Bitcoin (BTC), while continuing to trade in a narrowed range during US trading hours on Tuesday; Ethereum (ETH), It has “turned green” again, reversing Monday’s loss.

At the time of writing, leading crypto asset Bitcoin was trading at just over $46,000 with little change over the past 24 hours, according to data from TradingView and Coinbase.

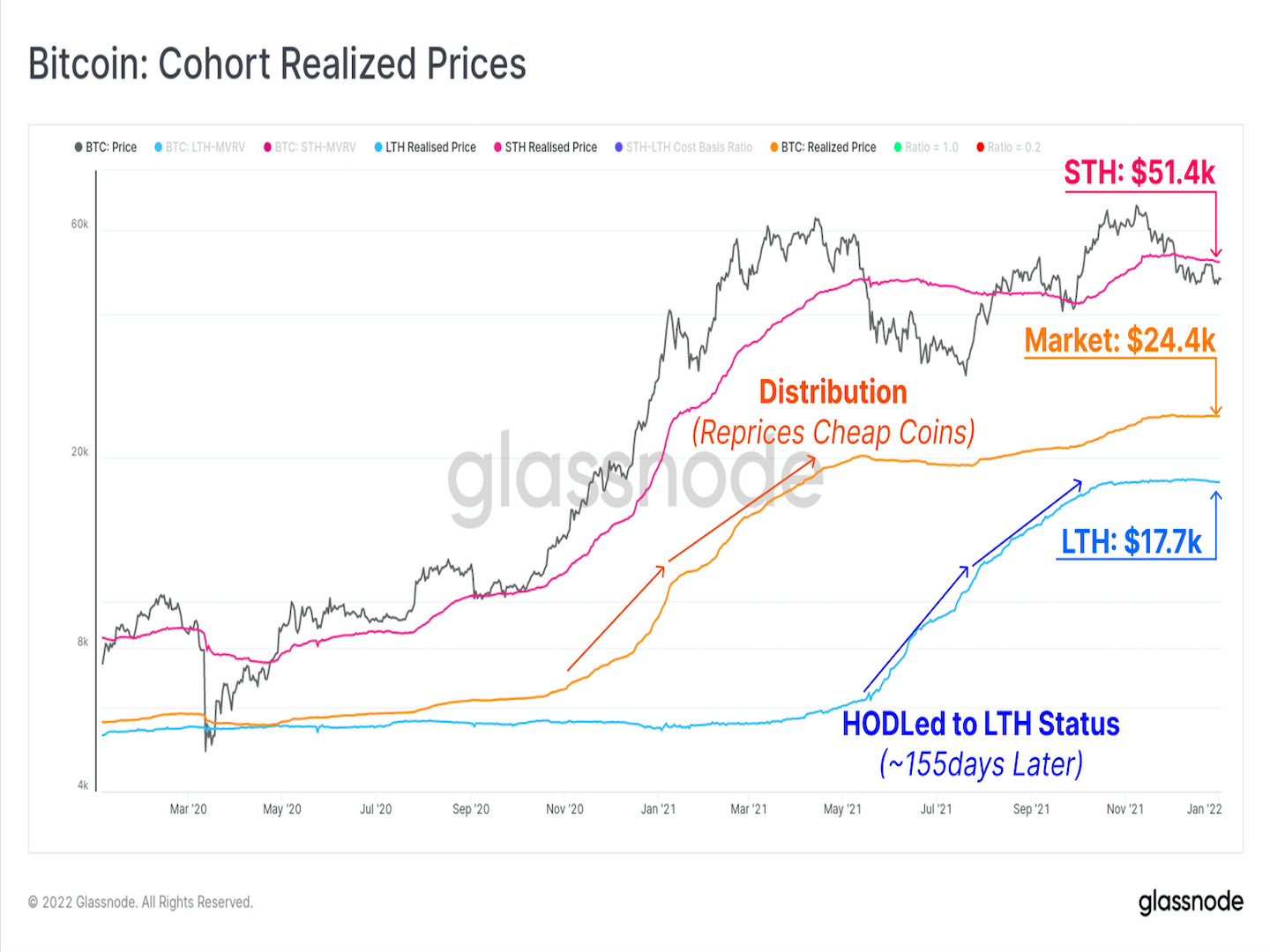

Data from blockchain data firm Glassnode shows that with Bitcoin’s small move, short-term investors are suffering, creating increased selling pressure.

Bitcoin short-term holders traded at roughly $51,400 compared to the overall market average of $24,400 and long-term investors costing $17,700, according to Glassnode, a measurement technique called the “realized price model,” a measurement technique that evaluates each Bitcoin when it was last spent on the blockchain. looks like.

Glassnode analyticsIn a news release on Jan. 3, Bitcoin’s short-term holders were interpreted as “who are under their investment overall and most likely to create resistance on the sell side.”

Meanwhile, Ethereum recovered some losses yesterday, climbing above $3,800 at the time of writing, according to data from TradingView and Coinbase.

Several other Tier-1 tokens also rose on Tuesday: tokens from smart contract platforms such as Internet Computer, Cosmos and Celo were among the biggest winners of the day, according to data from Messari.

De-correlation of alternative cryptocurrencies (altcoins) with Bitcoin price could also put more pressure on Bitcoin price, according to one analyst.

“The bullish situation remains for Bitcoin, but it will be a much more difficult year as many traders will also focus on altcoins,” Edward Moya, OANDA, Americas Senior Market Analyst, said in his daily market update on Tuesday.

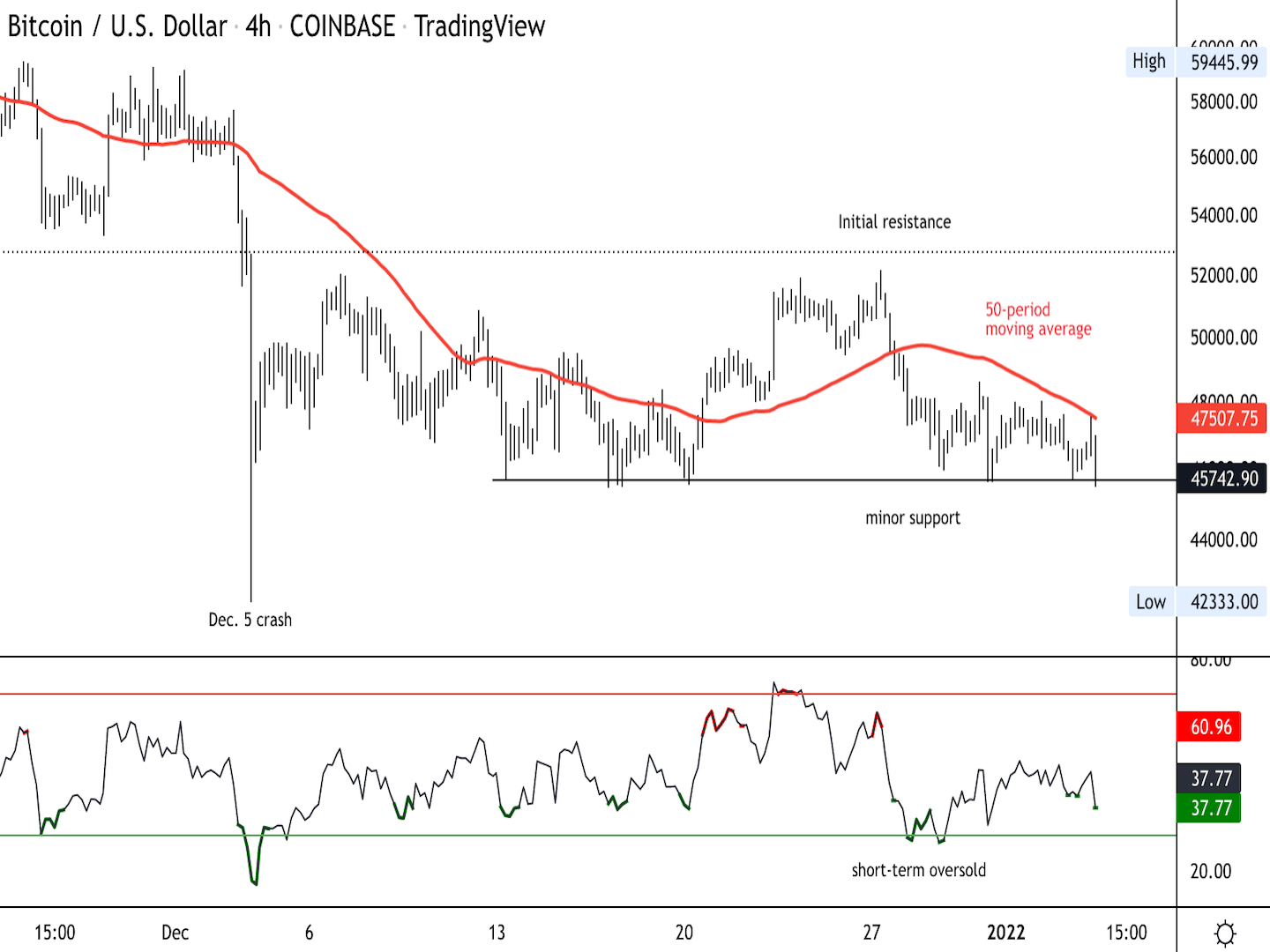

Bitcoin Drops Towards $44,000-45,000 Support As Analysts Wait For Price Jump

Bitcoin (BTC) was falling towards the $44,000-45,000 support zone at the time of writing and has been trending sideways for the past 24 hours. Indicators point to a possible price bounce, albeit limited to the $55,000 resistance level.

BTC is stuck in a one-month trading range after a near 20% crash in early December deterred some buyers. Since then, the relative strength index (RSI) has given several oversold signals, although price gains have remained muted compared to previous signals.

Katie Stockton, managing partner of Fairlead Strategies, a technical research firm, also noticed countertrend signals that typically precede a price jump.

According to Stockton, a daily price above $46,334 (20:00 ET) will confirm a positive signal, increasing the possibility of a rise to $55,644 according to Stockton.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.