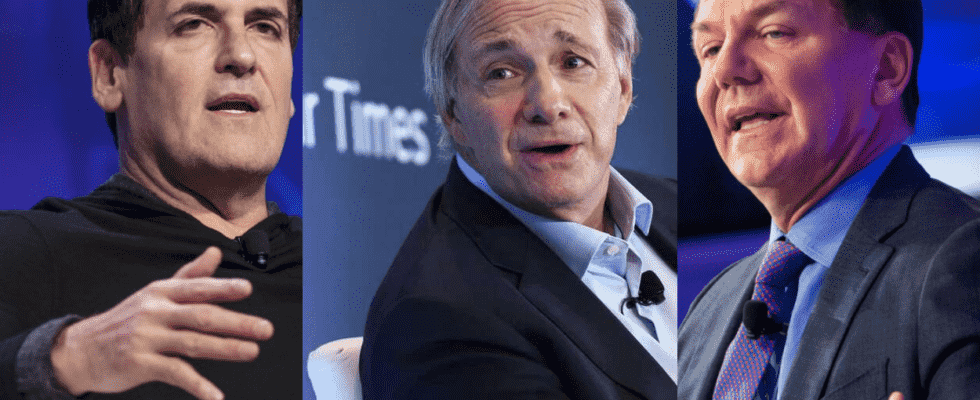

Over the past decade, some of the world’s most famous billionaires have enriched their portfolios with various altcoin projects. But did you know that billionaire investor and hedge fund manager Ray Dalio is an Ethereum investor?

Here are the altcoin projects that billionaires have bought

Ray Dalio

The founder of the world’s largest hedge fund firm, Ray Dalio is widely regarded as an expert on all aspects of macroeconomics and markets in general. He shares his views with the public through books or blog posts. Ray Dalio winked at Bitcoin, saying that “cash is still garbage,” one of his most popular comments recently. However, Bitcoin isn’t the only cryptocurrency Ray Dalio has. In December 2021, he mentioned that he also owns some Ethereum.

The macro specialist is above all a big proponent of portfolio diversification. Therefore, it is unlikely to gather cryptocurrency investors in a single focus. By choice; Ethereum’s smart contract functionality and broad developer ecosystem are its most notable features. Plus, the merge that frees Ethereum from mining paves the way for the network to scale faster for more transactions and lower fees. As a result, it might make sense to follow in the footsteps of an expert like Ray Dalio.

Paul Tudor Jones

Paul Tudor Jones is the legendary investor at the helm of Tudor Investment Corporation. His company currently has a net worth of approximately $7.5 billion. Tudor Jones is best known for predicting the stock market crash of 1987. He also had the foresight to be open-minded about Bitcoin. He became one of the first major figures in the traditional wealth management world to step out in favor of Bitcoin. Jones looks at Bitcoin as a unique asset. He sees Bitcoin as an inflation hedge, among other features. Jones thinks the incoming level of intellectual talent from the crypto industry is a good reason to own Bitcoin:

What I learned was that Bitcoin has this enormous corps of really smart and sophisticated people who believe in it… From all over the world, Bitcoin is successful and an ordinary store of value. I’ve never seen an inflation hedge where you have a trigger that you have huge intellectual capital behind it.

The legendary investor confirms that he has allocated a “small, single-digit” stake in his portfolio to Bitcoin. But he states that for a multi-billion dollar fund, this is considerable money. Jones is one of the highest-paid investors of the past few decades.

Mark Cuban

Mark Cuban has built a reputation for nearly four decades as one of the most prolific technology investors of our time. With his initial investments in the industry during the internet boom of the 1990s, he amassed more than $4.5 billion in wealth. No stranger to emerging technologies, Cuban is a fan of cryptocurrencies. It invests in companies that offer blockchain-based products like OpenSea. Cuban currently owns a handful of more popular cryptocurrencies like Bitcoin and Ethereum. But one that may come as a surprise is undoubtedly Polygon (MATIC).

In May 2021, Cuban invested directly in Polygon rather than just owning altcoins. “I was a Polygon user and I find myself using it more and more,” Cuban said.

Cuban isn’t the only one who noticed Polygun. cryptocoin.comAs you follow on, Meta, Coca-Cola and even Disney have partnered with Polygon this year for various reasons. Since Cuban’s initial investment in May 2021, Polygon’s price has fallen by more than half. It fell almost 75% from its all-time high in November. Yet despite the decline, Polygon’s achievements this year make Cuban look like a scholar once again.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.