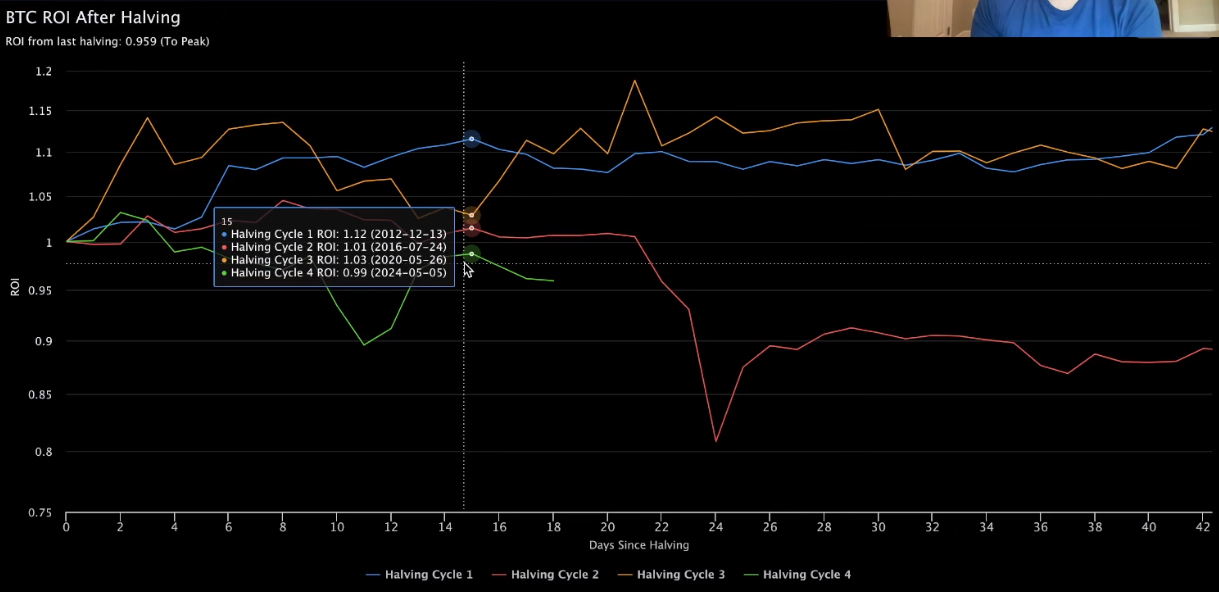

According to Cowen, the potential for Bitcoin to reach the cycle bottom in the near future is quite high. Post-Halving Bitcoin Return on Investment (ROI) metric emerges as a critical metric to evaluate this potential. This metric expresses the ratio of the current Bitcoin price to the BTC price at the time of the halving and provides investors with important guidance in understanding performance in a particular cycle. The last halving, which took place on April 19, was an important milestone in this regard.

Cowen emphasized that it is important to make a comparison going back to 2016. Based on historical data, we see that Bitcoin has failed to achieve a persistent return on investment above 1 for approximately three and a half months after the halving. Although it is difficult to predict whether this situation will repeat in the future, Cowen’s analysis strengthens the possibility of Bitcoin falling lower in the summer months.

In summary, the post-halving Bitcoin ROI metric strengthens the possibility of reaching bottoms in the summer compared to the 2016 cycle. However, this is only an estimate and market conditions may change, so it is important for investors to be careful.

Because Bitcoin’s price is affected by a number of factors, Cowen’s analysis represents only one piece. Many factors such as geopolitical events, regulations, technological developments and market demand can affect the price of Bitcoin. Therefore, investors must make their own decisions by evaluating information and analysis from various sources.

At the time of writing, Bitcoin is trading at $62,916, with a small increase over the last 24 hours.

You can access current market movements here.