bitcoinhas been depreciating since the end of last year. The leading cryptocurrency is trading at 59% lower than on October 4 last year.

Discussions continue in the crypto community about where the bottom is in Bitcoin. Some of the investors expect BTC to fall to 10 thousand dollars. However on-chain According to the new data shared by the tracking platform Glassnode, we may be seeing the bottom levels in Bitcoin right now.

Published weekly by Glassnode “Puell Multiple” value has passed the recovery phase from the lowest level seen in the summer months.

According to the chart posted by Glassnode, the Puell Multiple bottomed out in January 2019 and June 2020. After the metric recovered, large rallies took place in Bitcoin.

If the date recedes and the Puell Multiple continues to rise, according to the chart A new rise may come in Bitcoin.

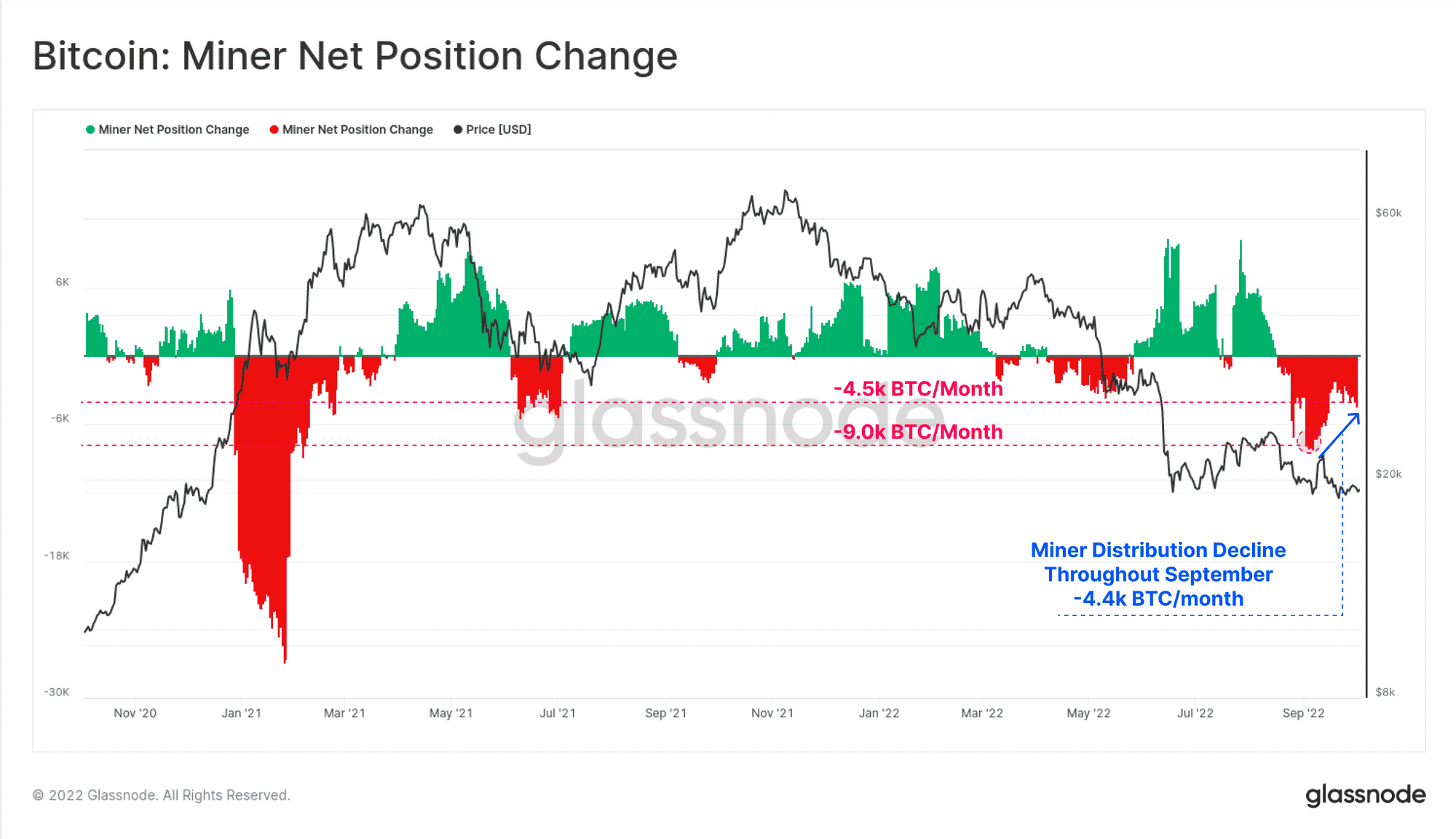

Selling Pressure from BTC Miners Reducing

Another graphic shared by Glassnode about BTC is about Bitcoin miners. According to the data, in September, miners were selling an average of 9,000 BTC per month. As of October 4, miners’ average monthly sales BTC amount decreased by 50% to 4,400 BTC.

The 50% decrease in miners’ monthly sales average indicates that the selling pressure on BTC may have been significantly broken.

Bitcoin and other cryptocurrenciesshowed a slight recovery, gaining an average of 5-8% in the last 2 days.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!