Buffett’s Berkshire Hathaway significantly reduced cash reserves in the first quarter and bought millions of new shares.

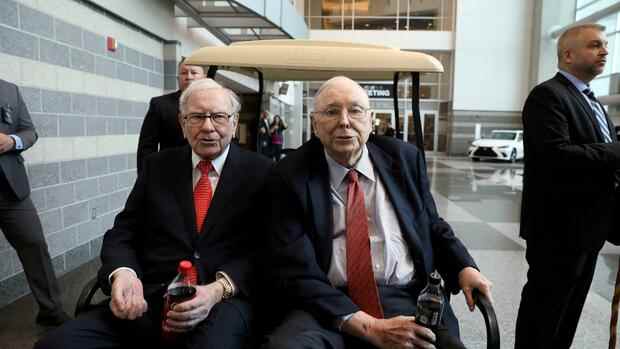

(Photo: Reuters)

omaha Warren Buffett is back – as a host and as an investor. On Saturday, he welcomed tens of thousands of shareholders to his legendary general meeting at the company’s headquarters in Omaha, Nebraska. It is the first time since 2019 that the event will take place with spectators again. Buffett likes to call the spectacle “Woodstock for capitalists.”

“We always have so much fun when you come to visit,” said the CEO of the Berkshire Hathaway conglomerate on Saturday. The 91-year-old, who shared the stage with his three vice-chairmen Charlie Munger, Ajit Jain and Greg Abel, had big news to announce.

In the first quarter, it bought $51.1 billion worth of shares, according to earnings results also released on Saturday. This is a clear departure from the cautious attitude that has prevailed in recent years.

Berkshire has significantly increased its stake in oil company Chevron. The stake is now worth just under $26 billion and is one of his top five holdings. Combined with Occidental Petroleum’s stock purchases over the past few weeks, Buffett now has more than $40 billion invested in the oil industry, according to Edward Jones analyst Jim Shanahan.

Top jobs of the day

Find the best jobs now and

be notified by email.

Buffett spent $41 billion in three weeks

As a result, Berkshire’s cash reserves decreased significantly. They were at $106.3 billion at the end of March. At the end of December they were just under $147 billion.

Buffett and his two investment managers, Ted Weschler and Todd Combs, made most of these purchases in just over three weeks. Between February 21 and March 15, they spent $41 billion on stocks. “We have an employee in our office who executes the trades,” Buffett explained. “And he doesn’t have an assistant, he’s just spending $41 billion.”

In April, however, Berkshire made no purchases. Buffett sold over $10 billion worth of stock in the first quarter.

Berkshire Hathaway’s net income was $5.5 billion, down significantly from a year earlier. However, the result is subject to fluctuations because paper profits and losses have to be shown there as well. Operating profit is $7 billion, slightly better than a year ago.

Buffett’s railroad, industrial, and energy businesses were particularly strong. The insurance business, meanwhile, was poor, with profits falling from $764 million to $47 million.

Buffett had announced a series of deals in recent weeks: In March, the company announced the purchase of the US insurance group Alleghany for $11.6 billion. At the beginning of April it was announced that Buffett and his holding company had entered the computer group HP Inc on a large scale. He bought 121 million shares, which based on the closing price at the time, resulted in a package value of approximately $4.2 billion. Buffett also increased his stake in Occidental Petroleum.

That went down well on the stock market. The paper gained 7.5 percent this year. The broader S&P 500 stock index, which Buffett likes to compare himself to, lost 13 percent.

More: Buffett goes shopping again