CoinShares According to a new report published by Bitcoin, long-term Bitcoin investors tend to hold their BTC even in the face of rising prices.

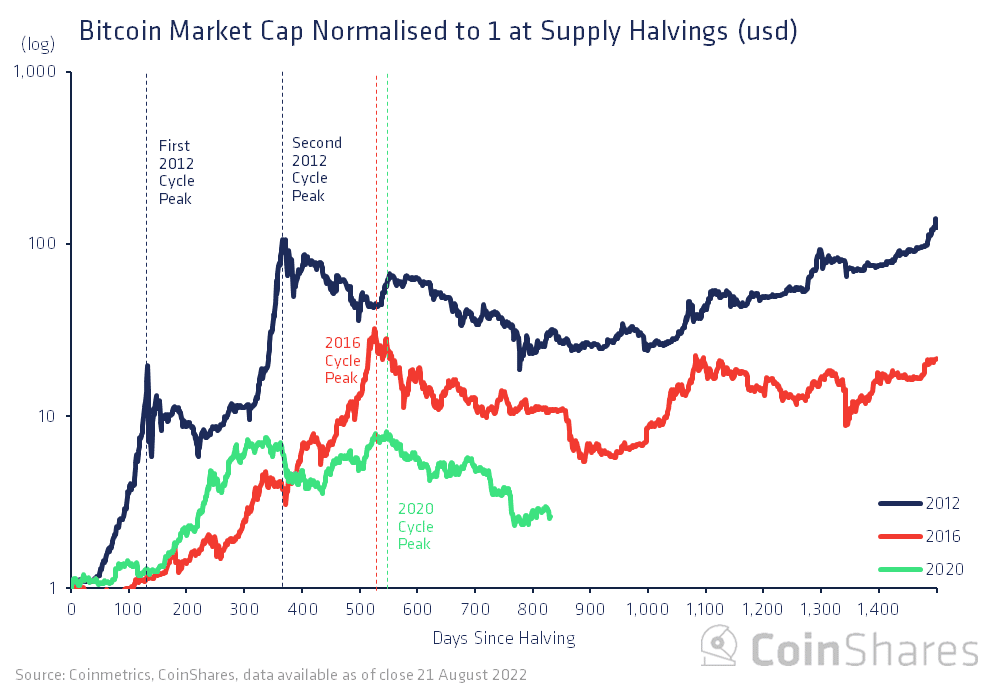

The report by CoinShares, the leading analytics company in the cryptocurrency industry, revealed that new investors are included in the Bitcoin market during each halving. This remarkable detail gives an important clue for a new “bull cycle”. With prices rising during bull cycles, BTC is gaining more popularity as well and naturally there is an increase in investments as well.

Another notable behavior in the report is bitcoin It was related to the bear market that took place after the traders completed a full cycle. According to the report, during such declines, long-term investors prefer to hold their assets for longer terms rather than selling them at a loss. Investors’ behavior naturally limits the available supply and helps create downside support. After these moves are successful, they sell at a level where they can make a profit.

As we mentioned above, the detail that new investors enter the BTC market with each halving draws attention. After the first halving event in 2012, BTC was on hold for five years at the end of 2013, which was initially bought by new entrants to the market.

This “hodling” by these long-term investors has led to a constraint on the lead cryptocurrency supply. This, combined with the halving event in 2016, contributed to BTC’s rapid price surge in 2017. When these investors profited, new investors came to the market in 2017.

CoinShares found that investors who bought BTC in 2016 and 2017 continued to hold it because they were idle at their addresses. According to the report, this category of investors preferred to hold their assets rather than sell them even above their acquisition cost. In this regard, CoinShares noted:

“We can now see the pattern in 2017 where a new era of investors chose to resist the urge to sell their coins despite having the opportunity to make a profit anytime in 2021. While this provides some explanatory power to the BTC price surge following the 2020 halving, when the current Bitcoin supply was re-constrained, it means that class of 2017 investors have a similar stance to those launched in 2013.”

Additionally, CoinShares found that the class of long-term investors that entered the market in 2017 “seems to be accumulating coins more aggressively than we have seen in past cycles.”

According to the report, while some investors sent their BTC to exchanges to make a profit during the 2021 rally, the exits from the exchanges have exceeded the entries since 2022. This shows that 2017 long-term buyers are determined to hold on.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.