The crypto market has been hit hard by the negative news in the market last week. Traded on the Chicago Mercantile Exchange after declines CME Bitcoin Futures The index has been trading below the BTC value on the spot market for a week.

CME Futures are trading at a premium of 0.5% to 2% under healthy market conditions. However, due to the panic in the crypto market last week, large CME investors upset the market balance.

Futures listed on the exchange do not include a funding rate, unlike perpetual contracts traded on crypto exchanges. Therefore, drastic market movements can separate the value of the contract from the spot market.

The Chicago CME Bitcoin Futures Contract has been hovering close to the market price over the past month. However FTX The selling pressure that came with the bankruptcy of the stock market increased the gap between the contract and the market to 5%. Despite a correction as the selling pressure subsides, CME continues to trade 1.5% behind Bitcoin’s market cap.

Investors were confused by the fact that futures were trading lower than the spot market. Institutional investors’ interest in CME Futures remains stable.

The Interest of Institutions Has Not Changed

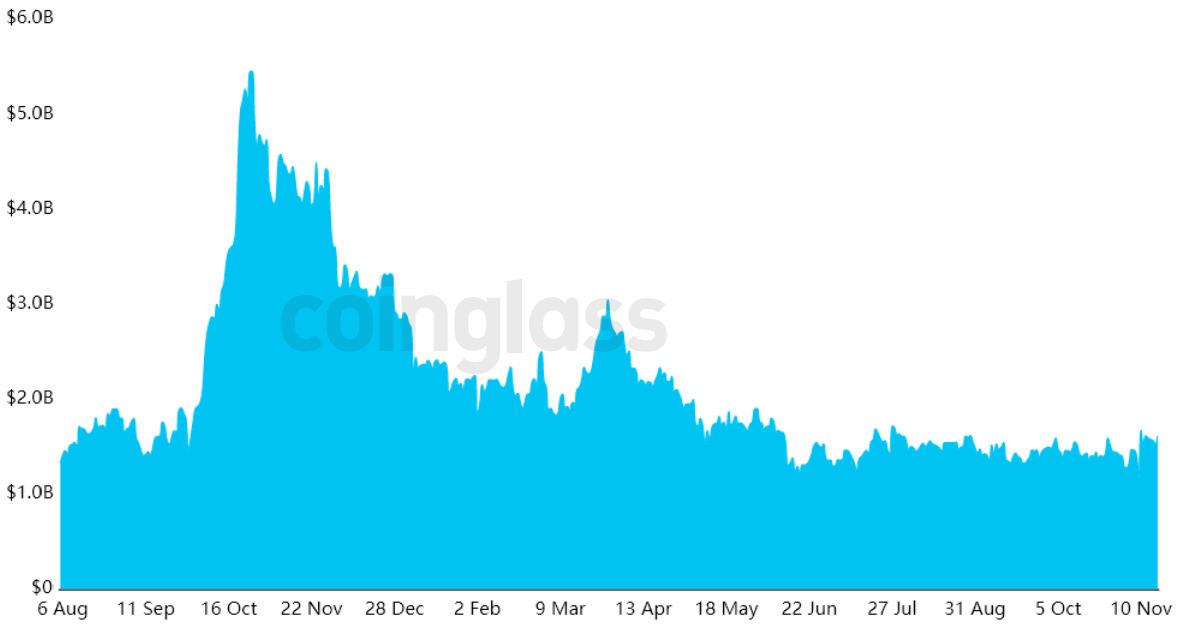

Institutional investor interest for CME Futures Bitcoin transactions has remained steady since the summer. According to Coinglass data, open interest in CME transactions has hovered around $2 billion in recent months.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!