bitcoin While Wall Street displayed a fluctuating outlook at the opening of April 28, the macro data expected on the US front came at a level that was in line with the expectations.

While Bitcoin was trading around $29,300, it showed a relatively volatile price movement yesterday and today.

The US Personal Consumption Expenditure (PCE) Index data, which is shown as the macro event of the week, did not provide a performance catalyst as it generally fits with the figures that the markets are currently pricing.

Tedtalksmacro, a finance expert, said, “The trend is our friend, but for now, the core data is pretty tight. It has been hovering at 4.6% since December,” he commented. In his Twitter comments, the expert added that the latest figures are “nothing to shock the market in general.”

Attention is increasingly focused on the macro events of the week ahead, including a decision on the Federal Reserve’s interest rate.

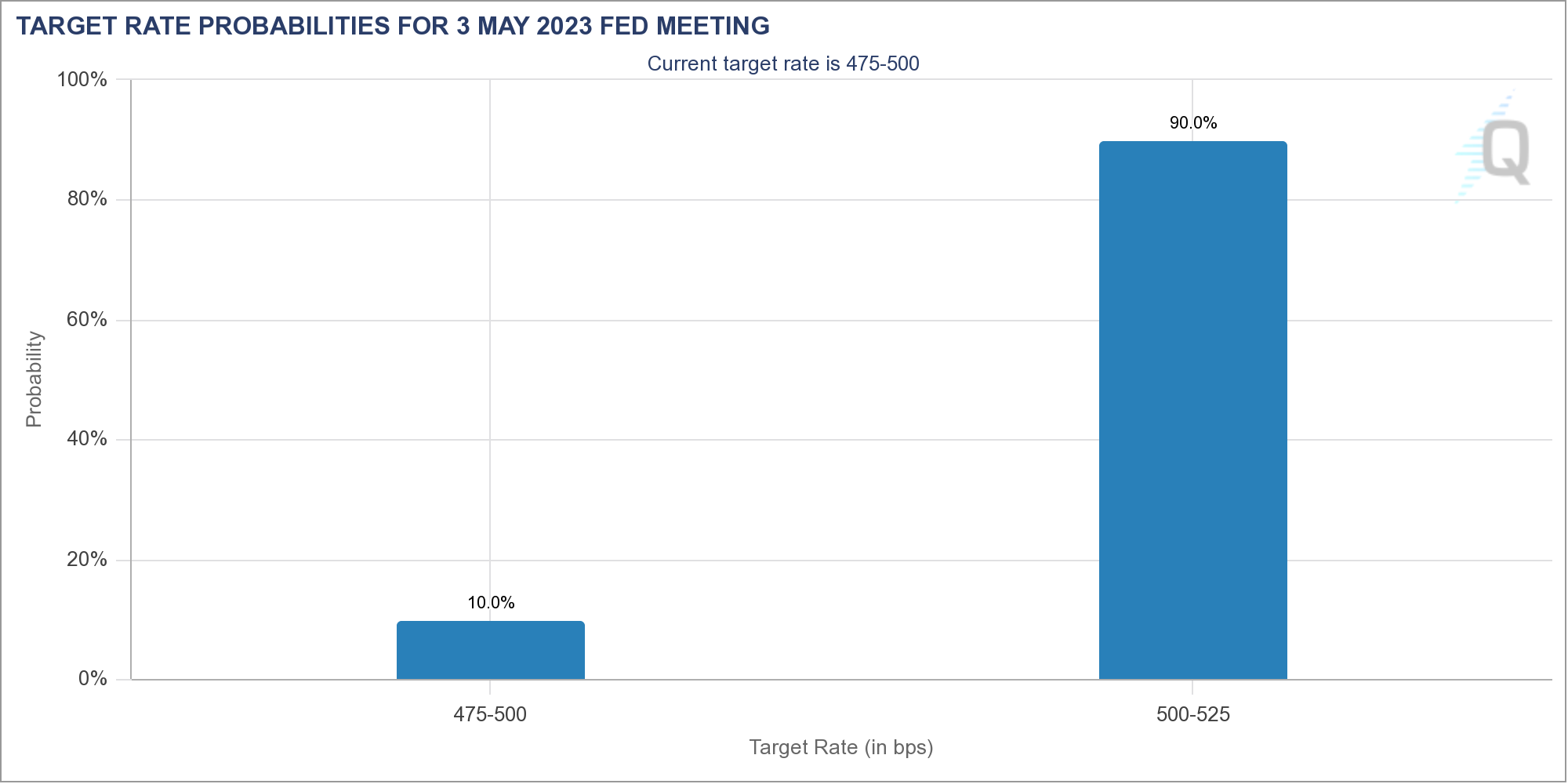

As The Kobeissi Letter points out, the already strong prospect of a new rate hike seems to have gained momentum with the PCE data. The source, who shared his analysis on Twitter, commented, “Interestingly, the probability of a 25 basis point rate hike in June rises to 28%.”

As a matter of fact, expectations are that the Federal Reserve will cut at least two interest rates this year. While there is no confirmation on this issue, the next week will be critical for the interpretation of the trend.

A 0.25% rate hike was 90% certain at the time of writing, a 5% increase from the previous day, according to CME Group’s FedWatch tool.

What Will Bitcoin Price Do In The Short Term?

While the Bitcoin price is not showing a very definite trend, traders are focused on long-term results. Analysts stated that these decreases will be compensated in the long term, although the short-term outlook is a bit mixed. believes.

#Bitcoin is establishing a new range here – seems like volatility will come down in the coming days.

Slow bleed towards 28.7 makes sense.

No need to get euphoric or scared, consolidation is a necessary part of market movement.

The long-term direction remains up, be patient. pic.twitter.com/rwil38uRkP

— Jelle (@CryptoJelleNL) April 28, 2023

Rekt Capital, on the other hand, zoomed in further, considering a potential repeat of historical bullish trends to confirm the end of last year’s downtrend. However, he underlined that he was undecided as to whether a retest phase was needed.

You can follow the current price action here.