A crypto analyst who sold Bitcoin and Litecoins at high profits, which he bought during the FTX crisis last week, is warning of a major collapse this time.

Analyst who knows about Bitcoin crashes expects more losses

The popular crypto analyst nicknamed DonAlt successfully closed all his positions at the November 2021 summit. Then, he bought it again in November 2022 when Bitcoin, Litecoin, and XRP prices crashed during the FTX crisis. As the crypto market rose again in April 2023, he announced that he had closed all his positions and cashed in.

The accurate analyst, in his current analysis, suggests that the cryptocurrency market will show a decline in the short term. This is because of the drastic price movements that prey on leveraged investors. cryptocoin.com As we reported, Bitcoin, which fell hard with the Fud news yesterday, led to a long liquidation of 320 million dollars.

DonAlt finds the Bitcoin price zone between $20,000-30,000 to be quite dangerous given the current market conditions. In his latest analysis, he warned that leveraged traders could suffer more. According to their analysis:

Under $30,000 and over $20,000 are lies. We are in the market stage where we shed the blood of all leverage traders and the BTC price will go as high or low as needed within these limits to kill them.

DonAlt watches Bitcoin price movements in this region

DonAlt said last week that Bitcoin will re-enter the market once it drops to $20,000 or rises above $30,000. According to DonAlt, it makes more sense to stay on the sidelines as long as Bitcoin is trading between these two levels. The analyst plans to evaluate only the positions that will come from these two levels:

The general plan for me: If we manage to get back $30,000, I’ll get back the BTC I sold at around $30,200. If we test $20,000 again, I’ll do the same thing I sold. Choose to stay calm between the two.

How about the BTC price?

While the price of Bitcoin has been rocking wildly over the past 48 hours, it has given some investors an edge. Meanwhile, Bitcoin HODLers continued to rise, continuing to accumulate despite market volatility. In terms of price, BTC embarked on a bumpy journey with some dramatic fluctuations as it approached the close of April 27.

On the daily chart, it hit a high above $30,000. It dropped to just about $27,000 over the same period. At the end of the trade, BTC was trading at around $28,500.

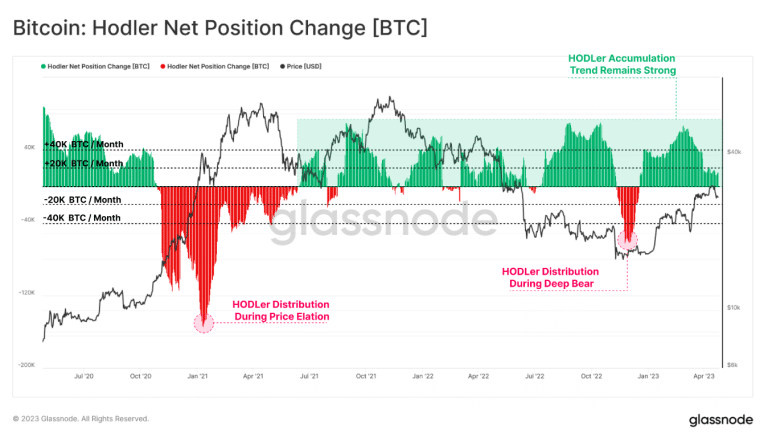

According to data from Santiment, Bitcoin’s rise to the $30,000 range was accompanied by a significant increase in trading volume. Recent data from Glassnode revealed an increase in the accumulation rate by BTC Hodlers. The chart below shows a consistent upward change in position, reflecting a sustained phase of accumulation, despite the price drop and significant fluctuations.

Despite recent market volatility, the metric shows that especially long-term investors remain. BTC is now trading above $29,000 again after losses from the last 48 hours.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.