It is expected that the Bitcoin price will suffer a serious shake-up in the coming days. However, BTC market participants are increasingly worried that it will be bearish.

scary levels for bitcoin

Markets are preparing for the July 23 candle close. On the other hand, Bitcoin faced the threat of a new decline over the weekend.

cryptocoin.com Looking at it as a whole, the data showed that BTC is currently moving below $30,000, which is designated as intraday resistance. There was a brief dip to $29,640 before recovering towards the daily close on July 22. However, traders continued to worry that the worse was to come.

In a new analysis of the three-day chart, popular trader Crypto Tony told his Twitter followers, “We currently have a double top rejection for Bitcoin. So we really need to note the levels in case we go down,” he warned. “These two levels are $25,000 and $20,000. Both of these are important psychological levels. Take notes.” is warning.

Downside move possible

Another analyst, Nebraskan Gooner, states that BTC/USD fell below the narrow range in the game last month. Accordingly, he acknowledges that downward BTC price action “seems likely.”

Others were waiting for volatility to re-enter the market. However, Bitcoin has not made a statement on whether BTC will ultimately break to test the levels earlier in the year. Among them was popular trader and analyst Toni Ghinea. He predicted a make-or-break decision next week for the narrow price range in the last period. “I expect a big move with BTC next week. 31-32 thousand resistance. 29 thousand support.” It also makes the following emphasis.

“If there is a break above, don’t get too excited. We are literally in the highest range. If there is a nuclear bomb, the next key zone is 27-28 thousand. Be prepared to buy the pullback if it holds. It’s still on the cards if it breaks lower than 19-23k. Play this level. That is all.”

We have a tight week ahead with the FOMC

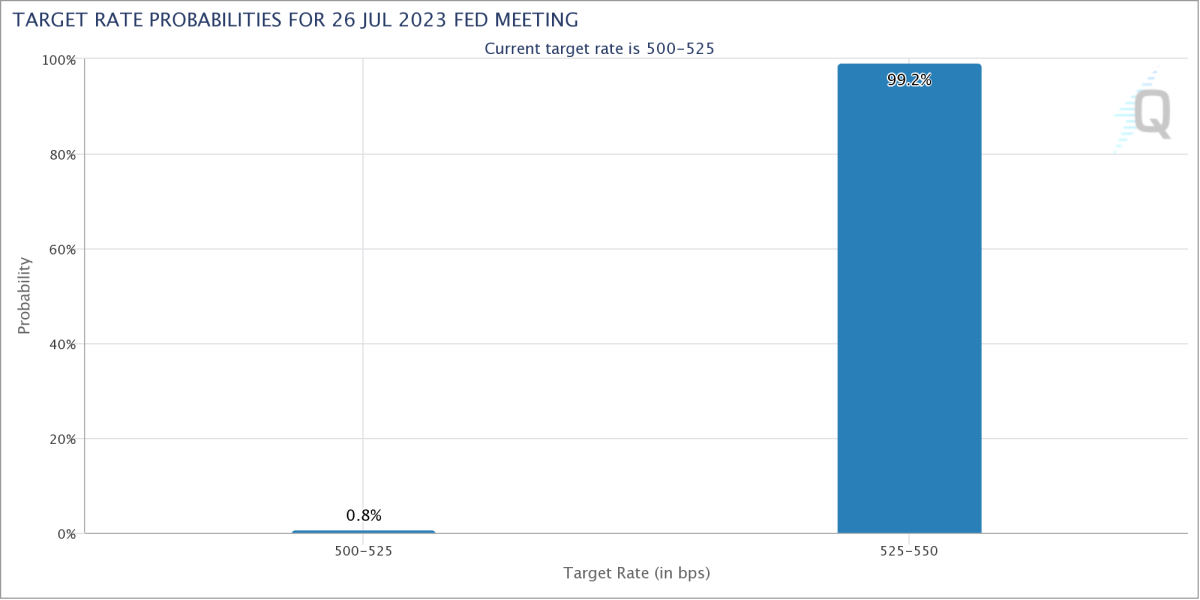

In the coming week, markets will digest macroeconomic policy clues. On the other hand, it will offer a lot of potential volatility indicators. The Federal Open Market Committee of the United States Federal Reserve (FOMC) will meet to decide interest rates before the Bitcoin monthly close.

The views predicting a return to rate hikes this month after the previous pause were almost unanimously accepted. According to CME Group’s FedWatch Tool, these odds stood at 99.2% as of July 23.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.